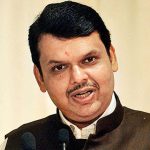

The Pune Cantonment Board (PCB) sent a delegation of elected members to Mumbai to meet Chief Minister Devendra Fadnavis on Tuesday. The mission behind this meeting was to urge the Chief Minister to help the Board by offering them a share in the collection of the Goods and Services Tax.