LUT or the Letter Of undertaking is a hot term these days. LUT is paramount for exporters and traders. Export volumes are the real and only parameter that determines the growth rate of a country. It brings in important foreign reserves and also opens up new business opportunities. Hence an easy process for frictionless LUT submission was the need of the year. The GST council has to be lauded for making the process smoother and more transparent than before.

Latest Update In LUT Filing Deferment

- The GSTN department has updated the new functionality to file the Letter of Undertaking (LUT) for FY 2025-26 on the official website. View more

- “The GSTN department has allowed the taxpayers to file LUT for FY 2022-23 and this facility is available on the GST government portal. The application of LUT is needed to be fulfilled by 31st March 2022 or before supply for SEZ and exports.”

Under GST regime, export falls under the IGST umbrella. As per IGST act export can be conducted via two ways. These are:

- File LUT to export without IGST payment

- Pay IGST at time of export and claim later

LUT is an ideal option for exporters. You have to submit the LUT only once in a current financial year. The process involves no additional compliances. Further, the process does not attract any additional costs.

Read Also: How to Save Goods and Services Tax in India Without Any Fraud?

Eligibility For Export Under LUT:

If you want to avail the facility to export under LUT, make sure that you have cross-checked the following eligibility points.

All GST registered traders/persons who have not been prosecuted for any offence under the CGST Act or the Integrated Goods and Services Tax Act,2017 or any of the existing laws.

The amount of tax evaded by individuals who have been booked under the CGST or IGST Act must not exceed two hundred and fifty lakh.

Let’s Start with Procedure to File LUT Online Under GST:

GST Complying Exporters can now fill the ‘LUT (Letter of Undertaking)’ under the GST Process online. This is a great step forward in automation of the GST process and reduces growing grievances of exporters.

Follow the steps below to file your LUT Online.

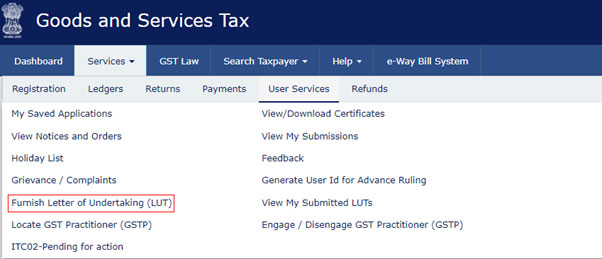

- Visit the GST Portal and login to your GST account using your credentials

- Now go to the menu bar and select ‘Services’ option

- Now select the ‘User Services’ Option as shown in the above image.

- Finally, click on ‘Furnish Letter of Undertaking’.

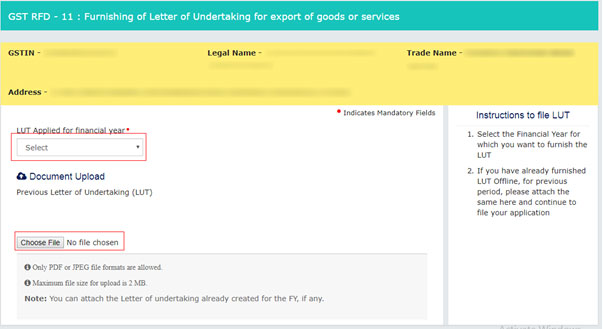

- You will be directed to the following screen:

- Now select the Financial Year for which period you want to submit the LUT

- You can also upload those LUT’s that belong to an earlier period by clicking on the choose file option and uploading the LUT file

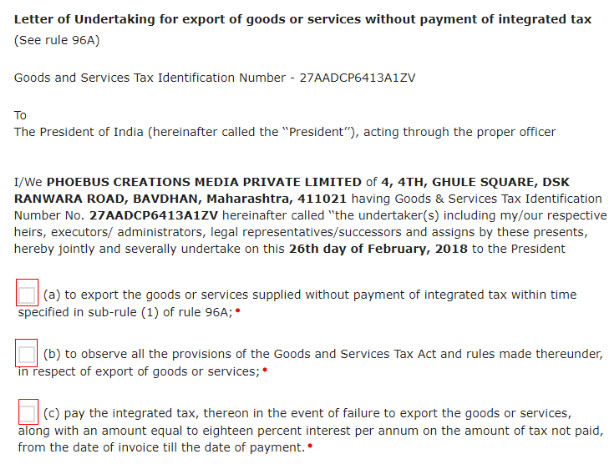

- After this, you have to tick all the three checkboxes as shown in the below screenshot

- After selection all the checkbox, fill other compulsory fields on the opened form. Now you need to provide the details of two witnesses

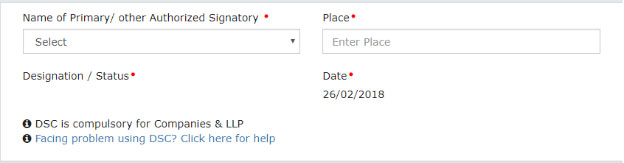

- Next, select name of the primary/ authorized signatory who will sign LUT and fill the place details

- Last but not the least, sign the LUT with your unique DSC/EVC

Remember: Once filed, the LUT form cannot be re-edited. Make sure that you recheck at least once before signing and submitting.

Recommended: How to File GSTR Forms Online in India?

Hi Sir,

While Submitting My LUT through EVC Code it shows ”Error! Something seems to have gone wrong while processing your request. Please try again. If the error persists quote error number null-9018 when you contact customer care for quick resolution ” is there is any Solution for this error…..please reply.

Hello. Sir.. we are getting error lu-luas-9018 while filling LUT through evc.. please Help us.

Contact department for assistance.

Error LU LUAS 9018 occurring while submitting LUT online after DSC Signing.

have you got any solution? I am also getting the same issue.

I am also getting the same problem since 02.07.2018 please share if you get any solution

Error LU LUAS 9018 occurring while submitting LUT online after DSC Signing

I got LUT for 2018-1019 but I did not get LUT from last year. Can I get LUT for 2017-18? The portal still allows selecting the 2017-18 financial year.

Letter of the undertaking has to be filed /submitted online before exporting the goods/services.

I have applied for LUT online for 2018-19 as on 30.05.18 under GST RFD – 11 , ARN no is generated & status shows submitted. How much time will it take to get LUT certificate online?

I have applied for LUT online for 2018-19 as on 03.05.18 under GST RFD – 11 from Mumbai, Maharashtra. ARN no is generated & status shows submitted. How much time will it take to get LUT approved & get the certificate online?

As soon as the ARN no. is generated, LUT is deemed to be accepted by the department. (Circular no. 40/14/2018 dated 06.04.2018)

http://www.cbec.gov.in/resources//htdocs-cbec/gst/circularno-40-cgst.pdf

it will be deemed to be accepted if ARN is generated refer above cir of 6 April 2018

Yes agreed

PLEASE REFER MAHARASTRA CIRCULAR. ONCE SUBMITTED & IT IS VALID FOR ONE YEAR AND ALSO AS PER CIRCULAR IT IS DEEMED TO ACCEPTED AFTER 3 DAYS.

Please specify your query.

can you share circular reference?

Sir, we applied for online LUT and we received online acknowledgement of our application on 08.03.18 but till date, we have not received any confirmation from the department that our application has been accepted or not. please suggest what to do next?

Contact to department.

How we can confirm that application has been accepted?

After Filing, Intimation for ARN generated will be sent to your registered mail id. You can track the status of your application using the facility at GST Portal available under Services > User Services > View My Submitted LUTs.

After online submission of LUT, do we need to submit in Hard copy (with mention of ARN) as well?

Whether any letter regarding acceptance of LUT will be issued by the department on submission of LUT online?