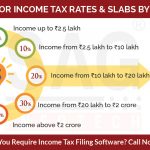

Every Indian Taxpayer contributes to the well-being of the nation by allowing the outgo of some money from their personal account in the form of Tax. Centralized Processing Center (CPC) governed by the Income Tax Department is responsible for verifying the documents and processing them for the claimed tax refunds. There is no way to […]