What is Section 115BAC of the IT Act?

A person, whether an individual or an undivided Hindu family (HUF), having income apart from the income from a profession or business, can practice the same option for the earlier year to be taxed u/s 115 BAC including with his or her income return to get provided u/s 139(1) of the Income-tax Act for each year, as per new Section 115BAC of the Income-tax Act, 1961.

The total income must be calculated without any particular exemption or deduction set off of a loss and other depreciation applicable before the concessional rate proposed u/s 115BAC of the Income Tax Act.

Eligibility Criteria Under Section 115BAC

HUFs and individuals can practice the choice of filing the income tax as per the updated income tax slab rates, provided their total income for the precise fiscal year fulfils the prerequisites that are stated below-

- The shown income must not wrap up any of the business income.

- The computation of it is performed without any deductions or exemptions given under the following:

- Chapter VI-A, except those under section 80CCD/ 80JJAA

- Section 35/ 35AD/ 35CCC

- Clause (iia) of Section 57

- The calculation is performed without considering losses from past AYs yielded from the deductions above or from real estate owned by the homeowner.

- It is decided without making any exemptions or deductions for any perks or allowances.

- Section 24b

- Clause (5)/(13A)/(14)/(17)/(32) of Section 10/10AA/16

- Section 32(1)/ 32AD/ 33AB/ 33ABA

- The computation is completed without claiming any depreciation under clause (iia) of Section 32.

Tax Exemptions and Deductions U/S 115BAC

Most tax deductions under the new income tax system are no longer available. The ones are allowed under section 115BAC of the Income Tax Act.

- Interest on Home Loan on the let-out property (Section 24)

- Any compensation obtained to satisfy the travel cost on the tour/transfer

- Getting a daily allowance to fulfil the ordinary charges or expenditures you made based on the absence from his regular place of duty

- Deduction for additional employee cost (Section 80JJA)

- Transport allowances for a specially-abled person

- Deduction for employer’s contribution to National Pension Scheme (NPS) account [Section 80CCD(2)]

- Perquisites for official purposes

- Exemption on voluntary retirement 10(10C), gratuity under section 10(10) and Leave encashment under section 10(10AA)

- Gifts up to INR 50,000

- Conveyance allowance acquired to fulfil the conveyance expenditure made as part of the employment

Steps to Process NTR Under Section 115BAC via Gen Income Tax Software

Below, we have outlined the main steps for processing the new tax regime under Section 115BAC using Gen IT Software:

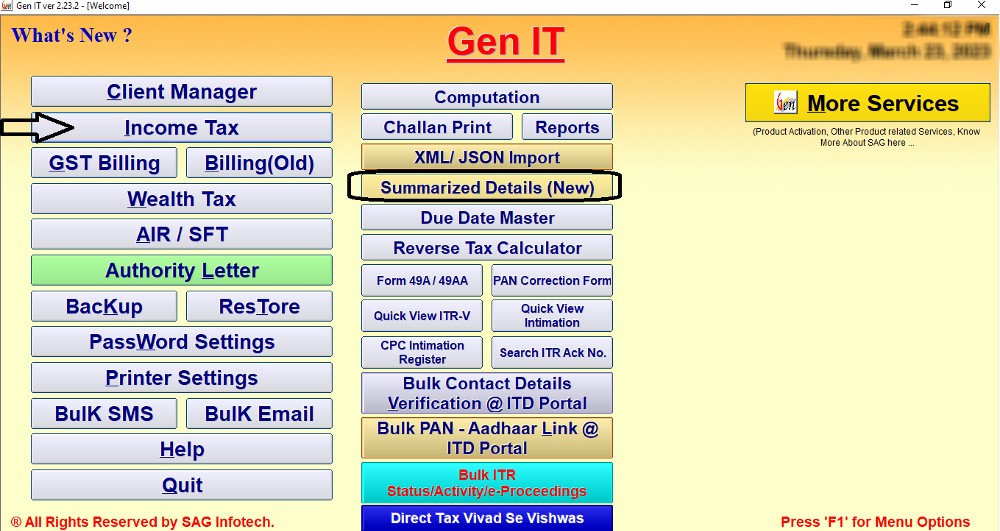

Step 1: First, install the Gen IT Return Filing Software, then select Income Tax-> Computation option.

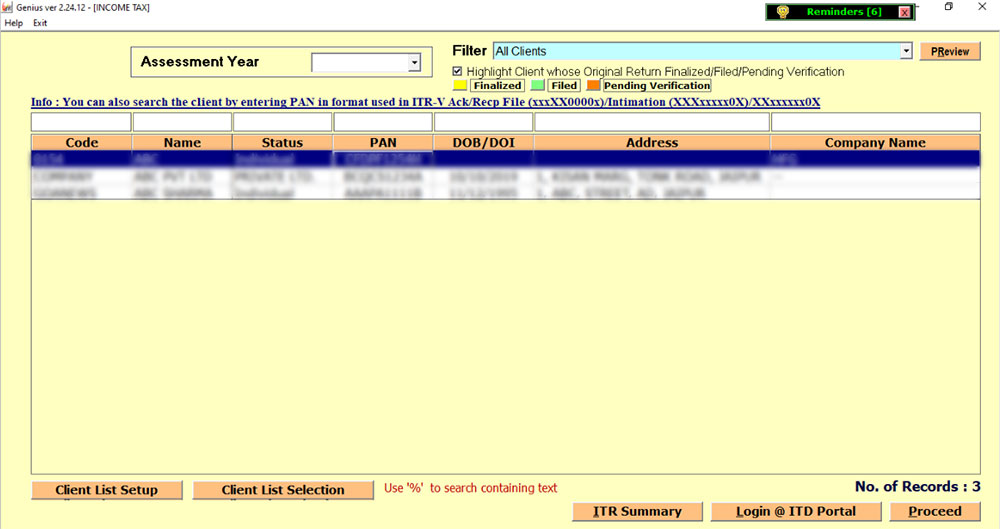

Step 2: Then you have to select the client from the client list.

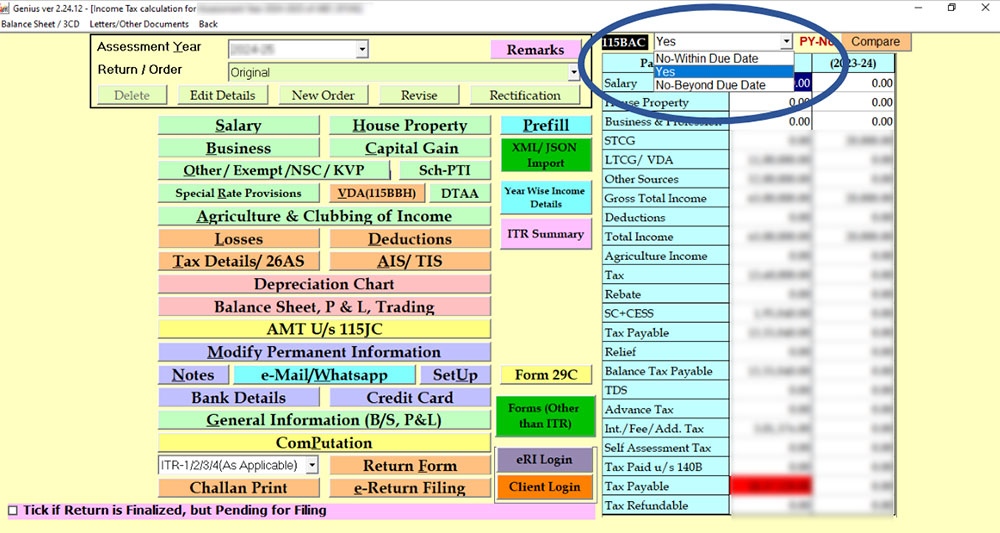

Step 3: Please select ‘Yes’ in 115BAC as shown in the screenshot below.

In this way, you can select ‘115BAC’ as ‘Yes’ in the software, and the calculations will be performed according to this section.