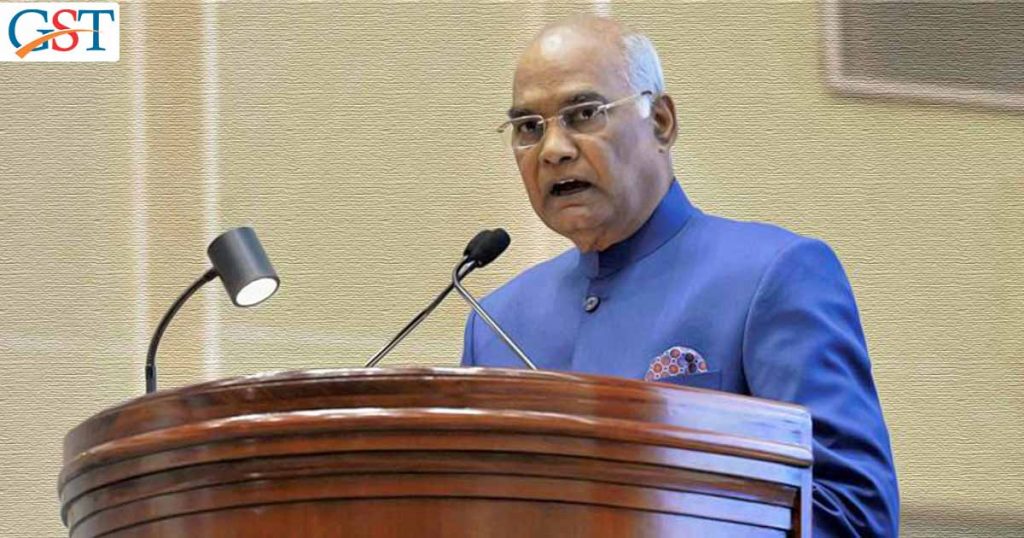

While addressing a joint session of Loksabha and Rajyasabha on June 20, the President of India, Mr Ram Nath Kovind said that my government will continue to take effective measures further in wake of simplification of the GST rule.

Further, he said that the government is working towards to make Indirect tax simpler and effective. “With the implementation of GST, the concept of ‘One country, One tax, One market’ has become a reality. Efforts to further simplify the GST will continue,” he added.

The Goods and Services Tax (GST) which is a complete package of over a dozen local taxes, was implemented in the country on July 1, 2017.

Moreover, he proposed an accident insurance plan of up to INR 10 lakh for all the traders registered under GST.

Read also: GST Council 35th Meeting Latest Updates

While for the small traders, there was a proposal of the National Traders Welfare Board and a National Retail Trader Policy in the bag of Mr Ram Nath Kovind to support retail businesses to grow.

He noted the taxation system plays a vital role in accelerating economic development.

Further, he added, “Along with continuous reform, simplification of the taxation system is also being emphasised. Exemption to persons earning up to Rs 5 lakh from payment of income tax is an important step in this direction”.