Payroll is the most important structure for every company so to manage the data of the employees. Information such as name, contact number address, bank details, leaves, attendance, and miscellaneous comes beneath the payroll software. This is needed because every company has employees and all of them have dissimilar details, thus it is not possible to manage it in notebooks.

Fill Form for PF & ESI Filing Software

One of the companies that provides you with payroll software with effective functionality is SAG Infotech. Gen Payroll software helps you in business managing the comfortable work regarding payroll function. It proactively handles the employee’s daily data from check-in to check-out along with the leaves and additional status. It is a helping hand to HR and guides them to handle the employee information with no stress.

Gen payroll software is quite easy to use for both the HR and employee as they both can access contact information, personal information, salary data, attendance, investment details, PF & ESI data, generate employee challan PF/ESI, salary certificates along with the preparation of forms 16, 16AA, 12BA, TDS returns and ITR 1 return, etc.

How to Change/View PF & ESI Rates by Gen Payroll?

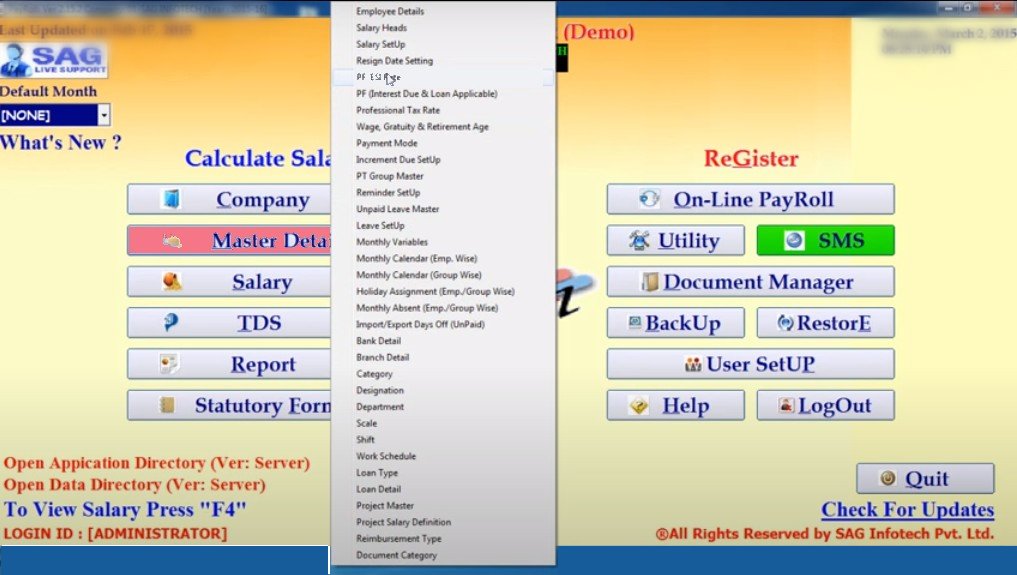

Step 1: Open the Gen Payroll software

Step 2: Go to Master-Detail–>PF and ESI rate

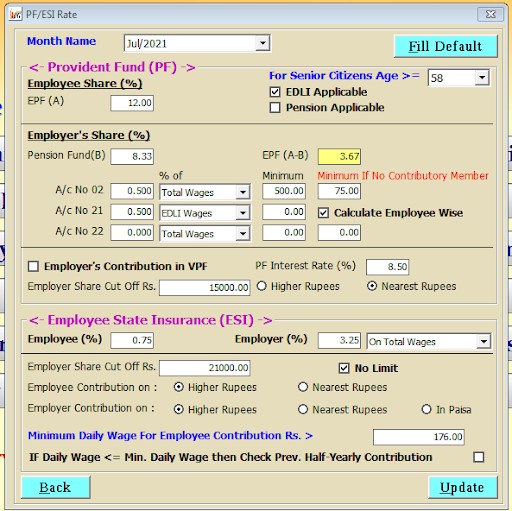

Step 3: Here you can Manually Change the PF/ESI Rates or you can also choose to fill Default Option to make Default Rates

Employee Provident Fund – PF

A Provident Fund or PF is the mandatory fund for the employees. It provides corpus funds generated via regular and monthly participation built through the employee as well as the employer. 12% is the least computed from the basic component of an employee’s salary and contributed as the provisional fund gets cut out from CTC. From the contribution of the employee and the employer, the amount is then added to the PF account of the employee, which can easily be obtained for future goals. Firms will have to hold the EPFO complaint once they have 20 or more employees. Gen Desktop payroll software has PF/ESI challan management capabilities to makeshift all the latest labour laws 2022 requirements with its featured solution.

How to Generate PF Challan via Gen Payroll Software?

Below here, we have listed the specifications of how to generate employees PF by Gen payroll software for Indians.

Step 1: Open the software of Gen Payroll

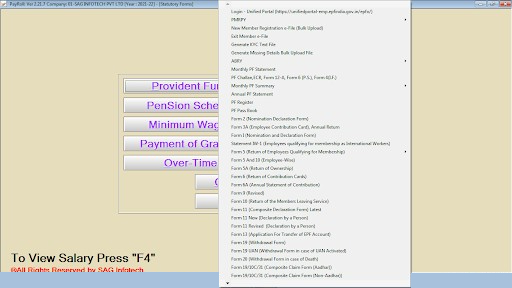

Step 2: Then go to from home screen and select/click statutory forms

Step 3: Now click on provident fund and here you select an option–> PF Challan, ECR, Form 12-A, Form 6 (P.S.), Form 4(I.F.)

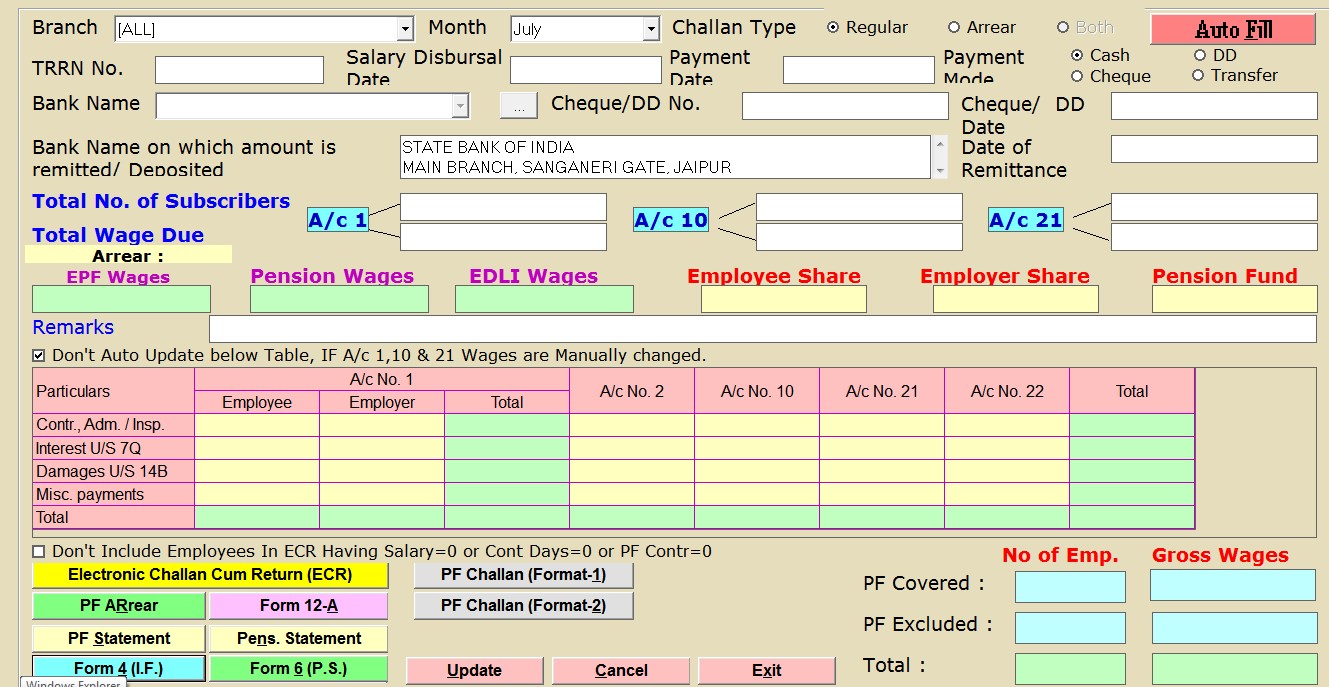

- On the next screen, you can Prepare Monthly PF Challans

Step 4: The software will automatically calculate Challan as per Employees salary details after clicking on the Auto-Fill option

Step 5: After Clicking on–> “Electonic Challan Cum Return” Button you can create ECR File. You can also Login & Upload that Challan to the EPFO Portal Directly from the software

Employee State Insurance – ESI

The person whose income is Rs 21000 is all applicable towards the ESI fund which is maintained through the ESIC is a social security scheme or less per month to have cash and medical advantages to them and their families. ESI is computed at 4.75% from the employer’s side and 1.75% from the employee’s side. All these are computed from the grounds of the gross monthly salary. The Gen payroll software has also included the ESI (Employee State Insurance) feature to cope up with the said labour laws 2021.

Steps How to Create ESI Challan by Gen Payroll Software?

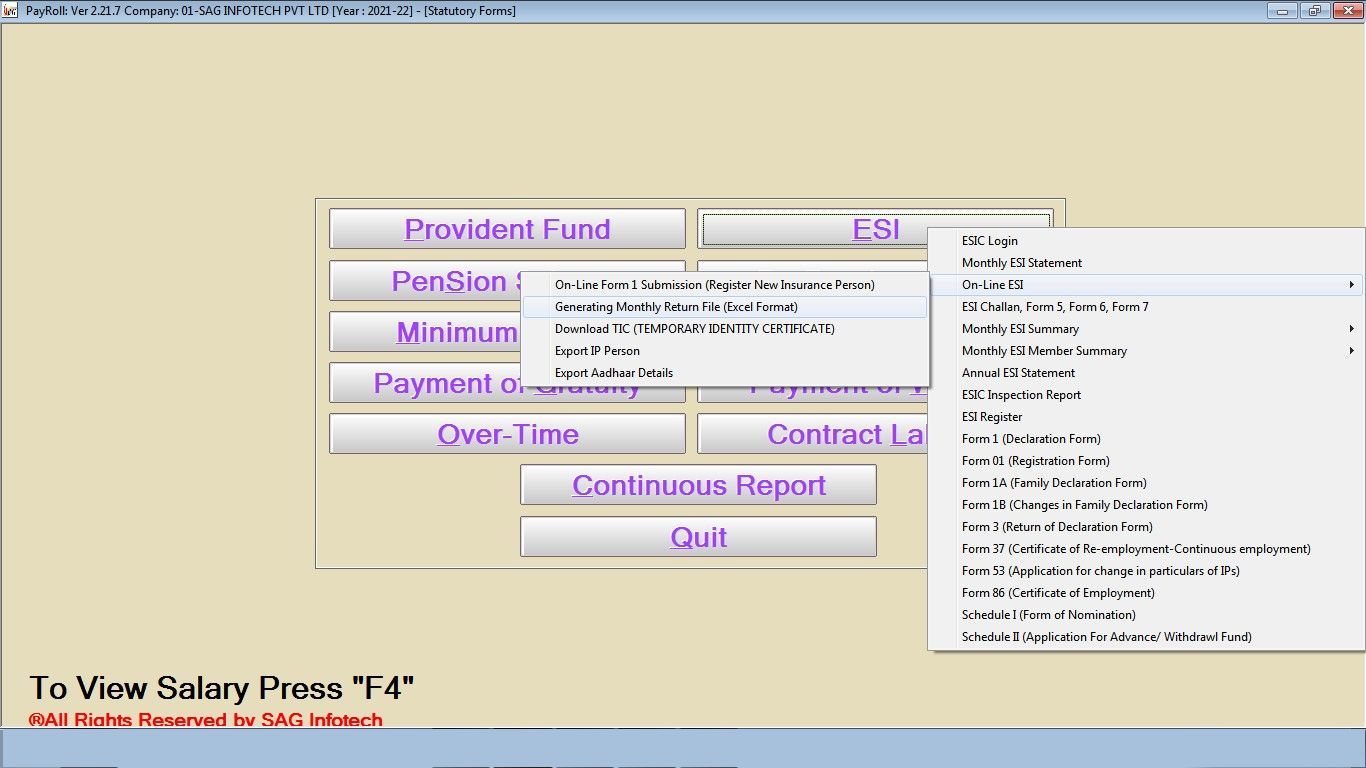

Step 1: From the home screen go to–>Statutory Forms

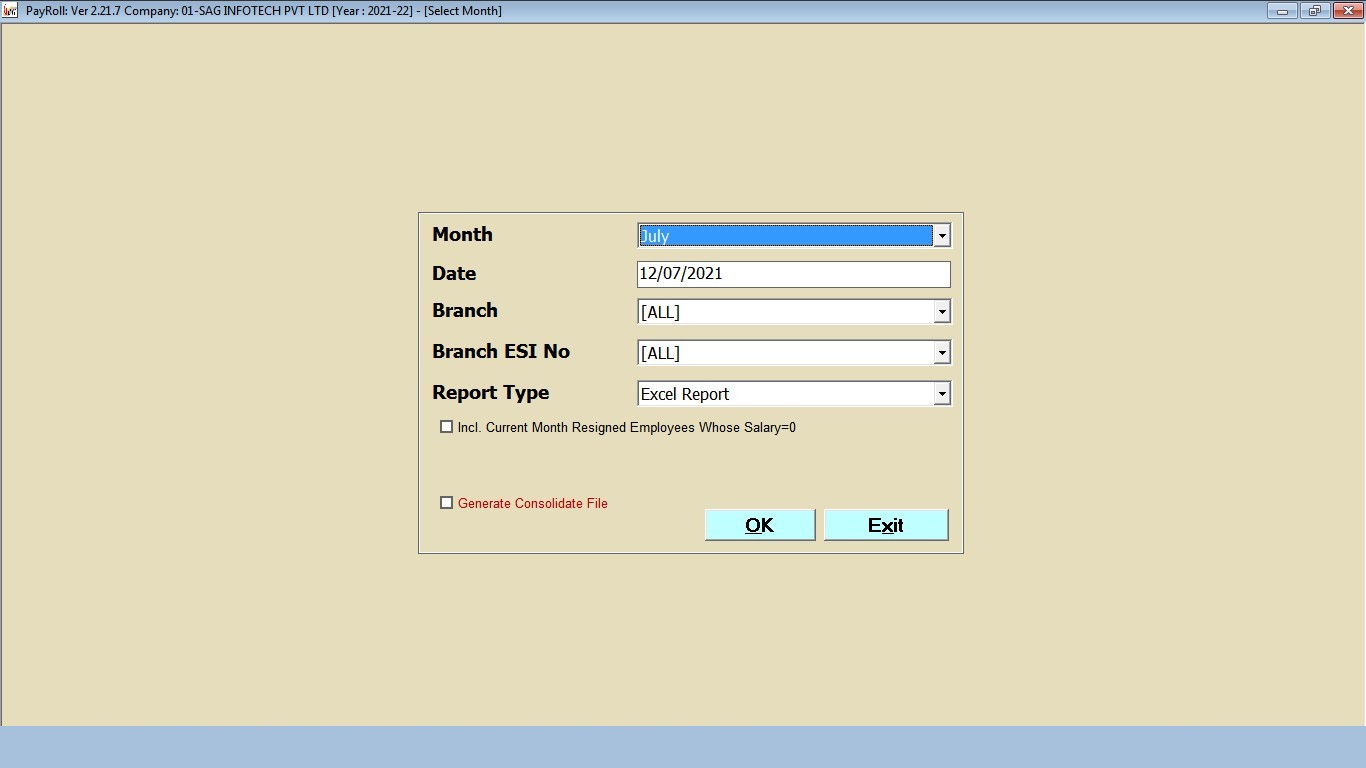

Step 2: Then click on the ESI option–>Here you do Select–>Generating Monthly return file (Excel Format)

Step 3: Now, here you can create a monthly ESI challan in Excel format and upload that Excel sheet to the portal by the software login.

e-Return TDS (Tax Deducted at Source)

Tax Deducted at Source or TDS will be cut down towards the indirect tax collection according to the Income Tax Act, 1961. TDS directs that employers cut down the particular amount of tax prior to furnishing the full payment to the receiver. TDS computed on CTC slabs. It is important to own TDS deductions prior to payroll being run. Gen payroll is able to handle all the latest labour law 2021 changes to file the e-return TDS as per government compliance.

Gen Payroll software assures complete coverage for incoming labour laws 2021 with its ever-increasing features and in accordance with government compliance. For a detailed review and to get your complete answers and queries solved one can always contact SAG Infotech at official mail and support.

whats the cost

PF AND ESIC SOFTWRE FOR CONSULTANT

pf

what is price for pf esic softwware for consultant and also share feature list

price of pf & esic software

PF ESI TDS RETURN ETC

SOFTWARE FOR CONSULTANT

Use Gen TDS Software for easy compliance.

Like to know about this software 9539######

PF ESI PAYROLL