In the case of Kashi Exports vs Union of India & Ors. (2024), the Gujarat HC instructed tax officials to take another look at a request for a refund associated with GST made by Kashi Exports. The matter is towards the computation of the adjusted total turnover under Rule 89(4) of the CGST Rules. Kashi Exports, a proprietorship in the zero-rated exports of fresh produce under a Letter of Undertaking (LUT), filed for a refund of unused Input Tax Credit (ITC).

The issues emerged when the authorities rejected the refund partially based on the amended Rule 89(4), as notified in 2022, leading the petitioner to approach the court. CBIC at the time of the proceedings has furnished a clarification by Circular No. 197/09/2023, elaborating how the adjusted total turnover must be computed following the rule changes.

It was noted by the court that the clarification of CBIC solved the confusion regarding the calculation methodology, citing that the turnover utilised in the formula should align with the changed definition. Clarification arises from this that Kashi Exports qualified for a GST refund of the full claim of ₹56,14,652, instead of the ₹35,31,021 sanctioned earlier.

Therefore the court remanded the matter back to the authorities with the norms to rerevalute the refund application under the updated guidelines and finish the process in under 12 weeks. The same ruling emphasizes the interplay between the rule amendments and exporter entitlements under GST laws.

Attributes

The applicant M/s Kashi Exports was a proprietorship firm that exported fresh fruits and vegetables and duly registered under the provisions of the Central Goods and Services Tax Act, 2017 (“the CGST Act”). The applicant was not holding any domestic sales. The applicant exported the goods without payment of GST under a Letter of Undertaking (LUT) under the provisions of Section 16(3)(a) of the Integrated Goods and Services Tax Act, 2017 (“the IGST Act”).

A zero-rated supply of the goods has been made by the applicant and was qualified to obtain the transaction value of the unused collected ITC under the provisions of Section 54(3) of the CGST Act read with Rule 89(4) of the CGST Rules.

An exporter to export the goods has furnished distinct documents along with a shipping bill and export invoice wherein, the goods details i.e. description and quantity, value, quality, etc. are remarked, the price of the goods charged by the exporter and also the Fee on Board (“FOB”) value or Cost Insurance Freight (“CIF”) value as the case may be are also declared.

The applicant for the period July 2017 to September 2021, was granted transaction value under Rule 89(4) of the CGST Rules before the explanation was inserted Rs.22,55,96,206.85 acknowledging the price received by the applicant from the foreign customers. Though the FOB value of these goods depicted in the shipping bills was Rs 12,34,04,096 which is 56% of the actual transaction value.

Read Also: No Need for Certified Copy of GST Appeal Order When Accessible on Common Portal

As per that, the applicant has submitted a refund claim of Rs 56,14,652 and the refund was paid to Rs. 35,31,021.90/- and rejected the claim of Rs. 20,20,803.80/- considering Notification No. 14/2022 on July 5, 2022 (“the Notification”), more specifically, Explanation (c) inserted in Rule 89(4) of the CGST Rules.

The applicant dissatisfied with the situation has submitted the present petition.

Issue

If the court sends the matter back to reconsider the refund request under the circular of CBIC on the adjusted total turnover computation?

Had

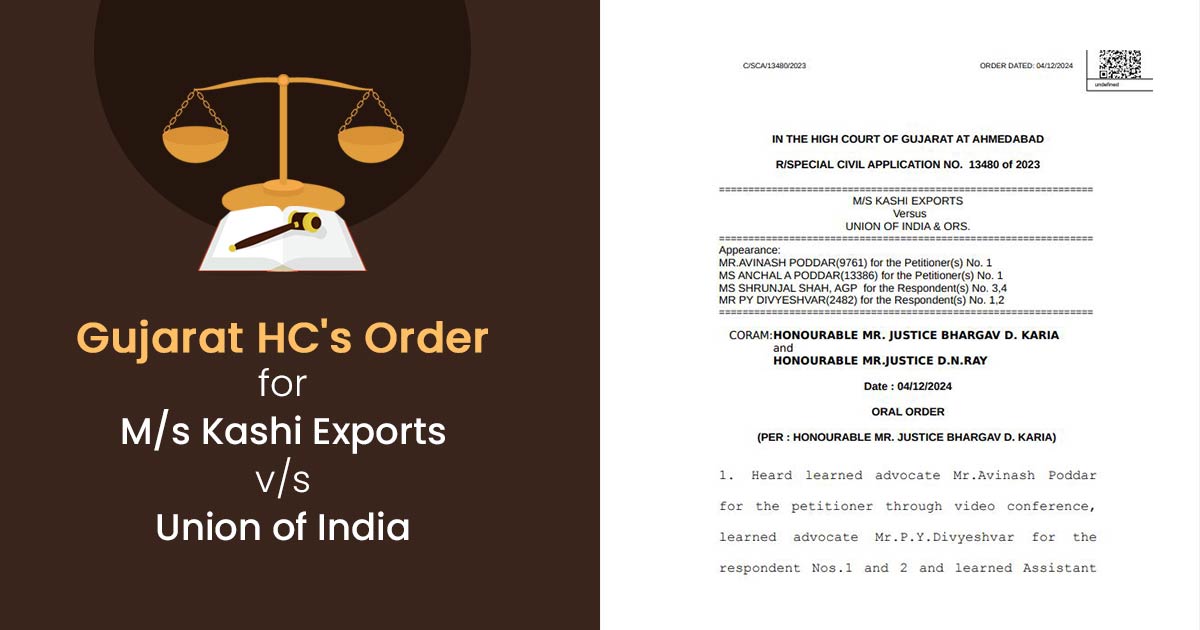

The Hon’ble Gujarat High Court in R/Special Civil Application No. 13480 of 2023 held as under:

Noted that at the time of pendency of the petition the Central Board of Indirect Taxes and Customs (“CBIC”) via Circular No.197/09/2023-GST dated July 17, 2023 (“the Circular”) furnished the clarification on the way of computation of the adjusted Total Turnover under Rule 89(4) of the CGST Rules resultant to the Explanation inserted in Rule 89(4) of the CGST Rules vide the Notification.

Mentioned that for the aforementioned clarification, the applicant is now qualified for a refund which the authority rejected. Under the clarification, the zero-rated supply of goods value needs to be computed under the changed definition of “Turnover of zero-rated supply of goods” acknowledging the turnover in the State or Union territory and consequently, the adjusted total turnover for Rule 89(4) of the CGST Rules.

Towards such explanation, the numerator and denominator shall be identical and the Petitioner would be qualified to get the complete refund of Rs.56,14,652/- instead of Rs.35,31,021.90/- as sanctioned by the Respondent. Therefore the case was remanded back to reconsider the application of refund incurred via the applicant to grant the refund through applying the circular.

Our comments-

Chapter X of the CGST Rules governs ‘Refund’. Section 89 of the CGST Rules controls ‘Application for refund of tax, interest, penalty, fees or any other amount’. Rule 89(4) of the CGST Rules states that in the matter of zero-rated supply of goods or services or both without payment of tax under bond or LUT following the provisions of section 16(3) of the IGST Act, refund of GST ITC would be granted under the following formula-

“Refund Amount = (Turnover of zero-rated supply of goods + Turnover of zero-rated supply of services) x Net ITC ÷ Adjusted Total Turnover

Where,

(A) “Refund amount” means the maximum refund that is admissible;

(B) “Net ITC” means input tax credit availed on inputs and input services during the relevant period;

(C) “Turnover of zero-rated supply of goods” means the value of zero-rated supply of goods made during the relevant period without payment of tax under bond or letter of undertaking or the value which is 1.5 times the value of like goods domestically supplied by the same or, similarly placed, supplier, as declared by the supplier, whichever is less,

(D) “Turnover of zero-rated supply of services” means the value of zero-rated supply of services made without payment of tax under bond or letter of undertaking, calculated in the following manner, namely:-

Zero-rated supply of services is the aggregate of the payments received during the relevant period for zero-rated supply of services and zero-rated supply of services where supply has been completed for which payment had been received in advance in any period prior to the relevant period reduced by advances received for zero-rated supply of services for which the supply of services has not been completed during the relevant period;

(E) “Adjusted Total Turnover” means the sum total of the value of-

(a) the turnover in a State or a Union territory, as defined under clause (112) of section 2, excluding the turnover of services; and

(b) the turnover of zero-rated supply of services determined in terms of clause (D) above and non-zero-rated supply of services, excluding the value of exempt supplies other than zero-rated supplies during the relevant period

(F) “Relevant period” means the period for which the claim has been filed.

Explanation.–For the purposes of this sub-rule, the value of goods exported out of India shall be taken as –

(i) the Free on Board (FOB) value declared in the Shipping Bill or Bill of Export form, as the case may be, as per the Shipping Bill and Bill of Export (Forms) Regulations, 2017; or

(ii) the value declared in tax invoice or bill of supply, whichever is less.”

| Case Title | M/s Kashi Exports vs. Union of India |

| Citation | R/Special Civil Application No. 13480 of 2023 |

| Date | 04.12.2024 |

| Petitioner By | Mr Avinash Poddar, Ms Anchal A Poddar |

| Respondent By | Ms Shrunjal Shah, Mr Py Divyeshvar |

| Gujarat High Court | Read Order |