The Delhi High Court quashed the show cause notice and the order of cancellation of GST registration after discovering that the SCN and the final order failed to furnish any clue concerning the provision of the statute which was alleged to have been breached or infringed.

“The SCN is gloriously silent concerning the provisions of the GST Act which are alleged to have been violated or infringed”, observed the Division Bench comprising Justice Yashwant Varma and Justice Ravinder Dudeja.

Case Facts

The petition was furnished with an order for cancellation of its GST registration, which was preceded by a Show Cause Notice (SCN), expressing non-compliance with specified provisions in the GST Act or the Rules made thereunder. Therefore the applicant approached the High Court.

Delhi High Court Statements

It was marked by the bench that neither the SCN nor the final order assigned or recorded any causes in support of the conclusion of the GST registration cancellation.

It was recorded by both the SCN and the final order that the applicant had breached the provisions of the Goods and Services Tax Act, 2017, or the Goods and Services Tax Rules, 2017, the Bench cited.

Therefore the High Court has permitted the petition of the taxpayer and set aside the SCN and the order of cancellation of registration.

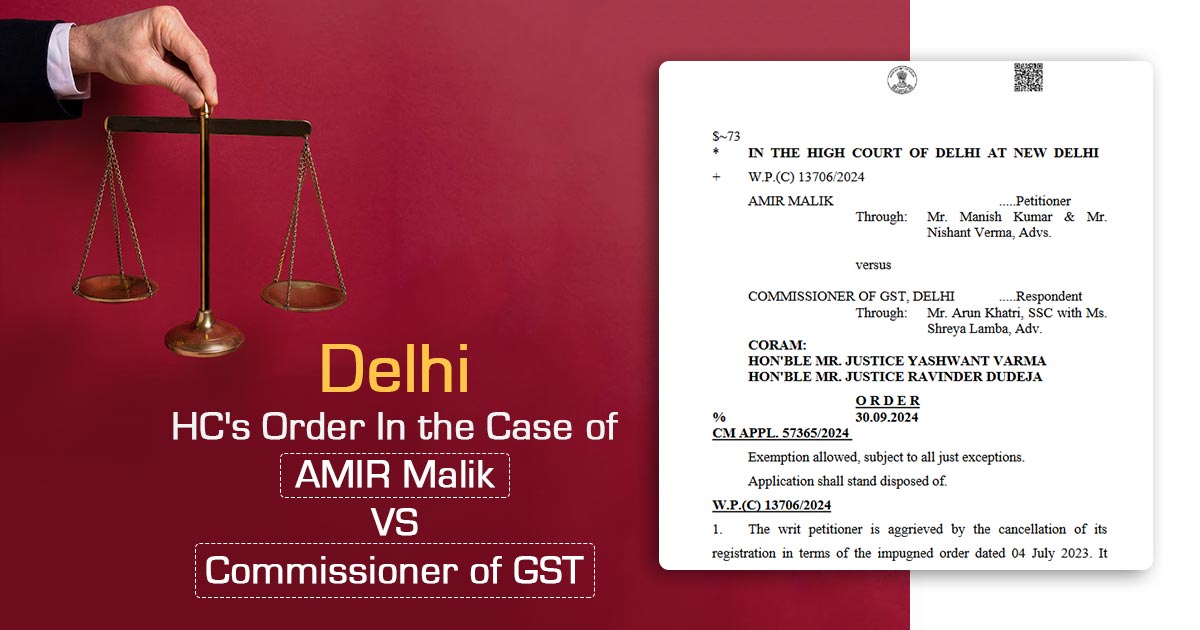

| Case Title | AMIR Malik vs. Commissioner of GST |

| Citation | W.P.(C) 13706/2024 |

| Date | 30.09.2024 |

| Counsel For Petitioner | Mr Manish Kumar and Mr Nishant Verma |

| Counsel For Respondent | Mr Arun Khatri, Ms Shreya Lamba |

| Delhi High Court | Read Order |