The Pune Bench of the Income Tax Appellate Tribunal (ITAT) remanded the case related to the addition of Rs. 24,89,121 as gross receipts of commission income u/s 144 of the Income Tax Act, 1961, for fresh adjudication.

Prakash Dipchand Kapadnis the taxpayer does not submit the ITR for the Assessment Year 2013-14 under Section 139(1) of the Income Tax Act, 1961. Commission/brokerage income of Rs. 24,89,121 credited to the taxpayer’s PAN based on Form 26AS with a TDS of Rs. 2,48,912 has been discovered by the assessing officer (AO).

A notice u/s 148 has been issued via AO but the taxpayer is unable to answer. The AO passed a ruling assessment u/s 144 imposing tax to the whole gross receipts of Rs. 24,89,121.

Before the NFAC, the taxpayer contested the assessment, claiming that merely the net income must have been levied to tax but the NFAC dismissed the appeal due to non-compliance with hearing notices.

The taxpayer on appeal before the ITAT is unable to furnish the related proof to NFAC or the tribunal even after claiming that the AO erred in taxing the gross receipts rather than the net income. The counsel of the revenue has claimed that the actions of AO and NFAC were accurate quoting the non-compliant taxpayer and the absence of any material proof provided to oppose the assessment order.

The single-member bench Dr. Manish Borad (Accountant Member) observed that the NFAC failed to satisfy its statutory obligation u/s 250(6) of the Income Tax Act which obligates appellate authorities to adjudicate appeals by stating points for determination, decisions, and reasons.

The tribunal quoting the Bombay High Court’s judgment in Pr. CIT (Central) vs. Premkumar Arjundas Luthra (HUF), mentioned that the duty of NFAC to address appeals on merits even in matters of non-compliance by the taxpayer.

Read Also: Ahmedabad ITAT Cancels Order U/S 144 for Sending IT Notices to Incorrect Address

The tribunal remanded the case back to the NFAC for denovo adjudication, asking to regard the appeal on merits and furnish the taxpayer with enough chance to show the related proof. For the statistical objective, the appeal was permitted.

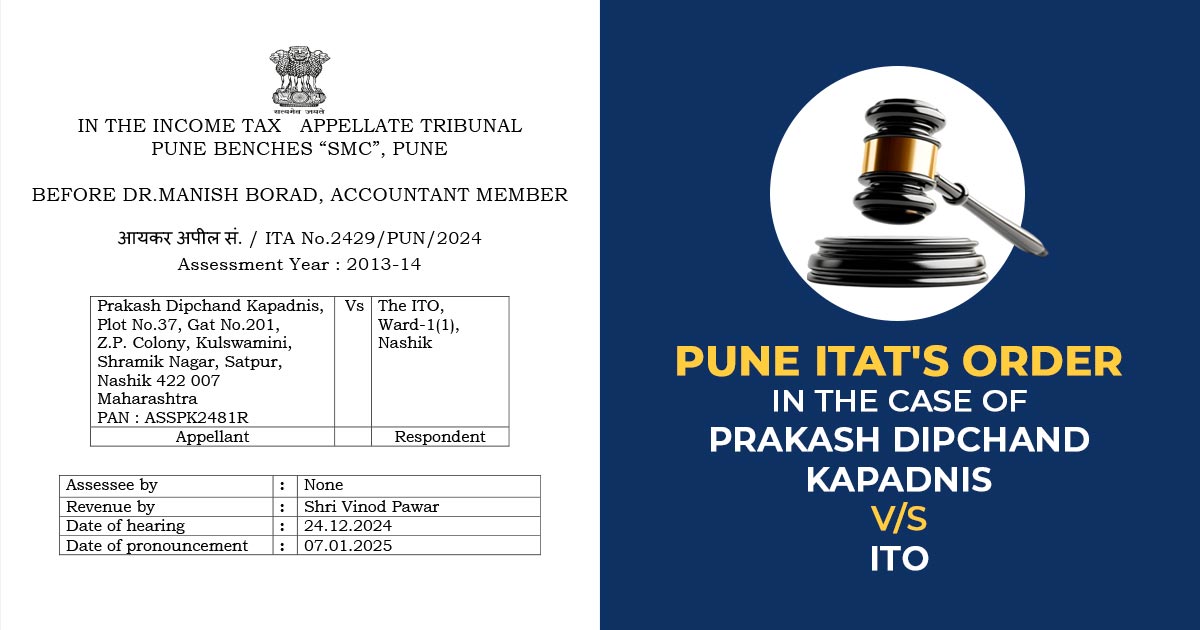

| Case Title | Prakash Dipchand Kapadnis V/S ITO |

| Citation | ITA No.2429/PUN/2024 |

| Date | 07.01.2025 |

| Counsel For Assessee | None |

| Counsel For Revenue | Shri Vinod Pawar |

| Pune ITAT’s | Read Order |