Discovering that the loans were nothing, however, the accommodation entries along with the repayment are indeed nothing only the return of accommodation entries, the Mumbai ITAT ruled that the money has been drawn in getting the unsecured loan is nothing but the unaccounted money of the taxpayer and is to be added under section 68.

It has been the objective of Section 68 of the Income Tax Act to ensure that individuals and corporations clearly show their income by addressing the unexplained cash credits in their books of accounts, putting the obligation on the assessee to establish these credits valid.

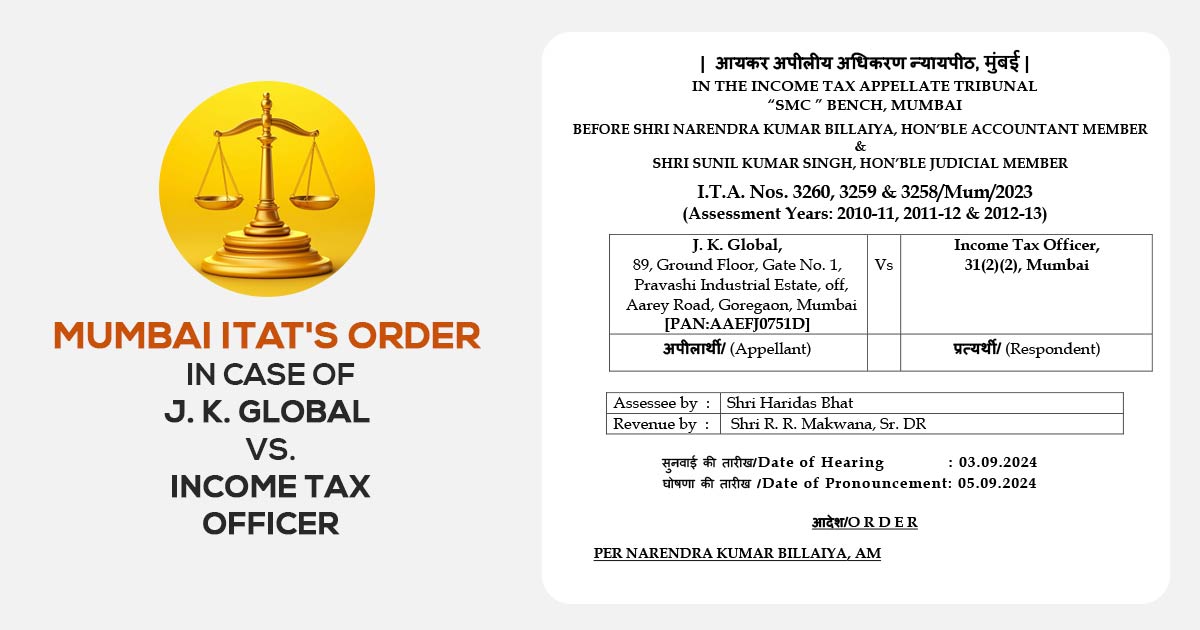

The Division Bench of Narendra Kumar Billaiya (Accountant Member) and Sunil Kumar Singh (Judicial Member) observed that.

“it has been established that these companies were providing accommodation entries through unsecured loans claimed to have been borrowed from these companies by the assessee during the year under consideration as unexplained and rightly added u/s 68”.

Read Also: Chennai ITAT Nullifies Section 68 Addition Related to Cash Receipts Converted into Sale of Jewellery

Case Overview

A big unsecured loan has been taken by the taxpayer of Rs 25 lacs from Ryan International, 5 lacs from Casper Enterprises, and 20 lacs from Duke Business. Such unsecured loans were deemed as unexplained and added under section 68 based on the data obtained from DGIT (Investigation), Mumbai that one Pravin Kumar Jain via a web of concerns run and controlled by him is involved in furnishing accommodation entries in the sort of fake unsecured loans, fake share application etc via distinct paper entitles and the taxpayer is one of the beneficiaries who opted accommodation entry.

Tribunal Observation

It was encountered by the Bench that the common addition is pertinent with the unsecured loans opted in the year deemed as unexplained under section 68 including the interest paid on these unsecured loans.

The companies list provided the accommodation entries names of Duke Business Pvt Ltd, Casper Enterprises Pvt Ltd, and Ryan International are cited which implies that as per the order of the coordinate bench, it has been verified that these companies were furnishing accommodation entries via unsecured loans claimed to have been borrowed from these companies by the taxpayer, the Bench mentioned.

The bench said that the counsel’s argument that the loans had been repaid during the year under consideration, and hence its set-off must be provided to the taxpayer, does not hold any water.

The impugned loans were nothing but accommodation entries and the repayment is indeed nothing but the return of accommodation entries, Bench cited.

ITAT also confirmed the additions as the loan amount has been regarded as unaccounted money of the taxpayer for the interest payment of these loan amounts claimed as unexplained.

The appeal of the taxpayer has been dismissed by ITAT.

| Case Title | J. K. Global Vs. Income Tax Officer |

| Citation | I.T.A. Nos. 3260, 3259 & 3258/Mum/2023 |

| Date | 05.09.2024 |

| Assessee by | Shri Haridas Bhat |

| Revenue by | Shri R. R. Makwana |

| Delhi ITAT | Read Order |