Section 44AD Streamlines Presumptive Taxation: Enhanced Requirements for Enterprises

The income tax department in an action objecting to easing the process of tax for businesses has waived the criteria for the presumptive taxation under section 44AD. A new ‘receipts in cash’ column has been presented, showing the cash turnover or gross receipts. To Rs. 3 crores the cash turnover limit has been raised given that the receipts of cash remain below 5% of the total turnover or gross receipts from the last year.

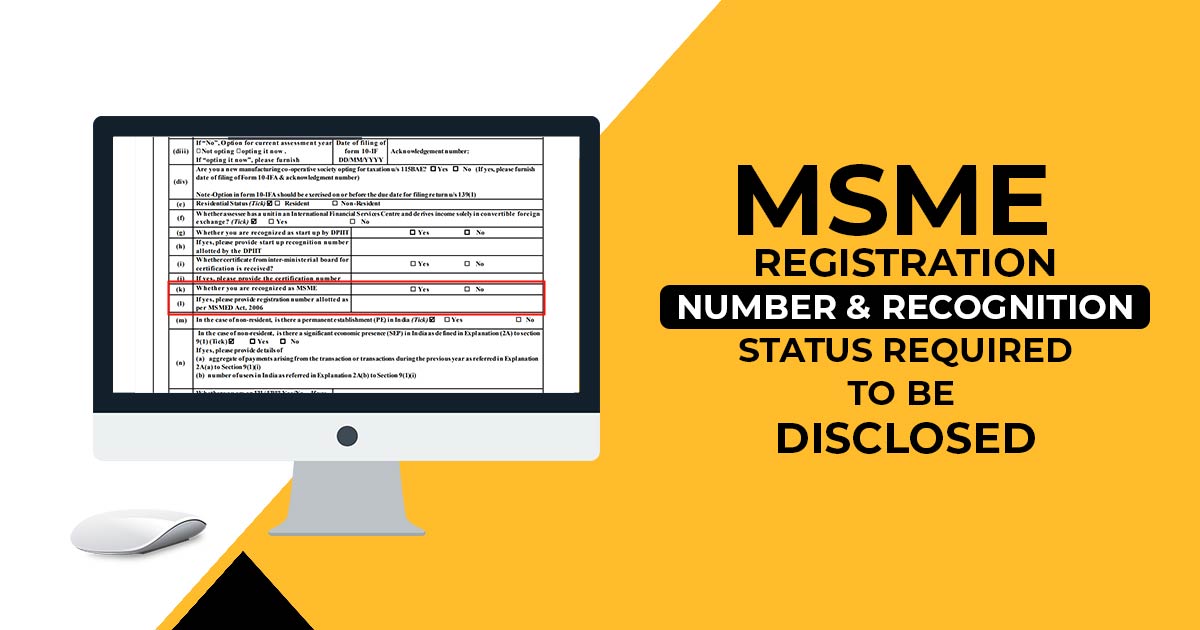

Updates on ITR-6: Additional Requirements Faced by MSMEs

Firms through the use of ITR-6 for filing the ITR are ready to face the revisions, with the form now needing the other information. Among the new needs are the inclusion of the Legal Entity Identifier (LEI), MSME registration number, reasons for tax audit under section 44AB, disclosure of winnings from online games under Section 115BBJ of the Income Tax Act, and virtual digital assets.

Firms Seeking Refunds Must Report Stricter Details

The firms that ask for refunds of Rs 50 crores or exceeding should furnish the legal entity Identifier (LEI) as part of strict reporting obligations. Moreover, ITR-6 requires the inclusion of acknowledgment numbers and Unique Document Identification Numbers (UDIN) for audit reports under section 44AB (tax audit report) and section 92E (transfer pricing report).

By staying informed of such revisions in the updated Income Tax Return forms, the businesses could confirm effective compliance and build increasing adherence to tax regulations.