GST CMP-08 is the statement that dealers registered under the Composition Scheme use to report their self-assessed tax liability. It provides information on taxes owed for sales and purchases (subject to the Reverse Charge Mechanism) and has replaced Form GSTR-4.

Composite Dealers are required to file CMP-08 Return every quarter through the GST Portal. They can calculate their tax liability and make payments online. If no tax is owed during the quarter, a Nil return must be submitted.

Some Features of GST CMP-08 Form

- Outward supplies(including exempt supplies:- Total amount of sales including exempted sales.

- Inward supplies attracting RCM including Import of services:- Purchase of goods/services including purchases on RCM Under GST basis. It includes import of services also.

- Adj of negative Liability of Prev. Tax period( Other than RCM):- Any excess liability paid in the previous tax period is mentioned here. It will be auto-filed from the portal.

- Adj of negative Liability of Prev. Tax period( RCM):- Any excess liability paid on an RCM basis will be shown here it will be auto-filed from the portal.

- Tax payable [(1-3)+(2-4)]:- Total amount of tax due.

- Tax paid:- Total amount of tax already paid.

- Balance tax payable (5-6):- Balance amount of tax required to be paid.

- Interest payable, if Any:- Any interest required to be paid.

- Interest paid:- Amount of interest already paid.

- Balance interest payable (8-9):- Balance amount of interest required to be paid.

- Late fee payable:- It will be auto-calculated from the portal.

- Late fee paid:- Amount of late fee already paid.

- Balance Late fee payable (11-12):- Balance amount of late fee required to be paid.

- Total Tax, interest paid and late fee paid (6+9+12):- Total amount of tax, interest and late fees already paid.

- Balance Tax, interest payable & late fee payable (7+10+13):- Sum of balance tax, interest payable & late fee payable required to be paid.

Procedure to e-File CMP-08 Return Using Gen GST Sofware

Below is the simple process to know how to e-File CMP-08 Return Using Gen GST Sofware:

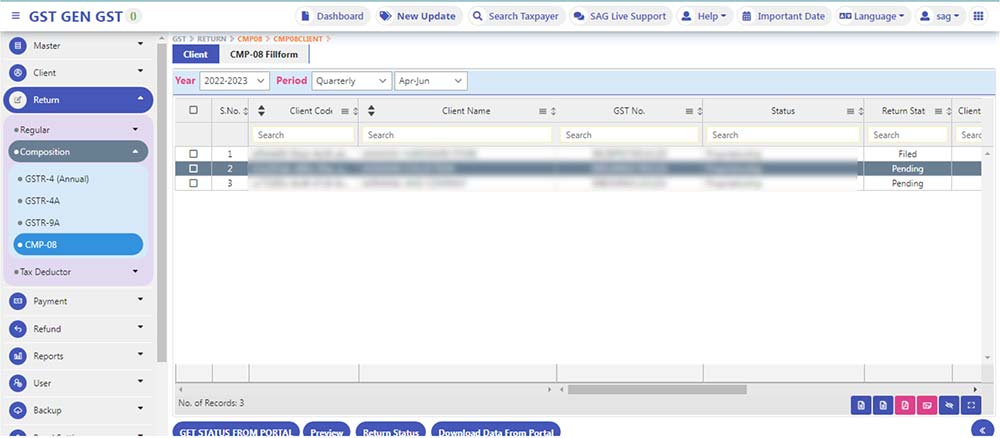

Step 1: First Install Gen GST Return Filing Software on your laptop and pc, after selecting the CMP-08 option, go to the CLIENT Tab (On the top of the page) as shown in Fig. 1

Step 2: Select Client from the list and period for which CMP-08 is required to be filed then select Fill form CMP-8.

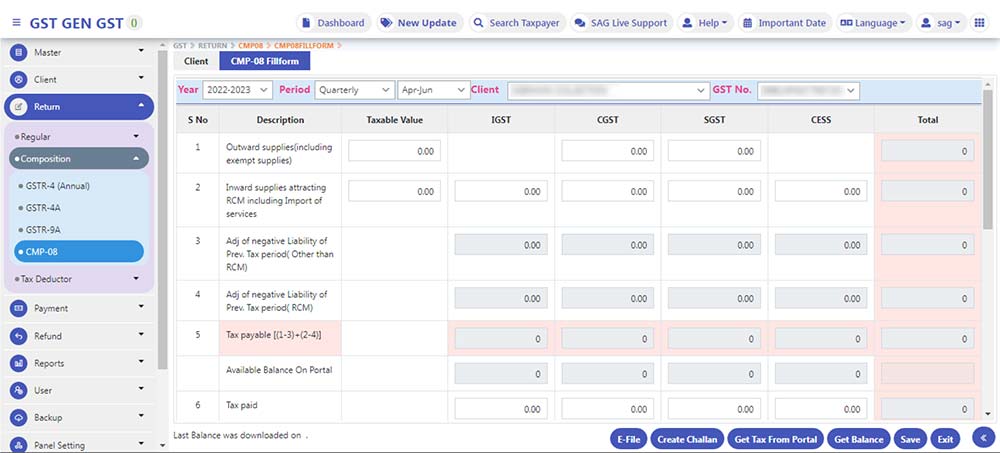

Step 3: The page will appear as shown in Fig no 2. Enter the required details in the form.

Step 4: After providing all details select the save option as shown in Fig no-2.

Step 5: The balance of the cash ledger available on the portal will be auto-filed by selecting Get Balance Option. For this, you are required to log in to the portal as shown in fig no 3.

Step 6: Amount of tax, and interest will be filed from the portal by selecting the Get tax From Portal option For this you are required to log in to the portal as shown in Fig no 4.

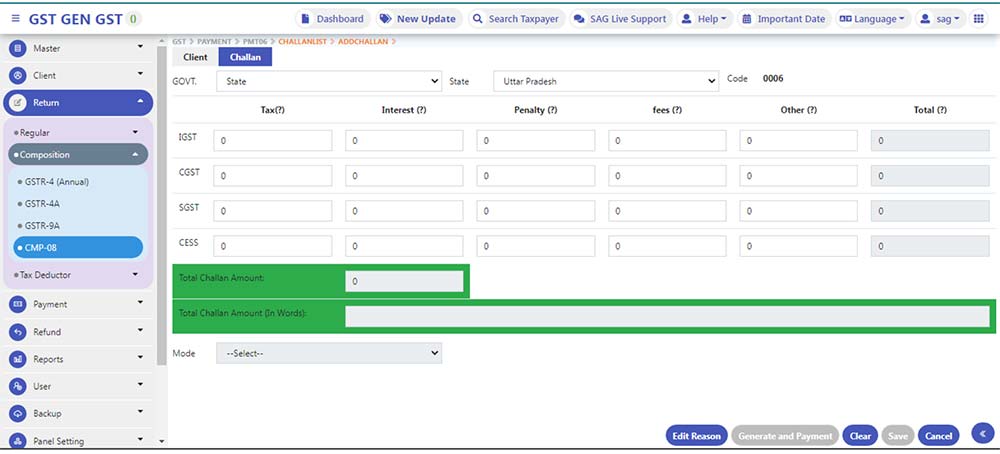

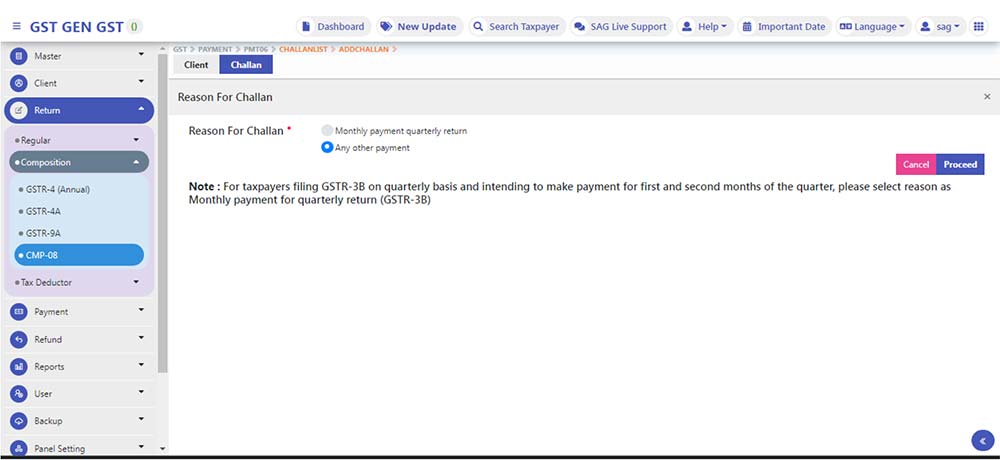

Step 7: By selecting this option you can create a challan to pay tax, interest and late fees as applicable as shown in Fig no 5. After providing the required details select the mode of payment as shown in Fig no 5.

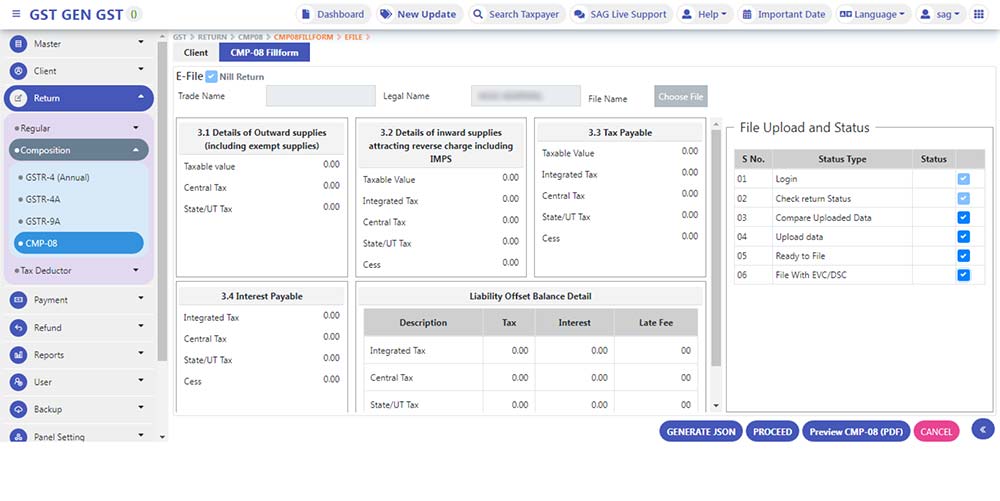

Step 8: After providing all the details Select the E-File option to file a return as shown in Fig no 6.