The Madras High Court in a ruling set aside the GST order that had been sent to the wrong address and instructed the council to treat the same as an addendum to the original SCN, which was sent to the correct address.

The taxpayer Karupanna Gounder Natarajan Suresh Kumar, filed a petition contesting the impugned GST order in original. The GST order has been addressed to the applicant’s present address, furnishing at the time of GST registration effective from 1st July 2017. However, the preceding notices were sent to the former address used for the service tax registration under the Finance Act, of 1994.

The respondent’s Senior Standing Counsel claimed that the notice preceding the impugned order was furnished to the applicant via email, but there was no answer.

The court mentioned that the applicant must be provided a chance to address his grievances against the proposals in the preceding SCN No. 26/2021-ST, on October 22, 2021.

The impugned order was quashed and the matter was remitted back to the respondent to pass the fresh orders on the merits and as per the law within 90 days of obtaining the copy of the order.

As per the court, the quashed order must be regarded as an addendum to the show cause notice on October 22, 2021. The taxpayer is anticipated to file a response within 30 days from today and the respondent is required to furnish a hearing to issue the new orders. With such directions, the writ petitions were disposed of.

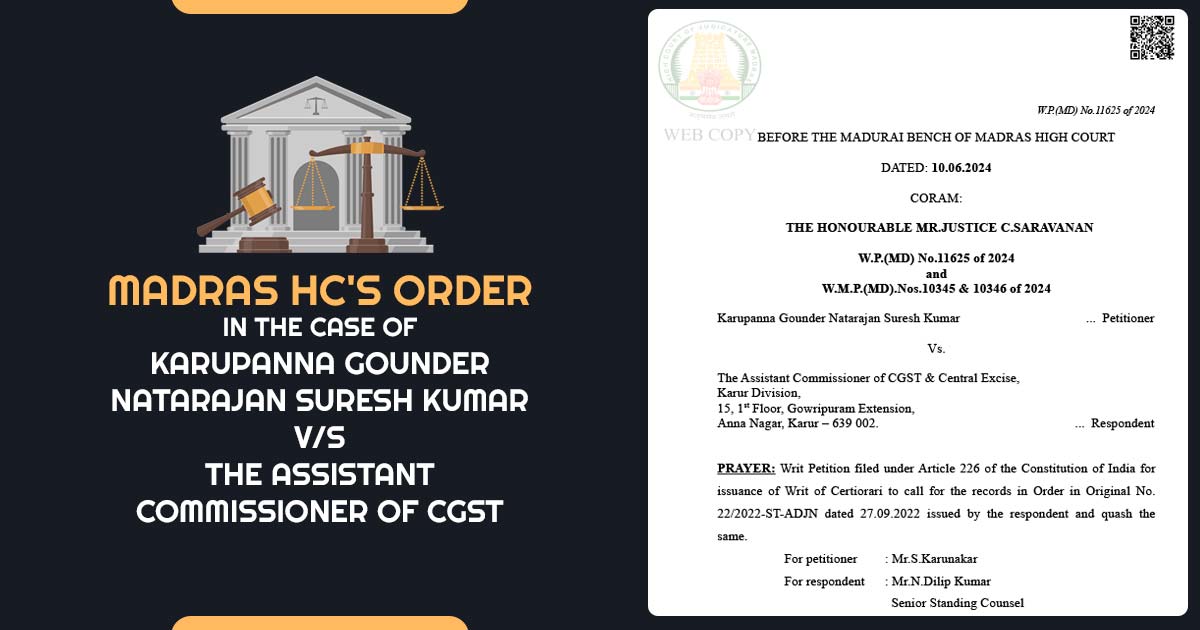

| Case Title | Karupanna Gounder Natarajan Suresh Kumar V/S The Assistant Commissioner of CGST |

| Case No.: | W.P.(MD) No.11625 of 2024 |

| Date | 10.06.2024 |

| Counsel For Appellant | Mr.S.Karunakar |

| Counsel For Respondent | Mr. N.Dilip Kumar Senior Standing Counsel |

| Madras High Court | Read Order |