The applicant, Shiv Construction, is a registered partnership firm under GST. The tax authorities have suspended its GST registration, citing rival claims between partners and alleged falsified documents.

As per the applicant, the suspension was ordered without any search and seizure of his complaint for the unauthorised amendments in the GST credentials, and without furnishing prior notice or hearing, hence it breaches the norms of natural justice.

For quashing the suspension order, restoration of portal access, investigation into forged documents, reinstatement of original signatory credentials, and compensation for business losses, the applicant prayed.

Previously, the High Court in pendency had ruled for provisional relief by restoring portal access and staying the suspension order, allowing the applicant to file updated returns.

The question at hand is whether a suspension of GST registration, based on contested claims about a partnership and supposed fake documents, is acceptable under the GST laws, especially when there was no prior notice or opportunity for a hearing under the CGST/BGST Act.

Before suspending the registration, no notice or hearing was furnished, even though during registration, the authorised signatory was duly designated as Mr. Rajiv Ranjan, the court stated. GST Registration suspension based on the partner disputes without adjudication and without complying with the due process breaches the norms of natural justice.

The court said that the business continuity needs to be preserved, and the businesses shall not be affected by the disputes between partners.

The court asked to provide a fresh chance to all parties for submitting the responses, hearing them, and passing a reasoned order within 4 months. The suspension order will remain stayed till such a decision is taken, and the registration of the applicant will continue to operate.

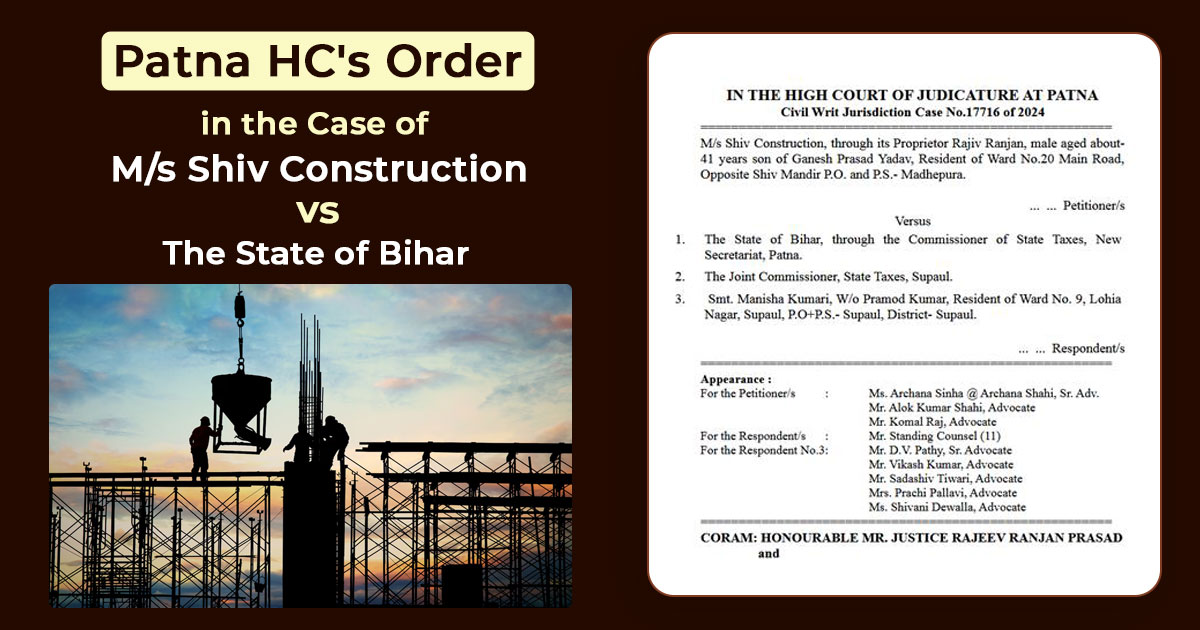

| Case Title | M/s Shiv Construction vs. The State of Bihar |

| Case No. | 7716 of 2024 |

| For Petitioner | Ms. Archana Sinha @ Archana Shahi, Sr. Adv. Mr. Alok Kumar Shahi, Advocate Mr. Komal Raj, Advocate |

| For Respondent | Mr. Standing Counsel (11) |

| Patna High Court | Read Order |