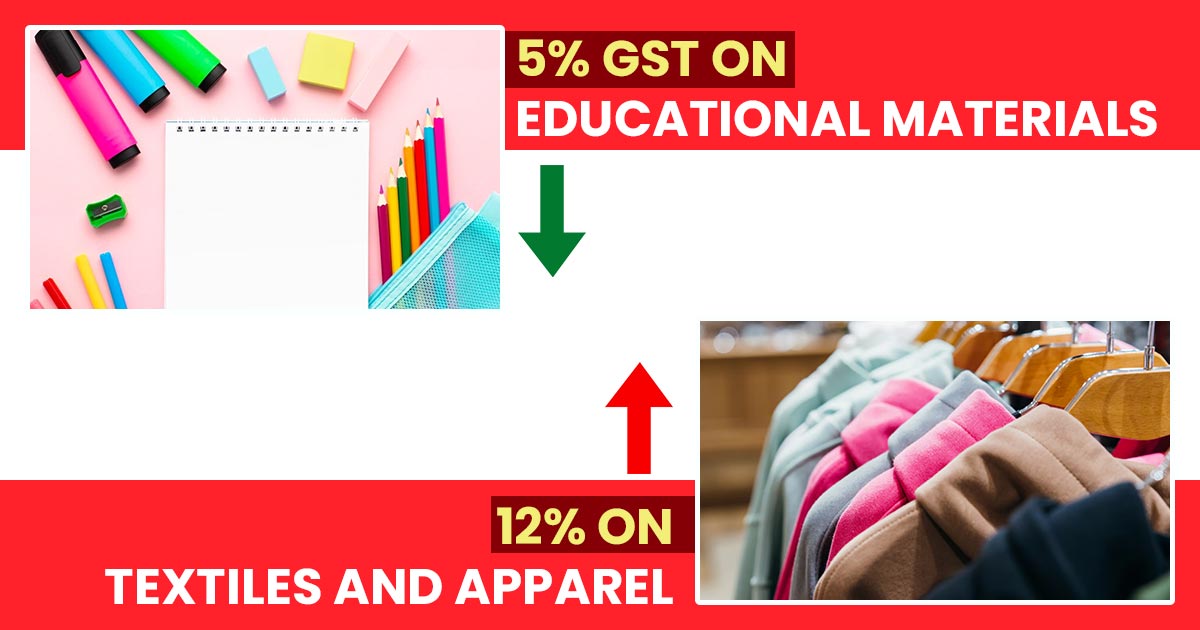

On GST rate rationalization the Group of Ministers (GoM) in its meeting conducted in Goa articulated assistance for diminishing the GST rate on education materials from 12 to 5 per cent relief to a wider portion of the population.

The panel arrived to raise the GST rates on textiles and apparel items that cost over Rs 1,000 from 5% to either 12% or 18%, to achieve “revenue neutrality.”

This decision has the motive to draw the weighted average GST rate closure to the revenue neutral rate (RNR) of 15.5%, which has fallen below 11% because of multiple rate cuts since the implementation of the GST in July 2017.

Bihar Deputy Chief Minister Samrat Chaudhary, who chaired GoM does not address the contentious problems of lessening or waiving GST on health insurance or revising the current four-slab structure of 5%, 12%, 18%, and 28%.

The upcoming GoM meetings on October 19 and 20 will address these topics, along with other outstanding issues.

After the October meetings for further deliberation, the suggestions of GoM comprised of the shift to a three-slab GST structure are anticipated to be submitted to the GST council.

The current system might be replaced by the proposal for a three-tier structure of 9%, 18%, and 27% which is under consideration.

Key ministers from states such as Uttar Pradesh, Rajasthan, Kerala, and West Bengal are the GoM members.