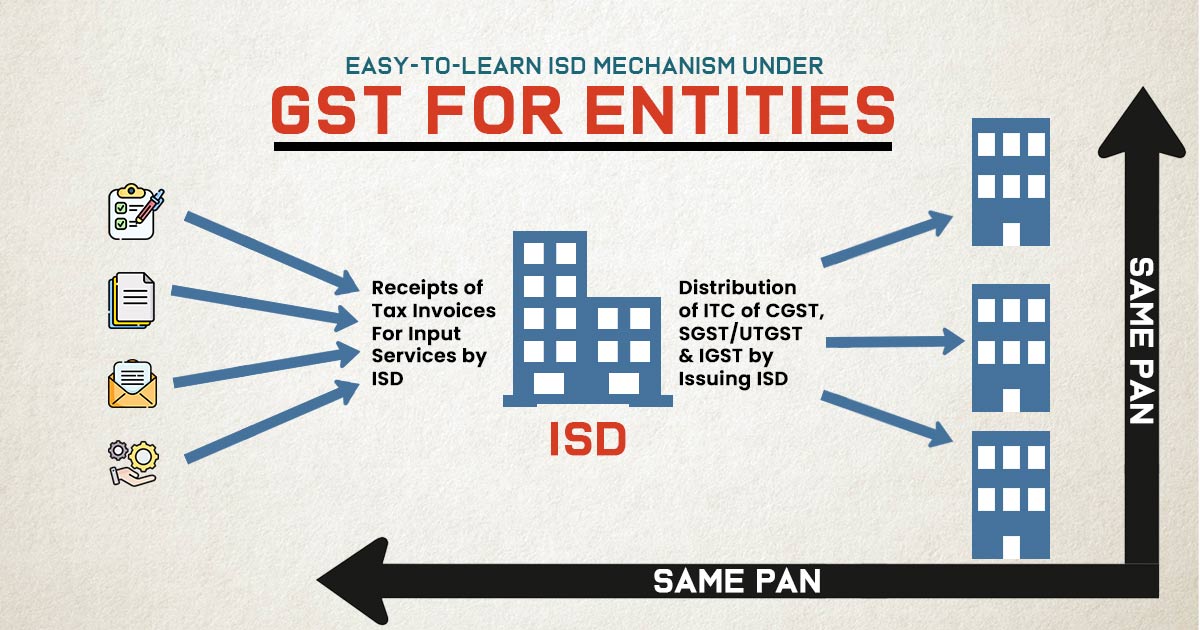

With the implementation of the goods and services tax (GST) in July 2017, businesses with multi-state GST registrations are under confusion about the process of distributing common input tax credits (ITC) available on services to lower net GST liability.

Some of the entities have chosen the input service distributor (ISD) process to allocate the common ITC to their other GST registrations (under the same PAN), while others have opted for the cross-charge procedure. The Central Board of Indirect Taxes and Customs (CBIC) in July 2023 mentioned that the ISD procedure is not obligatory for distributing common ITC availed from third parties to other GST registrations.

Consequently, the business can opt between the ISD mechanism and the cross-charge method. However, the same arrangement will be revised starting April 1, 2025.

GST Rule from April 1, 2025: ISD Obligatory to Claim ITC

W.e.f April 1, 2025, the government has made the ISD mechanism mandatory. It directed that the distribution of common GST input tax credit (ITC) is to be carried out exclusively through the ISD mechanism.

New GST rules have been explained in the below-mentioned table

| GST ITC Nature | Booking of GST invoice | Consumption of services | GST ITC distribution |

|---|---|---|---|

| Input services | Head office | Head office | Not required* |

| Head office | Location other than Head office | Mandatory GST ITC distribution through the ISD mechanism |

If the services used by the head office are used for supplying services to its other locations, the ITC does not need to be distributed but an outward tax invoice (cross charge) shall be issued.

Examples of services that are used at multiple locations are audit (statutory, tax) services, software license services, manpower supply services, security services, banking, consultancy services, litigation services, compliance services, security services, etc.

Why ISD is Being Made Obligatory from April 1, 2025

To avert the collection of the ITC pertinent to the services used in various locations at a single location and ensure the precise ITC allocation to the locations where the services are actually consumed. The function of ISD is to get the invoices for these services at one registration and thereafter distribute the ITC to the other registrations where the services are used.

What is the Method to Distribute the GST ITC via ISD?

The table mentioned below shows how the ISD distributes the common ITC-

| Services Type | ISD location and Services consumption location | Nature of GST ITC in the hands of ISD | Distribution of GST ITC by ISD |

|---|---|---|---|

| Services attracting GST under forward charge | Same State | CGST and SGST | CGST and SGST |

| Different State | CGST and SGST | IGST | |

| Different State | IGST | IGST | |

| Services attracting GST under reverse charge | Same State | CGST and SGST | CGST and SGST |

| Different State | CGST and SGST (always) | IGST |

Requirements for Distributing GST ITC by the ISD

- ITC (eligible or ineligible) available for distribution in a month would be distributed in the same month.

- ITC shall also be required to be distributed to the unregistered offices or offices supplying exempt supplies where such offices have used common input services.

- Where the Input services are used at one location, the ITC would be distributed to these locations only. But where the Input services are used at more than one location, ITC would be distributed to all these locations on a pro-rata basis in the ratio of the turnover.

Issues for GST Taxpayers

- Communication with vendors: Invoices concerning the services used at various locations or locations other than the office would be mandated to get ISD registration for the proper ITC distribution. As per that the taxpayers would be required to communicate and share the new GST number (ISD GSTIN) with the vendors for the invoicing purposes.

- Restructuring of GST invoices: The taxpayers would be required to perform an exercise to examine whether the invoices concerning services consumed at distinct locations could be via respective locations instead of the current practice of obtaining these invoices at the head office.

- Separate ISD registration: Every taxpayer to which the ISD mechanism applies must get separate registration for ISD compliance even though the taxpayer has taken the regular registration before.

- Proper bifurcation of common expenses: The taxpayer shall be needed to separate services into a) services concerning which benefit is derived/consumed by other locations though the invoice is obtained at the office (ISD) and (b) services used by the office for supplying internally generated services to other locations (cross-charge). The cited practice must be performed even though the ITC concerning the common services is not eligible.

- Modifications in the IT systems: It is mandated for the IT systems to be equipped with the new ITC distribution needs like the incorporation of ISD registration details, modification in the procurement process such as purchase orders, creation of ISD-specific ITC ledgers, recording of inward ISD invoices, ISD credit notes, the facility to generate outward ISD invoices, ISD credit notes incorporating statutory details, mapping of common input services consumed at more than one location, etc.

- Additional monthly GST compliances: It is significant for taxpayers to submit a separate monthly return in GSTR 6, incorporating ISD invoices and ISD credit notes. He or she shall also be required to perform an additional reconciliation of the transactions that appear in GSTR 6A before GSTR 6 filing. The locations in receipt of ITC from ISD are required to report the ITC so received in Table 4 while filing the respective monthly Form GSTR 3B.

- Teams Training: It is important to provide training to those accountable like the procurement team, accounts team, and tax filing team so that they learn about the new rules and the transactions are properly recorded/reconciled.

What Takes Place if the ISD Procedure is Not Complied With?

If a taxpayer is mandated to adhere to the ISD procedure however unable to do the same then the below-mentioned consequences may comply-

- The wrong (excess) ITC distribution via the ISD shall be recovered via the taxpayers from the locations of the receiver including an interest.

- The eligibility of common ITC (for the services used at other/multiple locations), if any, distributed (using cross charge route) will be disputed, directing to the refusal of ITC in the hands of the recipient location.

- For irregular ITC distribution, a penalty may be imposed for an amount of irregular ITC distributed or Rs. 10,000, whichever is higher.