Since the genesis of GST, one question that has been thrown at the GST Council from all corners is the impact of GST on petrol and diesel prices. The Government and the GST Council has been more often than not found in search for concrete answers on the burning topic. However, recent developments hint that the GST Council will have to bring petroleum and diesel under GST ambit sooner than it was originally intended.

53rd GST Council Meeting

The council has not discussed diesel, petrol and other petroleum products in the 53rd GST Council meeting that was held on 22nd June 2024. Currently, the five petroleum products are under the cess, central excise and state Value Added Tax which has been giving the most benefits and high revenues to the Centre and state government.

According to the market experts, if the government proceeded with Shri Hardeep S Puri’s idea and included the petroleum products under Goods and Services Tax (GST), then it is anticipated that there will be still no changes in the prices of petroleum products.

Under the present tax regime, due to the central and state levies at every stage of production, there is a spike in the overall prices of diesel and petroleum products in the country

GST Council Waiting for a Suitable Time

The Govt of India replied that there is no proposal at this point in time to include crude petroleum, diesel, petrol, natural gas, and aviation turbine fuel within the purview of Goods and Services.

In a written reply in the Lok Sabha, Finance Minister Nirmala Sitharaman said that “the GST council has not made any recommendation for inclusion of these goods under GST. The council may consider the issue of inclusion of these petroleum products at an appropriate time keeping in view the relevant factors including revenue implication, she said.”

Petrol Diesel To Still Attract Local Taxes

Note: No Changes in Price Expected Even Including Petrol Under GST

According to a government official, petrol and diesel might not get wholly included in the GST ambit and therefore highest tax slab i.e. 28 per cent and value-added tax with some local taxes are to be levied on fuels.

This incidence may not give any chance for price relaxation as the tax scenario would become equal to what is currently applicable. Another bone of contention is that the centre will have to let go of INR 20,000 crore input tax credit earnings by keeping fuels and oils out of the GST.

According to one of the officials, it is said that “There is no pure GST on petrol and diesel anywhere in the world and so in India too it will have to be a combination of GST and VAT.”

However, to introduce petrol and diesel within the GST is a political call to action and it must be according to the decisions taken by both the centre and states.

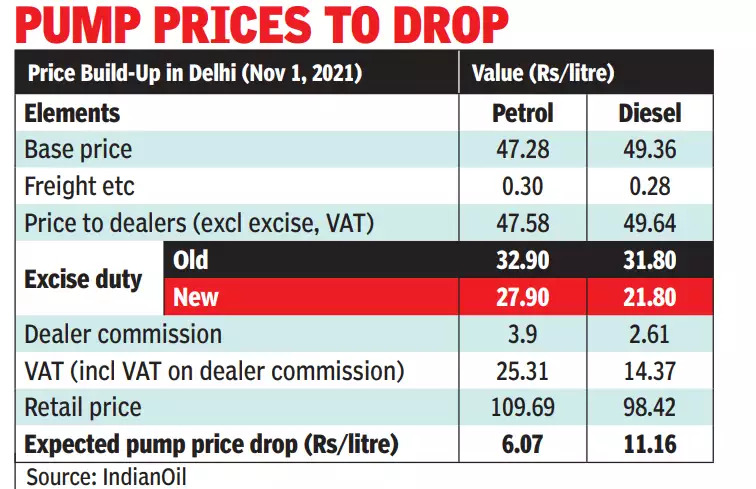

The Centre applied a total of INR 19.90 per litre of excise duty on the petrol while INR 15.80 per litre on the diesel fuel. Additionally, states also levy Value Added Tax (VAT).

It is found that after all the levied taxes, the final price after levying taxes on petrol and fuels is 50 per cent more than the pre-taxes scenario. While talking about GST on other goods and services apart from fuels, are kept within the same limitations and levels with of the pre-GST era.

The official also stated that “The Centre doesn’t have the money to compensate states for loss of revenue and so the solution is to have a peak rate of tax plus allowing states to levy some amount of VAT keeping in mind that the overall incidence should not exceed the present levels.”

Example of Tax on Delhi Petrol Rates

Note: Other taxes: Pollution Cess, Dealer Commission, etc.

States Not in Support to Include Under GST

The finance ministry has stated that most of the states from across the nation have said to not include petrol and diesel in the GST scheme for an unknown reason. The union finance minister Arun Jaitley himself commented on this topic and also mentioned that maybe in near future they may make their way into the GST.

The minister also added that natural gas and real estate possess legible points which directs it to be included in the GST ambit while he was oppressing the fact that petrol and diesel will be tried to bring it under the GST. Although he has indicated that the GST might be higher on petrol and diesel but still assured that the overall effect will lower the prices across the country.

As of now, petrol and diesel are out of the GST ambit and are wholly under the state government for tax levy purposes.

Petroleum Minister Pleads to GST Council

Recent statements from the Petroleum Minister Hardeep Singh Puri further add substantial weight to this. It seems that Petro-Diesel and GST are now the main topics of concern as well as prolonged debates amidst the inner corridors of power. Petrol price in Delhi could reach the Rs. 94.72 mark whereas diesel may record a price of Rs 87.62 a litre within upcoming months. A few main reasons for such aggravated price are:

- The surge in global crude oil prices

- Limited production by the Petroleum Exporting Countries

- Rising Consumer and Industrial Demands

Recommended: What If Electricity Comes Under Goods and Services Tax India?

Compensation To States Pose Big Hurdle

The Union Minister for Petroleum has over the past few weeks raised concern about the rising price of Petrol and petroleum-based products. He even hinted towards a sooner-than-later inclusion of Petroleum and petroleum-based products under the GST ambit.

But the reality it seems is in sharp contrast to the dreams of the billion Indians. A major agreement which laid towards the successful and mutual adoption of GST by the 28 states and 8 Union territories was the Central government’s assurance of bearing the revenue loss incurred by states due to GST implementation. A few highlights of the Compensation Bill for states under GST LAW include:

- Revenue loss compensation to States for five years

- Cess for 5 years (GST Compensation Cess) to be levied

- Input tax credit of Cess will be allowed

Considering the above points, states might refrain from giving up on the VAT revenues generated from Petrol and Diesel. Even if somehow the Government at the centre manages to pull out the rabbit from the hat, the burning question still remains… Where would the revenue for paying state compensation come from?

As now we are seeing the hike on price in petrol as i am feearing that in sooner days we soon see the petrol reaching upto 100plus which infact a low commoner people will face the price.

What if gst is implemented in petroleum products like any other goods.

In this article as per the view of Pradhan the petroleum product. Get the benefit to every sector and end consumer effect low price for better.