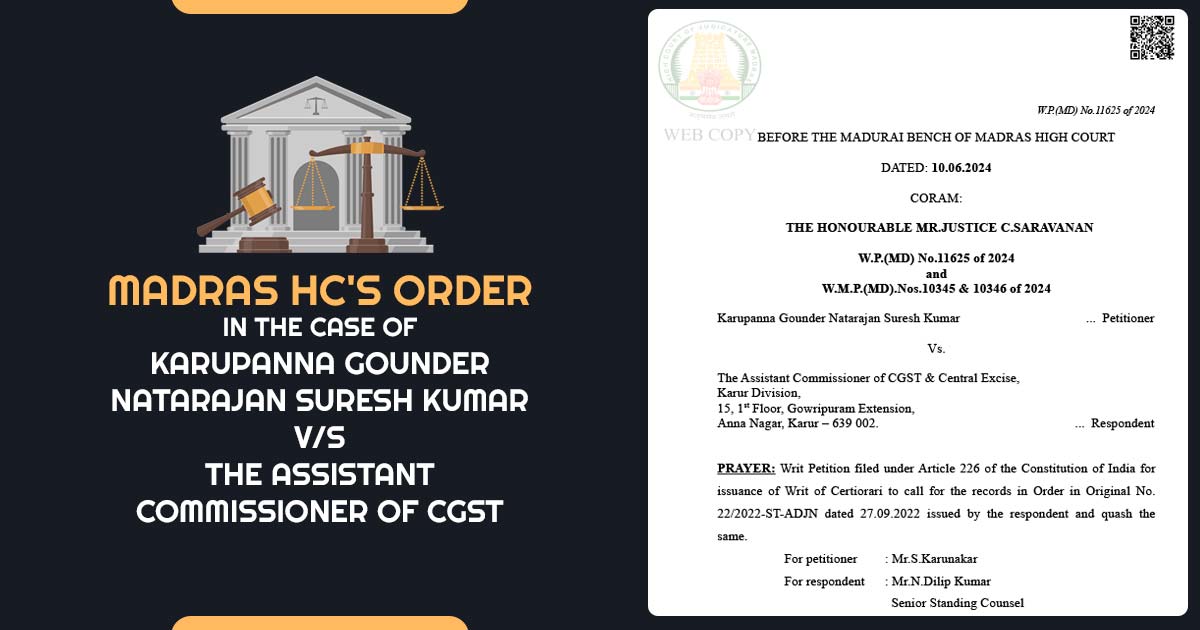

The Central Board of Indirect taxes and Customs (CBIC) has provided a circular concerning to essential filing of the correct and proper details of the inter-state supplies and the amount of the ineligible/blocked Input Tax Credit and reversal in return in FORM GSTR-3B and statement in FORM GSTR-1. Board who has been issued a circular […]