Employee Provident fund (EPF) is an ideal investment choice for any salaried person, owing to its E-E-E (exempt-exempt-exempt) nature. It rendered that the investment in EPF, interest through EPF, and withdrawal from EPF post 5 years is privileged. if an organisation employs less than 20 employees the contribution from both employer and employee is limited to 10%. This article tells about the method to perform PF transfer online.

Latest Update

- Interest Rate on Employee PF Deposits is 8.25% for FY 2023-24

- The interest earned on EPF contributions is usually tax-free, but from FY 2021-22, it is taxable if it exceeds a threshold provided by the EPFO.

- Utilize UAN to Online PF Transfer

- Information or Documents Online PF Transferring

- Process to Online EPF Transfer

- FAQs on PF Transfer

Why Transfer Your Employee’s PF?

After the person starts his career through employment in any of the PF enrolled companies, an employee will be enrolled for the purpose of PF and both the employee and employer contributes to the employee’s PF, and the fund earns interest till withdrawal. Moreover, it is common for early or mid-years of the career to change jobs for different reasons with or without break. In these cases, what occurs to the PF account of the employee already made with the previous employer? The employee has two choices in these cases.

- Employee’s contribution along with interest can be withdrawn if the employee resumes being on leave for up to 60 days

- Transfer the balance to the existing employer

As it is prescribed that for making it an ideal saving for retirement it is always effective to transfer the PF balance rather than withdrawing. It is indeed suggested from the tax point of view as withdrawal of PF in 5 years of continuous service is taxable.

Method to Utilize UAN to Online PF Transfer

The Employees Provident Fund Organisation (EPFO) has been adopted various measures to make the functioning of EPF accounts easier for employers as well as employees. Upgrading within the technology, EPFO is indeed attempting to perform all the processes concerned to EPF electronic, more precisely PF transfer and withdrawal of PF is a difficult process and takes much time. EPFO has initiated the Universal Account Number (UAN), which acts as an umbrella for the multiple Member Ids assigned to a person through different employers.

The linking of multiple EPF accounts member Id given to the single member is being enabled via UAN. UAN provides multiple services such as dynamically updated UAN card, updated PF passbook along with all transfer-in details, facility to link previous members’ ID with present ID, monthly SMS concerning credit of contribution in PF account and facility for auto-triggering transfer request on change of employment.

Read Also: Generate PF/ESI Challan & TDS Filing Via Gen Payroll Software

Information or Documents to Keep Ready Before Online PF Transferring

While the PF transfer was made possible online before beneath the ‘Online Transfer Claim Portal’, through the introduction of UAN, the process of transfer is amended and shifted beneath the unified portal. But for making the online PF transfer, you must note the below mentioned things:

- The member must be held with activated UAN in UAN portal mobile number used towards the activation must also be active

- The bank account and bank IFSC code of the employee must be linked with respect to UAN, seeding the Aadhar number and PAN with respect to UAN is not essential for raising transfer claims

- The employer must pose approved e-KYC

- The former or current employer must hold digitally enrolled authorized signatories in EPFO

- PF account number of both the former and the current employment of the employee must be entered in the EPFO database

- Just one transfer request with respect to the former member ID would be accepted

- Personal details and the PF account concerned with the information shown in EPFO must be correct

Easy Steps to Check PF Balance by UAN Portal

- Step 1. Proceed to the government EPF UAN portal

- Step 2. Choose the location (state, regional branch office) of your PF office

- Step 3. Fill out the online form with your personal details along with the EPF account number revealed on your payslip

- Step 4. Submit the form post to validate the information given

- Step 5. When all your records are in place then your EPF balance would be sent to your registered mobile number

Easy Steps to Employee Online PF Transfer

Now we would remember that the PF transfer would be made online and the mentioned criteria are required to be fulfilled. See the process through the screenshots attached below:

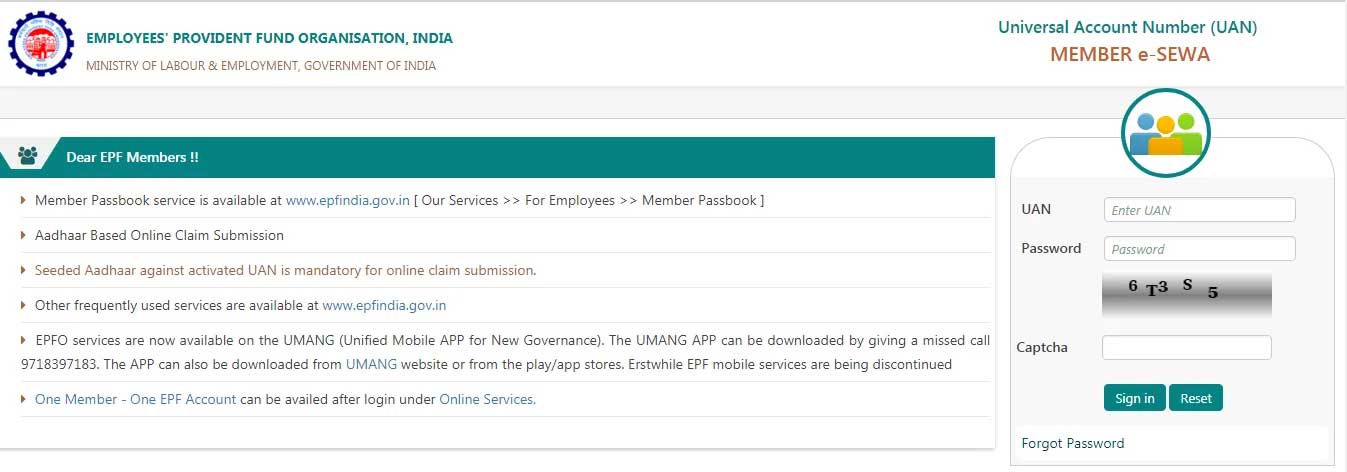

Step 1: Log in to Unified portal (member interface) through your credentials that are, UAN number and password

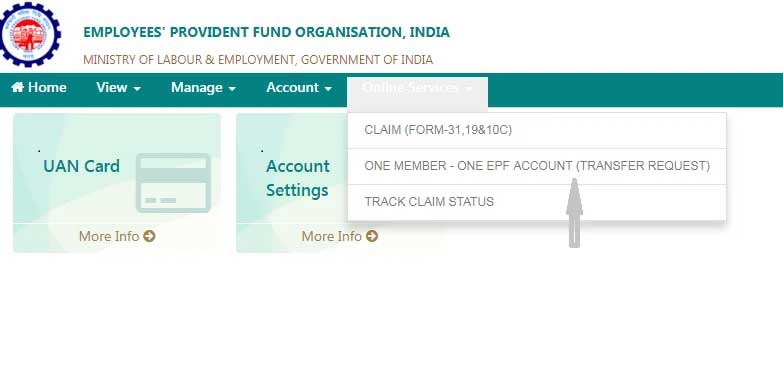

Step 2: After login, tap on ‘One Member – One EPF Account (Transfer Request)’ beneath Online Services

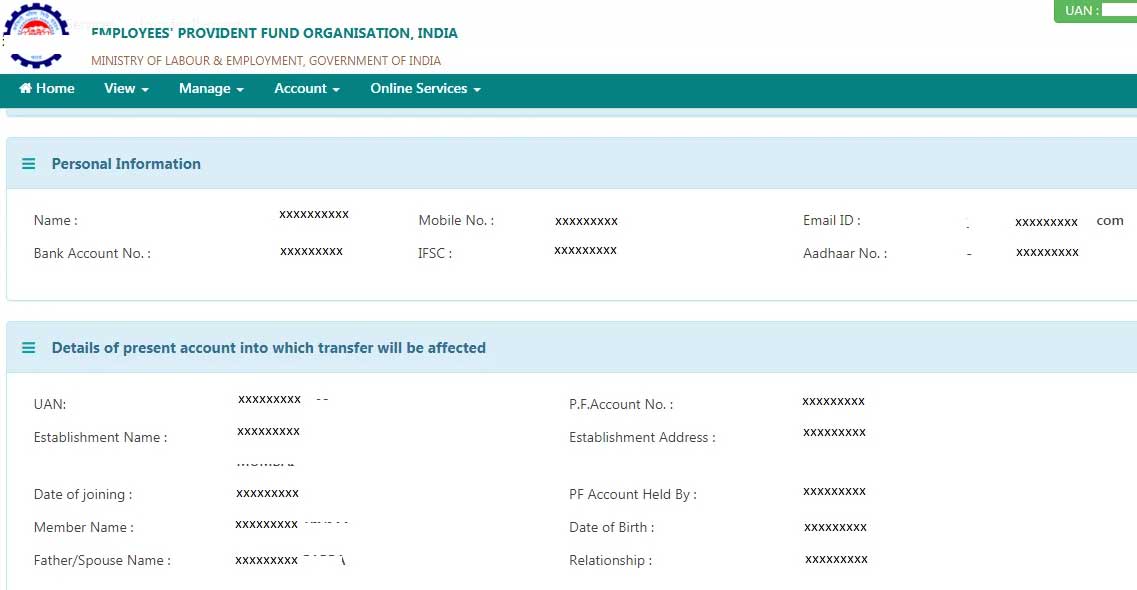

Step 3: validate the personal details and PF account for current employment:

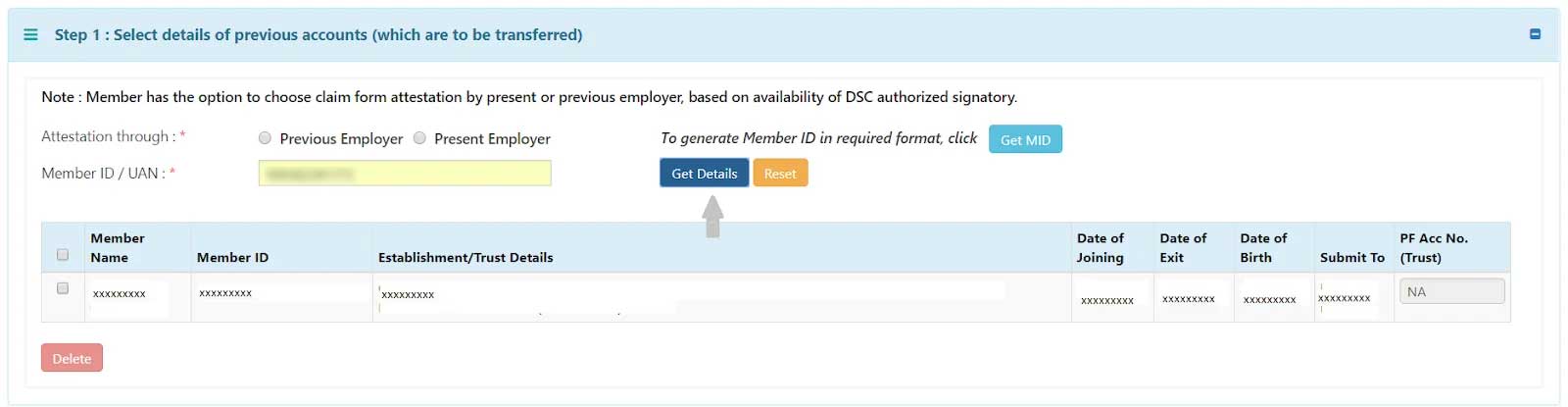

Step 4: PF account details of former employment will prompt on tapping on ‘Get details’ below.

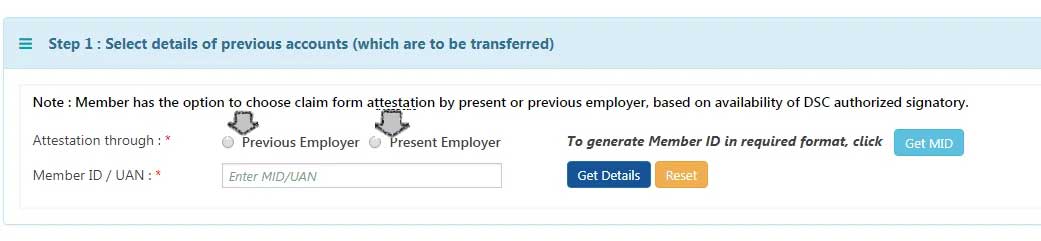

Step 5: You have the choice of opting either the former employer or current employer for attesting the claim form relied on the availability of the authorized signatory holding DSC. select for either of the employers and give the member ID/UAN.

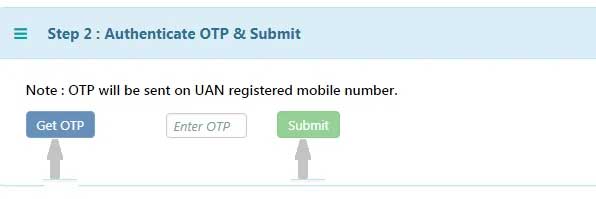

Step 6: In the subsequent step, tap on ‘Get OTP’ to obtain OTP to UAN registered mobile number and enter the OTP and tap on submit.

The employer would digitally approve your EPF transfer request by accessing the employer interface of the unified portal. Fill the Form 13 through the information along with the PF number for both the former and the current employer and download the transfer claim PDF format. Submit the physical copy of the online PF transfer claim form to the chosen employer in a duration of 10 days.

FAQs on PF Transfer

Q.1 – Is it possible to revise the information such as father’s name, DOB, date of joining, date of exit as available in the EPFO database?

Yes, it is possible to revise the information like father’s name, DOB, date of joining, date of exit as available in the EPFO database.

Q.2 – Do I need to take the printout of the claim submitted and give the same to the employer post to sign it?

Yes, one is needed to take the printout of the claim submitted and provide the same to the employer post to sign the same.

Q.3 – What is the method to know the status of the claim which was submitted online?

You will be held with the updated status of the claim in the “view the status of transfer claims” beneath the tab CLAIM.

Disclaimer:- "All the information given is from credible and authentic resources and has been published after moderation. Any change in detail or information other than fact must be considered a human error. The blog we write is to provide updated information. You can raise any query on matters related to blog content. Also, note that we don’t provide any type of consultancy so we are sorry for being unable to reply to consultancy queries. Also, we do mention that our replies are solely on a practical basis and we advise you to cross verify with professional authorities for a fact check."