The government sources have said, to make the tax filing simpler for businessmen, the return filing may be changed from monthly to quarterly. They also said that the requirement for filing three GST returns will likely to be taken down to one.

Powerd By SAG INFOTECH

Notifications can be turned of anytime from browser settings

The government sources have said, to make the tax filing simpler for businessmen, the return filing may be changed from monthly to quarterly. They also said that the requirement for filing three GST returns will likely to be taken down to one.

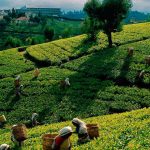

The tea industry figured slow growth at the auction centres instead of global and domestic signal working in favour of the Indian market. The reason behind the confusion is generated after goods and services tax (GST) implementation in India.

The union finance minister has clearly stated that the states are not in the favour of including petrol and diesel in the GST ambit due for some unknown reasons.

There is always a doubt as to how a taxpayer can withdraw its remaining tax balance left with the government in case he chooses to cancel its GST registration.

Now even the B2B i.e. business to business merchants are in the queue to obtain certification of passing benefits to the consumers from the final vendors and retailers in order to corner down the anti-profiteering clause that may hamper there otherwise obligation if paid no concern.

Arvind Subramanian, the Chief economic adviser of the government of India, recently gave a hint that the country might be headed to implementing a single rate for GST, which was launched in July 2017.

Security goods which are imported for Special Protection Group (SPG) who guards the Prime Minister has not been exempted from GST making a weird situation for the ministry.

The 25th GST council meeting which was chaired by the finance minister Arun Jaitley and state finance ministers offered a great relief to the educational institutes.

The technical issues of GST Network (GSTN) coupled with errors in invoice matching have brought in criticism from all corners.