The Andhra Pradesh High Court in a case mentioned that the petitioner can contest the cancellation of GST (Goods And Service Tax) registration by availing remedy u/s 30 of CGST (Central Goods And Service Tax) Act and disposed of the writ petition.

The applicant Madeena Steels, proprietor is in the business of purchase and sale of iron scrap and has been regularly paying monthly returns after claiming GST ITC (Input Tax Credit) as per GST Act, 2017. On 23.06.2023 SCN was served by the 1st respondent expressing that the suppliers claimed ITC without actually receiving the goods and passed on this credit to the applicant without supplying the goods and proposed to cancel the registration of the applicant.

It was argued by the applicant that when the 1st respondent’s claims of the bogus invoices and the ITC without the goods movement were accepted, no goods were bought. Consequently, there can be no sales, as without obtaining the goods, goods could not be sold.

Hence if the 1st respondent asked about the purchases then the sales must be sought. The registration was cancelled without taking into account the contention raised by the applicant. Aggrieved via the decision the writ petition is filed.

The counsel of the applicant claimed that the applicant was not involved in the fake transactions to assist the supplier’s claim the ITC fraudulently and the applicant did not furnish those reports on the grounds of which the SCN was issued. It has averted the applicant from answering and the same is a breach of natural justice.

Opposite to the argument, the Government Pleader for Commercial Taxes mentioned that a writ petition is not maintainable as the applicant has alternative remedies, like filing a petition u/s 30 of the APGST (Andhra Pradesh Goods and Service Tax) Act or appealing u/s 107 of the Act.

It was claimed by the Government Pleader that the applicant could not claim the non-supply of the data or a breach of the natural justice principles.

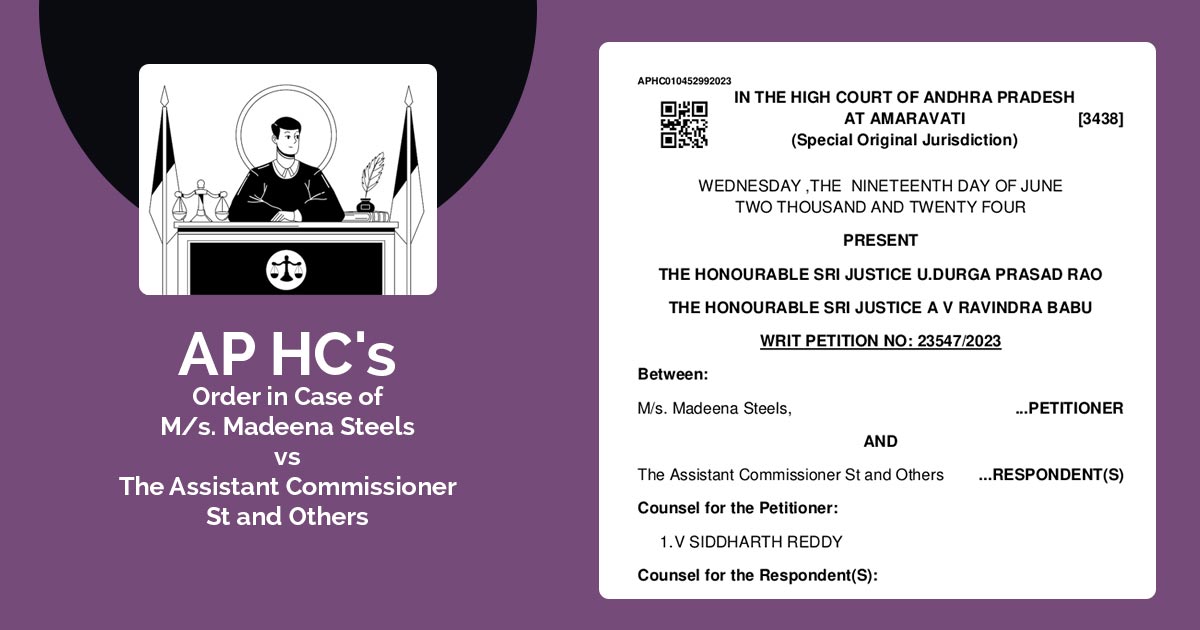

Hearing both sides a division bench of Justice, and A V Ravindra Babu disposed of the writ petition mentioning that via filing an application u/s 30 of the GST act for revocation of cancellation or for contesting the order an appeal can be filed to ask remedy.

| Case Title | M/s. Madeena Steels Vs. The Assistant Commissioner St and Others |

| Citation | WRIT Petition No: 23547/2023 |

| Date | 19.06.2024 |

| Counsel For Appellant | V Siddharth Reddy |

| Counsel For Respondent | GP for Commercial Tax |

| Andhra Pradesh High Court | Read Order |