An order passed by the Deputy State Tax Officer against a dead person has been set aside by the Madras High Court.

The Bench of Justice Krishnan Ramasamy noted that “the impugned order was passed by the Deputy State Tax Officer/respondent against a dead person, who passed away on 21.11.2019. In such case, the impugned order must be set aside.”

Case Facts

The wife of assessee/petitioner, who was the proprietor of M/s. S.R. Steels passed away on 21.11.2019. After that, the Deputy State Tax Officer (respondent) issued a show-cause notice and passed an impugned order on 07.02.2024 against the assessee/petitioner’s wife, despite her deceased.

A petition has been filed by the taxpayer to the Madras High Court contesting the order passed by the Deputy State Tax Officer. He asked the court to grant him a chance to present his case, as the only legal heir of the deceased, before the Deputy State Tax Officer. He asked the court to de-freeze his bank account.

As the taxpayer is the only legal heir of the deceased hence the department asked the court to ask the taxpayer to file a response to the SCN. Also, the department asked the court to remit back to the Deputy State Tax Officer, subject to the payment of 10% of the disputed tax amount by the taxpayer.

Madras High Court Observations

It was said by the bench that it resembles that the impugned order on 07.02.2024 was passed via the Deputy State Tax Officer against a dead person, who passed away on 21.11.2019. the impugned order in such case, is liable to be set aside.

As the taxpayer is the only legal heir of the deceased it is just and important to furnish a chance to the taxpayer to prove his case on merits, bench cited.

Read Also: Madras High Court Sets Aside GST Assessment Order Issued to Deceased Person

The taxpayer has been asked by the bench to file a response within 2 weeks.

The bench cited that “The impugned orders itself have been set aside, therefore, the attachment made on the bank account of the assessee/petitioner cannot survive any longer and hence, it is lifted. As a sequel, the respondent is directed to instruct the concerned Bank to release the attachment and de-freeze the bank account of the assessee/petitioner, immediately upon the production of proof with regard to the payment of 10% of the demand amount by the petitioner as stated above.”

Considering the above, the bench permitted the petition and remanded the case to the Deputy State Tax Officer/respondent for fresh consideration.

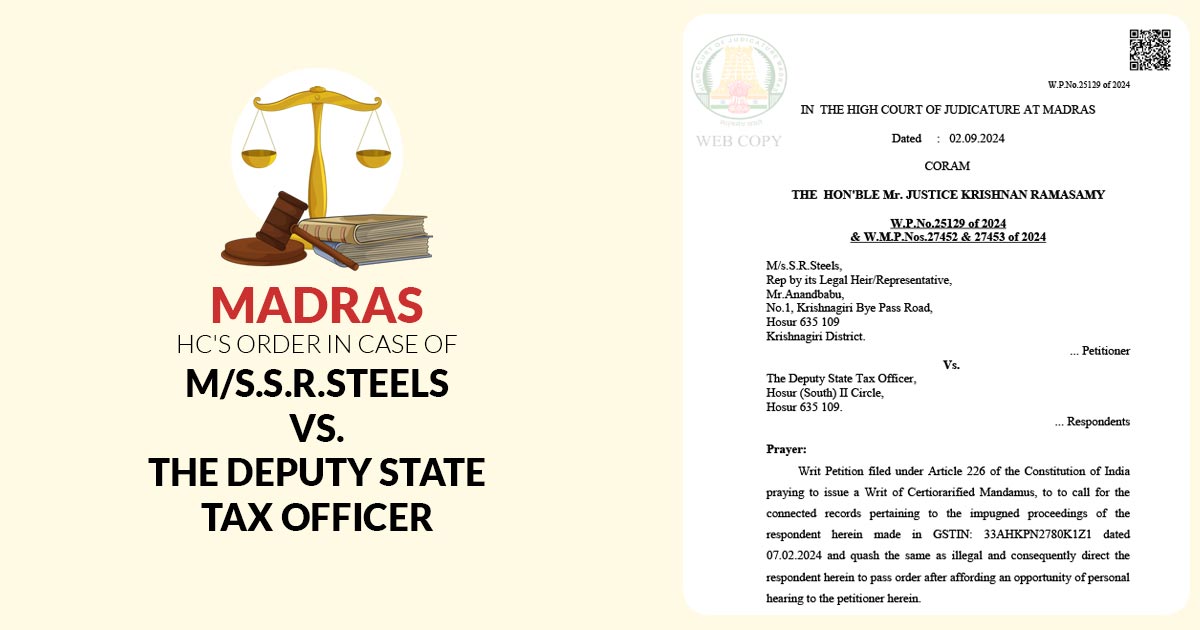

| Case Title | M/s.S.R.Steels Vs. The Deputy State Tax Officer |

| Citation | W.P.No.25129 of 2024 & W.M.P.Nos.27452 & 27453 of 2024 |

| Date | 02.09.2024 |

| For Petitioner | Mr.Manoharan S Sundaram |

| For Respondent | Mr.G.Nanmaran |

| Madras High Court | Read Order |