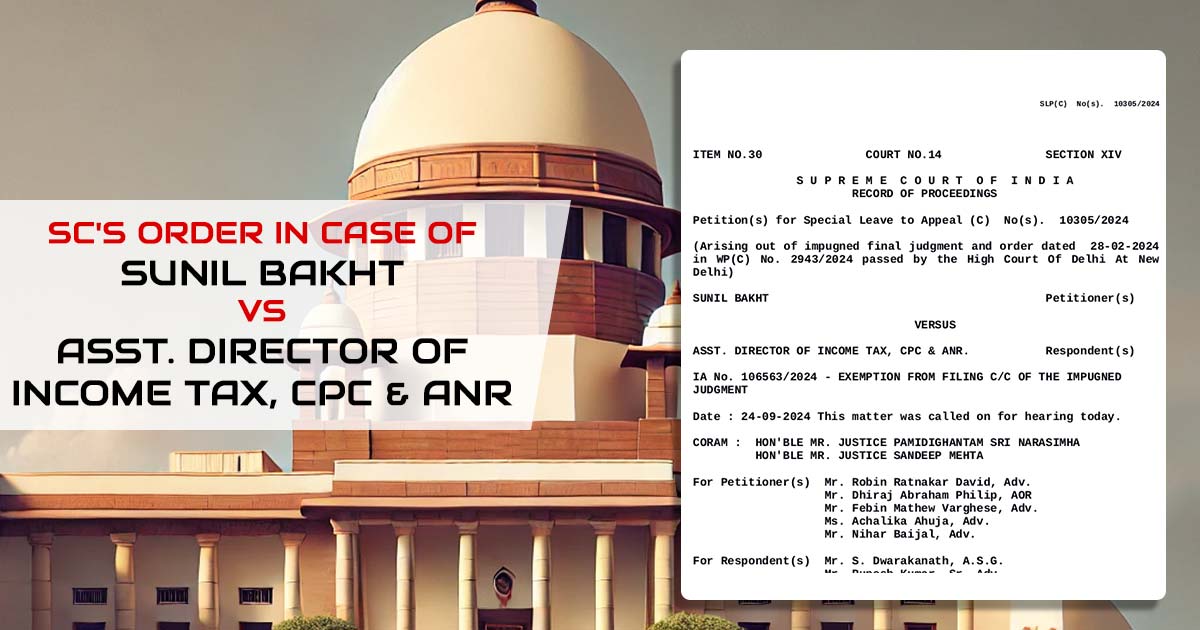

This article will aware of the TDS claim process if credit is not reflected in 26AS, AIS and TIS forms. There is Section 205 of the Income Tax Act of 1961 that gives you rights in certain situations. For example, if you are paying 60% tax on your income but your adequate tax liability is […]