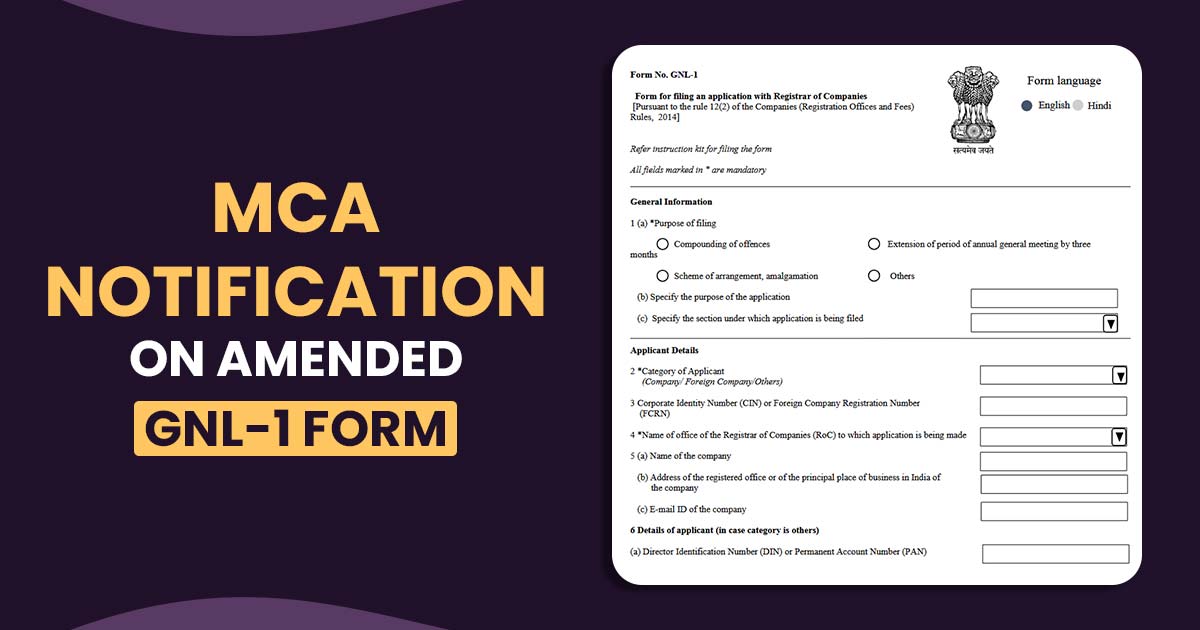

The MCA has announced the Companies (Registration Offices and Fees) Amendment Rules, 2025, introducing several modifications to the GNL-1 form. With effect from 14th July 2025, the new amendments, issued through G.S.R. 360(E), will come into force and must be certified by a whole-time tax professional such as a Chartered Accountant (CA), Company Secretary (CS), or Cost Accountant.

The amended Form GNL-1 has substituted the earlier form, which was annexed to the Companies (Registration Offices and Fees) Rules, 2014. For various objectives, the new form automates and establishes the process of applications like compounding offences, extending the duration for the Annual General Meeting(AGM), and approving plans such as mergers or arrangements, among others.

Based on the objective of applications, the detailed disclosures are mandated in the updated forms. Components, including the type of default, the parties involved, the duration of the default, the corrective actions carried out, and any continuing investigations, should be revealed, for instance, in the case of compounding of offences. In the furnished applications, suo motu or in answer to the statutory notices, the related reference numbers and dates are to be included.

The companies should mention the fiscal year-end date, the regulatory AGM deadline, and the proposed extended date, asking for the extension to convene their AGM.

Read Also:- MCA Set to Unveil 38 e-Filing Forms on V3 Portal from 14th July 2025

The new form’s important part is the needed certification via a practising professional, chartered accountant, company secretary, or cost accountant, which verifies the accuracy of the submission based on company records. The professionals are mandated to attest that no material data has been hidden and to specify compliance with the Companies Act’s restrictions.

Important: Companies Act Section 448 for Penalty of Wrong Statement

Under the notifications, it mentions that Sections 447, 448, and 449 of the Companies Act, 2013, which address the penalties for fraud, wrong statements, and incorrect proof, respectively, levy obligations on the applicants and the certifying professionals.