The Pune Bench of the Income Tax Appellate Tribunal (ITAT) condoned a delay of 38 days in filing an appeal, attributing the delay to a change in the taxpayers’ tax consultant.

The taxpayer Sujit Arun Taware does not submit an Income return for the assessment year 2014-15. On the grounds of the data obtained via the department, the taxpayer had deposited Rs 35.50 lakh in cash and purchased the immovable property of Rs 2.04 crore.

Hence a notice has been issued by the assessing officer u/s 148. With an addition of Rs 2.39 crore, the assessment was completed which has been made u/s 68.

The taxpayer dissatisfied has furnished a plea before the Commissioner of Income Tax (Appeals) [CIT(A)], with a delay of about four months. CIT(A) has denied condoning the delay and dismissed the plea without furnishing the detailed reasons u/s 250(6) of the Act.

The taxpayer dissatisfied with the CIT(A) order has submitted a plea before the Pune ITAT. The taxpayer’s counsel furnished that the delay has arisen as of the dispute with the earlier consultant and the forthcoming change of the counsel.

It was claimed by the counsel that the questioned property was via a cooperative housing society in which the taxpayer was only the Charman and that the addition u/s 68 was made wrongly without validating the ownership or the purchase deed.

While the revenue counsel has kept the orders of the lower authorities and asked to dismiss the plea.

Read Also: ITAT Allows Rectification Due to Misleading Suggestion by Auditor, Leading to Higher Tax Payment

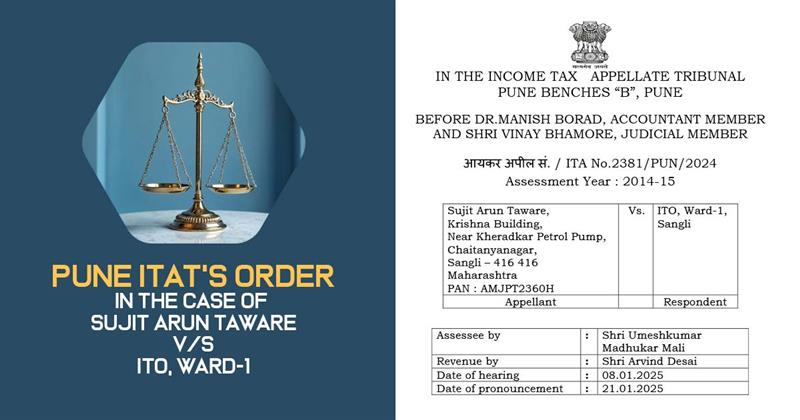

The two-member bench including Dr Manish Borad (Accountant Member) and Shri Vinay Bhamore (Judicial Member) noted that the taxpayer did not participate in the assessment proceedings.

Also, the tribunal noted that the CIT(A) does not furnish the reasoned findings while dismissing the plea. The tribunal relied on the Supreme Court’s decision in Collector, Land Acquisition v. MST. Katiji. It was noted by the tribunal that the influential justice should be there over technical considerations.

Hence the tribunal condoned the delay and restored the case to the Assessing Officer (AO) for denovo adjudication. Also, the tribunal asked the taxpayer to stay vigilant and cooperate in the proceedings. Hence the taxpayer’s appeal was permitted for the statistical objectives.

| Case Title | Sujit Arun Taware vs. ITO, Ward-1 |

| Citation | ITA No.2381/PUN/2024 |

| Date | 21.01.2025 |

| Assessee by | Shri Umeshkumar Madhukar Mali |

| Revenue by | Shri Arvind Desai |

| Pune ITAT | Read Order |