Delhi High Court in a case asked for re-adjudication when the order passed u/s 73 of the Central Goods and Services Tax Act, 2017 without furnishing a chance to clarify the response concerning the Show Cause Notice (SCN).

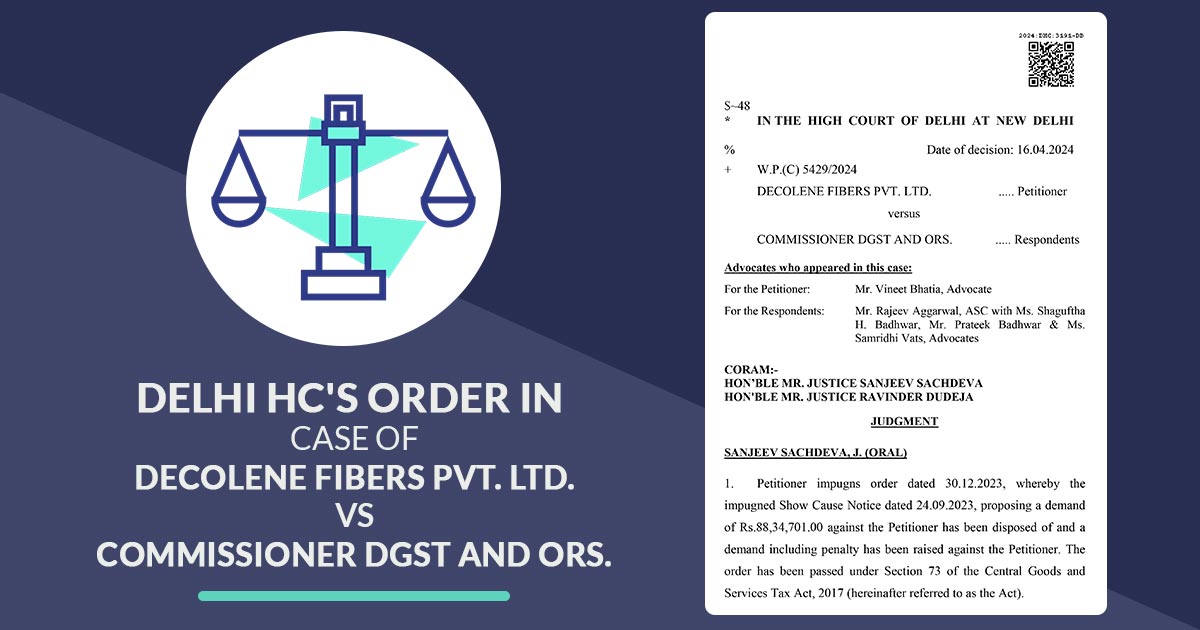

The applicant Decolene Fibers Pvt. Ltd. filed the writ petition against the show cause notice and order passed u/s 73 of the Central Goods and Services Tax Act by offering a demand of Rs 88,34,701.00.

During the adjudication applicant counsel Vineet Bhatia furnished that the applicant had furnished a detailed response on 17.10.2023, but, the impugned order on 30.12.2023 does not regard the reply proposed by the applicant and is a cryptic order.

Read Also: Delhi High Court Directs Officials for GST Refund to Petitioner Paid Under Pressure

The bench while deciding the case noted that the Impugned order on 30.12.2023 issued on SCN on 24.09.2023, after recording the narration records that the response uploaded through the assessee is insufficient.

It additionally noted that the proper officer had provided no chance for the Petitioner to clarify its response or provide additional documents/details.

A division bench of Justice Sanjeev Sachdeva and Justice Ravinder Dudeja post examining the facts and arguments of both parties, set aside the order passed u/s 73 of the Central Goods and Services Tax Act and directed re-adjudication without furnishing a chance for clarifying the reply concerning the Show Cause Notice.

| Case Title | Decolene Fibers Pvt. Ltd. VS Commissioner DGST and ORS. |

| Case No.:- | W.P.(C) 5429/2024 |

| Date | 16.04.2024 |

| Counsel For Petitioner | Mr. Vineet Bhatia, Advocate |

| Counsel For Respondent | Mr Rajeev Aggarwal, ASC with Ms Shaguftha H. Badhwar, Mr. Prateek Badhwar & Ms. Samridhi Vats, Advocates |

| Delhi High Court | Read Order |