A writ petition has been dismissed by the Patna High Court contesting the cancellation of GST registration, quoting that statutory remedies should be pursued within the said time limit.

Chief Justice K. Vinod Chandran and Justice Partha Sarthy noted that “The law favours the diligent and not the indolent”.

Rani Enterprises the applicant challenged the cancellation order on December 30, 2022, after failing to use the statutory appellate mechanisms furnished under the Bihar Goods and Services Tax Act, 2017 (BGST Act).

An appeal under section 107 of the Bihar GST Act, against the cancellation order can have been submitted in 3 months, with an additional one-month window for delay condonation.

The applicant does not submit the appeal via the extended due date of April 29, 2023. Additionally, section 30 of the GST Act permitted an application to revoke the cancellation within 30 days of the order. Even after these provisions the applicant neither submitted a plea nor asked for the revocation within the allowable period.

The government adding to this lapse has introduced an Amnesty Scheme through GST Circular No. 3 of 2023, permitting dealers whose registrations were cancelled to restore their status by clearing dues between March 31, 2023, and August 31, 2023. Also, the applicant loses to take this opportunity.

It was noted by the court that at the time of the cancellation of the period the applicant was not a registered dealer and no process is there to track their business activities. The absence of tracking has raised issues regarding the feasibility of transactions performed in the interrupted period.

Also Read: Delhi HC Cancels SCN and GSTIN Cancellation Order as It Was ‘Remarkably Silent’ on GST Provisions

The Court repeating the principle that “the law favours the diligent and not the indolent,” concluded that the failure of the applicant within the said timelines prevented them from asking for relief. Therefore the writ petition was dismissed.

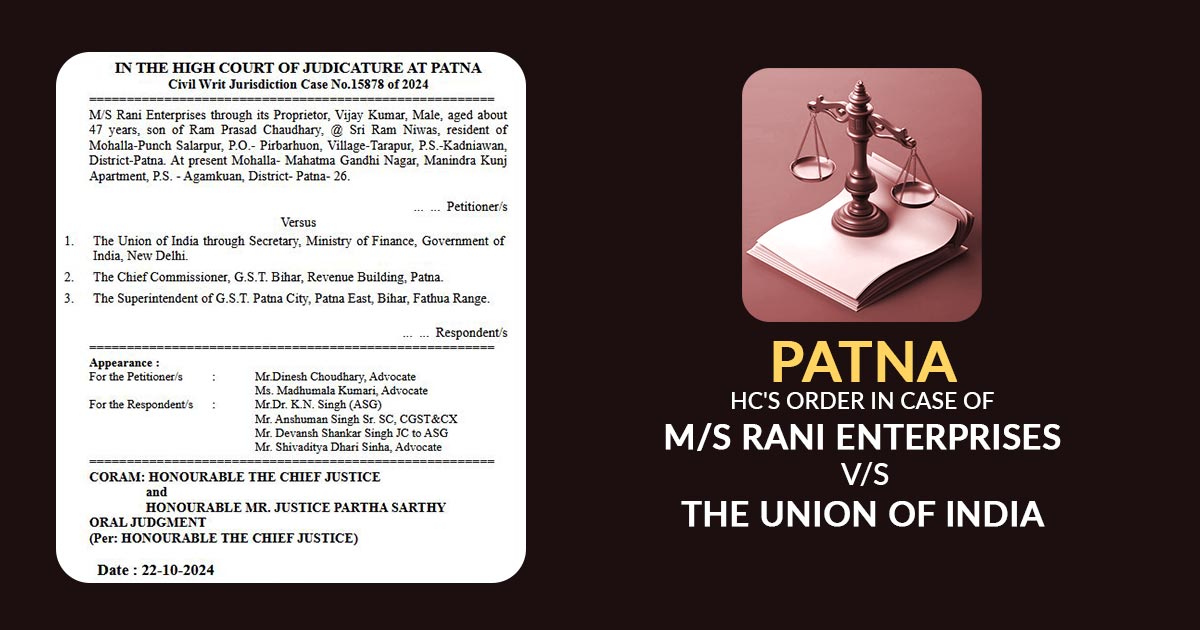

| Case Title | M/S Rani Enterprises vs. The Union of India |

| Citation | Civil Writ Jurisdiction Case No.15878 of 2024 |

| Date | 22.10.2024 |

| For the Petitioner | Mr Dinesh Choudhary, Ms Madhumala Kumari |

| For the Respondent | Mr Dr K.N. Singh, Mr Anshuman Singh, Mr Devansh Shankar, Mr Shivaditya Dhari Sinha |

| Patna High Court | Read Order |