The Maharashtra Authority for Advance Ruling (AAR) determined that the supply of a Geometry Compass qualifies as a mixed supply under section 2(74) of the CGST Act, 2017. As a result, it is subject to an 18% GST, rather than being classified as a composite supply.

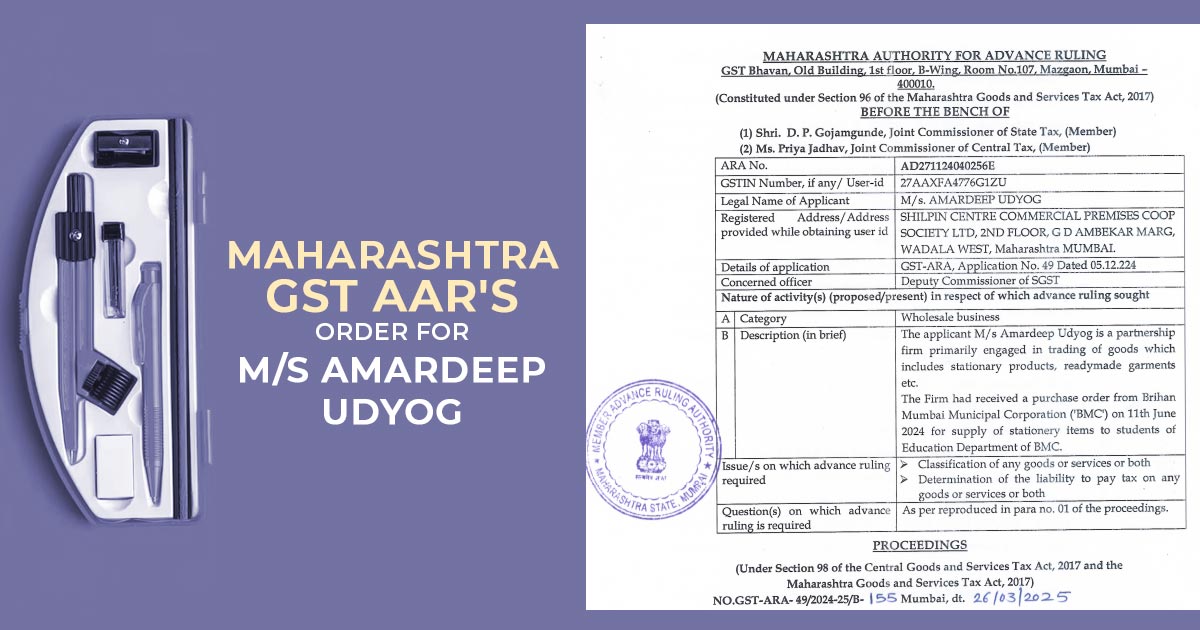

The petitioner, Amardeep Udyog, is a partnership business that deals in ready-made clothing and stationery. The Brihanmumbai Municipal Corporation (BMC) issued a purchase order to the company on June 11, 2024, for stationery supplies for fourth- through tenth-graders.

A Geometry Compass Box, which includes a compass, divider, scale, three set squares (30°, 45°, and 60°), protractor, rubber, pencil and sharpener, was one of the goods in the order.

As per the petitioner, the supplied product is categorised under HSN 90172010 as mathematical drawing instruments, citing Sr. No. 413 of Notification 1/2017 – Central Tax (Rate), and is imposed to tax at 18% GST (9% CGST + 9% SGST).

As per the firm, the box is a set of mathematical tools and is not to be treated only as a “geometry box” under HSN 73102910, which BMC used in its purchase order. As per the petitioner, the classification needs to show the nature and utility of the goods instead of the material composition of the container.

According to the jurisdictional officer, the product specified as a “geometry compass box” includes the description under HSN 73100000, which contains metal boxes, and recommended that a lower GST rate may be appropriate.

The bench, which consists of M. Priya Jadhav and D.P. Gojamgunde, noted that the product is a metal box with a variety of tools within. Mathematical instruments usually do not come with some of these items, like pencils and sharpeners.

According to the Maharashtra Authority for Advance Rulings (AAR), customers may anticipate that a basic geometry box will come with a few particular tools. But the addition of things like sharpeners and erasers goes against what is typically thought of as a typical bundled supply.

Laying on Section 2(74) of the CGST Act, which specifies mixed supply and guidance from the CBIC’s eduction guide on bundled supplies, AAR held that the product as a composite supply cannot be qualified as each items can be drawn and sold separately and is not naturally bundled in the course of a normal trade.

Read Also: Easy to Know Mixed and Composite Supply Under GST

As per Section 8(b) of the CGST Act, the applicable tax rate on a mixed supply is the rate of the item with the highest GST rate. As the scale in the box(categorised under HSN 90178010) draws an 18% GST, the whole supply should be imposed to tax at that rate.

AAR held that the Geometry Compass Box supplied by M/s Amardeep Udyog is entitled as a mixed supply, categorised under HSN 90178010, and is imposed with an 18% GST (9% CGST + 9% SGST).

Recommended: New List of GST Rates & HSN Codes on All Stationery Items

| Case Title | M/s Amardeep Udyog |

| Case No. | 27AAXFA4776GIZU |

| Date | 26/03/2025 |

| Maharashtra AAR | Read Order |