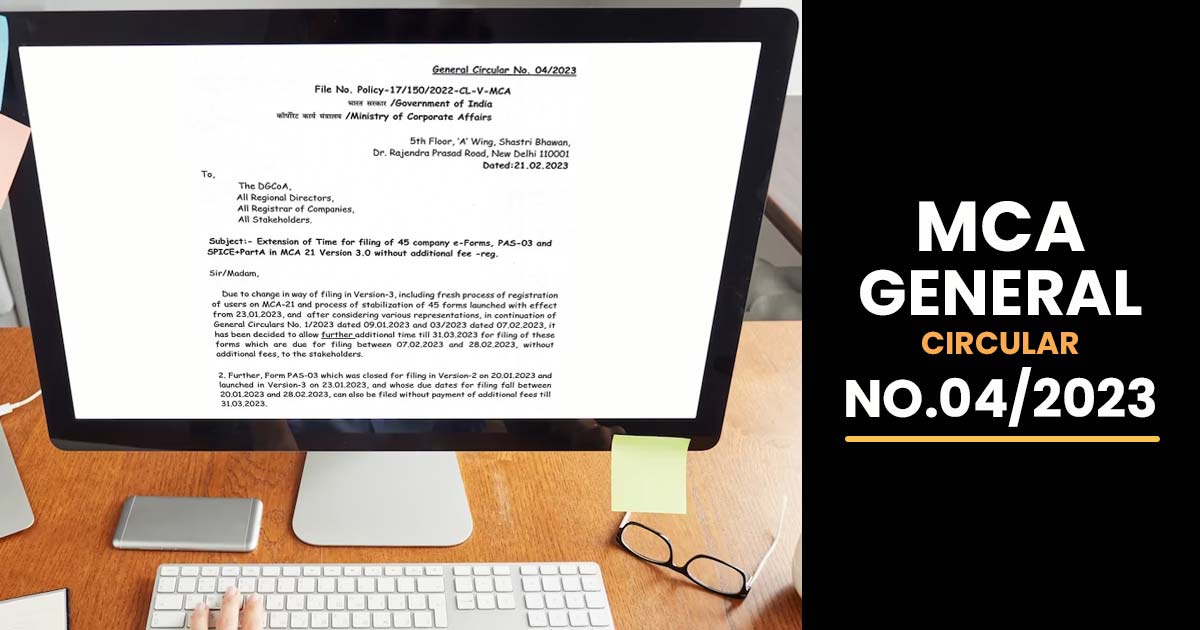

Because of the revision in the method of filing in version-3, along with the new registration process of users on MCA-21 and the stabilization process for 45 forms introduced from the date 23.01.2023 and post acknowledging different representations, it is decided to permit additional time till 31.03.2023, in concern for the furtherance of General Circulars No. 1/2023 dated 09.01.2023 and 03/2023 dated 07.02.2023, for filing such forms that are pending to file between 07.02.2023 and 28.02.2023, without extra fees, to the stakeholders.

On 20.01.2023, Form PAS-03 which was closed for filing in Version-2 and launched on the date 23.01.2023 in version-3, and whose due dates lie between 20.01.2023 and 28.02.2023 for filing could indeed get furnished without the payment of the additional fees till 31.03.2023.

Read Also: Most Common MCA21, V2 & V3 Problems with Proper Solutions

Moreover, the reservation time for names reserved under sub-section (5) of Section 4 of the CA 2013 is extended by 20 days. The resubmission time under Rule 9 of the Companies (Incorporation) Regulations, 2014, which falls between January 23, 2023, and February 28, 2023, is also extended by 15 days.

This requires the Competent Authority’s consent.