The Delhi Bench of Income Tax Appellate Tribunal (ITAT) ruled that as the taxpayer was a non-resident therefore the entire tax ought to be deducted at source on payment made via the payer to it, and no question was there for the advance tax payment by the taxpayer; consequently, no interest Under Section 234B can be charged upon the taxpayer.

The bench of G.S. Pannu (Vice President) and Astha Chandra (Judicial Member) has laid on the Supreme Court’s decision for the case of Director of Income Tax, New Delhi v. M/s Mitsubishi Corporation, in which it was kept that if a non-resident taxpayer has obtained any amount on which tax was deductible at source, the taxpayer could not diminish such tax during calculating its advance tax liability, which was applicable after FY 2012–13.

The petitioner is a foreign company and is a tax resident of Canada. It is in the business of supplying reservoir simulation software to oil companies like ONGC, Oil India, Vedanta, etc., including related software maintenance support services and training services for acquainting themselves with the function of such software.

On reviewing the list of non-filers, the AO discovered that the taxpayer did not file its return for AY 2012–13 even after the receipts from M/s. Cairn Energy India Pty. Ltd., M/s. Prize Petroleum Company Ltd., M/s. Shell India Market Pvt. Ltd., and M/s. Reliance Industries Ltd., on which TDS has been deducted.

U/S 148 of the Income Tax Act. the AO issued the notice. It was acted however the compliance was not incurred. He has furnished the notices to the aforesaid related with u/s 133(6), asking for the information for the paid amount or the accrued to the taxpayer, the sort of products or services that the taxpayer furnished to them, and the contract or agreement under which such payments have been made.

On the grounds of the inputs so received, the AO concluded that the taxpayer is furnishing products and services that are being used to support exploratory activities in oil and gas exploration and production.

Applying the provisions of Section 44BB, he calculated the taxpayer’s income at Rs. 36,43,546, equivalent to 10% of the aggregate amount of Rs. 3,64,35,459/- received or receivable by the taxpayer.

On December 30, A draft assessment order was passed. The AO passed the final assessment order dated February 21, 2020, u/s 144C/144/147 of the Income Tax Act, deciding that the income of Rs. 36,43,550 is subjected to get taxed at a 40% rate as per the provisions of the Act as the taxpayer did not file any objection to the DRP.

The taxpayer has drawn the case in a petition before the CIT (A), contesting the ex-parte assessment u/s 147 and the addition made u/s 44BB.

The CIT (A) did not recognize the additional proof, denying the taxpayer’s explanation, being a foreign company, was unfamiliar with the procedure of return filing, tax assessment procedure, and related law in India as it does not have any office or base in India. The CIT (A) ruled that the reassessment proceedings u/s 147 and 148 of the Income Tax Act as valid.

The proviso inserted in Section 209(1)(d) of the Act by the Finance Act, 2012, from 01.04.2012, would apply only in a case where the person liable for deducting tax has filed or credited this income without deduction of tax, the taxpayer argued.

The income (impugned receipts) has been obtained via taxpayer after deduction of tax at source, and thus the proviso to Section 209(1)(d) is not applicable. Under Section 209(1)(d) r.w. proviso, where tax deductible at source has been paid in the case of a non-resident company, the department shall not be permitted to levy any interest u/s 234B for alleged failure to file the advance tax via these taxpayers.

Read Also:- Latest News Related to Delhi Bench Income Tax Appellate Tribunal (ITAT)

The tribunal ruled that the proviso to Section 209(1) issued via the Finance Act, 2012, was applicable prospectively post-FY 2012–13; the taxpayer was not obligated to pay interest u/s 234B of the Act for the impugned AYs as the entire income was tax deductible at source in the hands of the payer.

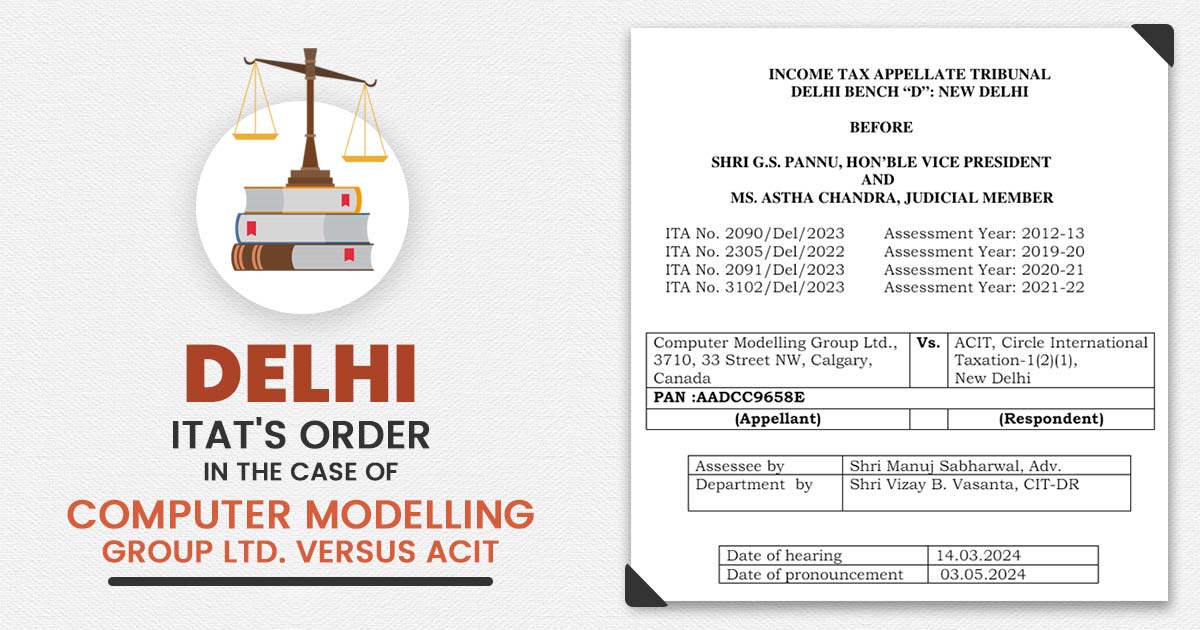

| Case Title | Computer Modelling Group Ltd. Versus ACIT |

| Case No.:- | ITA No. 2090/Del/2023 |

| Date | 03.05.2024 |

| Counsel For Appellant | Manuj Sabharwal |

| Counsel For Respondent | Vizay B. Vasanta |

| Delhi ITAT | Read Order |