ITR filing is important for all specific people if their taxable income exceeds Rs 250,000 per year. According to the ITR rules, the ITR filing is also important for the person who has furnished more than 1 lac in electricity bills or offered foreign travel exceeding Rs 2 lakh in the financial year.

But the experts advise them that even if the person’s income is less than the taxable limit then he or she must furnish the tax return. As the return filing comes up through various advantages.

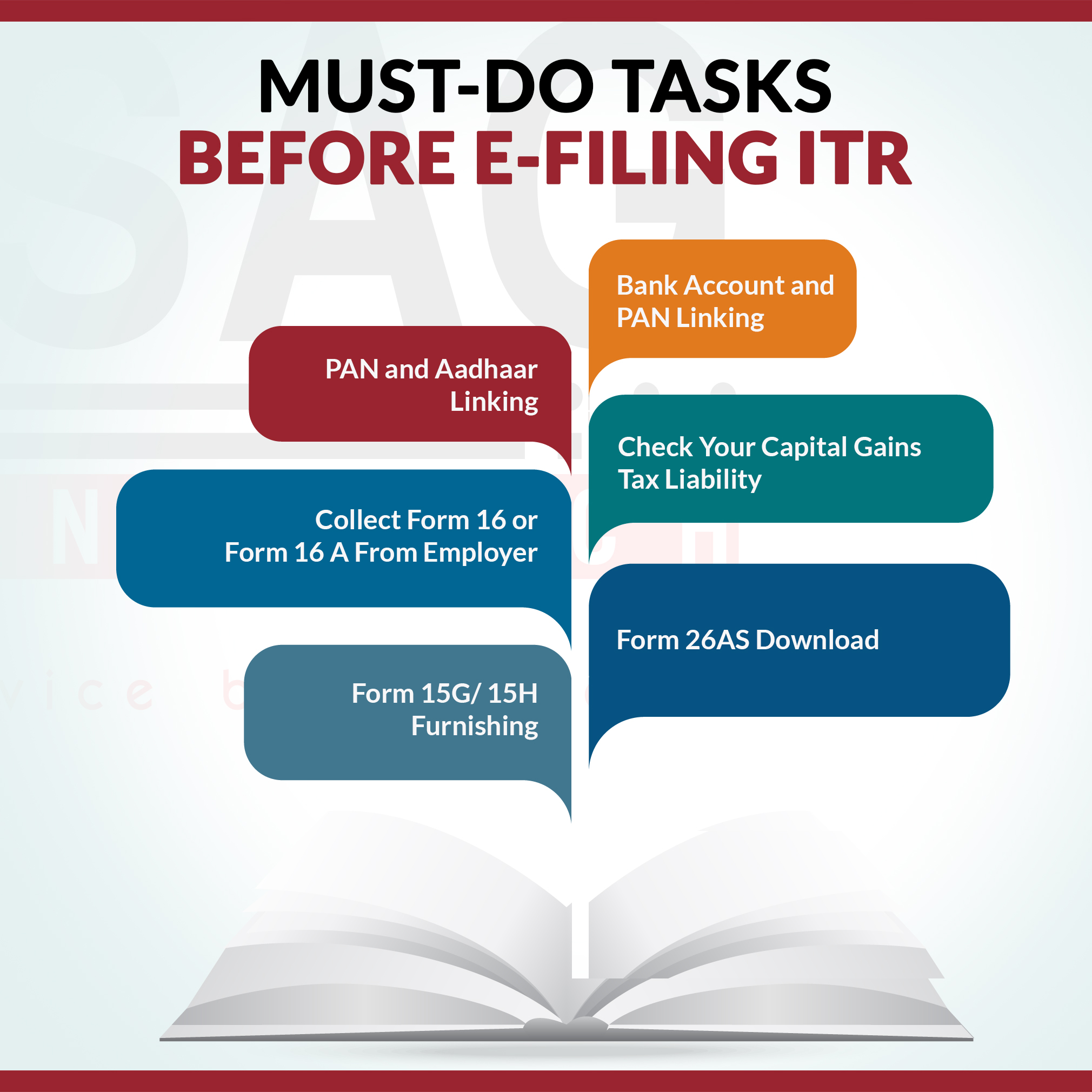

PAN & Aadhaar Linking

It is very important to link your PAN with an Aadhaar Card. You cannot E-verify the income tax return (ITR) through the Aadhaar-OTP option without linking the Aadhaar and PAN. The last date for linking PAN-Aadhaar is 30th June 2023. If not yet linked, provide to link your PAN with your Aadhaar by 31st May 2024. This reminder is given by the Income Tax Department.

Bank Account & PAN Linking

Linking the PAN through the bank account is needed as the refunds are straightly transferred to the bank account of the assessee. Indeed without linking the PAN through the bank account you shall not open the Fixed deposit or do the cash deposit beyond the specified limit.

Collect Form 16 or Form 16A From the Employer

Form 16 gives the information about the taxes deducted from your salary. The employer is responsible for providing the same. Form 16A is given through the other deducts such as banks. The last date to provide Form 16 and Form 16A is 15th June 2024. You are urged to validate them through Form 26AS and the bank statement for ITR filing.

Check Your Capital Gains Tax Liability

You are required to furnish the capital gains tax post to sell the capital asset such as residential property, gold, etc. You must check the capital gains tax liability if you build the transactions in the FY 2023-24.

Form 15G & 15H Furnishing

There is a procurement for the deduction of tax on the interest furnished upon your bank accounts. But if you have income beneath the mentioned tax slabs, you can remove the said tax deduction by submitting Form 15G/Form 15H (whichever is applicable).

Form 26AS Download

Form 26AS is your yearly tax credit statement. If it is the major essential credential for ITR filing. There are various amendments to Form 26AS that were built in the current year. You can download this Form through the upgraded “income tax website TRACES website, or from your net banking account.”

Documents Required Additionally

You are required to keep the additional documents handy before filing the tax like:

- Bank Interest certificate

- Dividend income Details

- Home loan Interest certificate

- Tax savings investments Proof