It appears that taxpayers who fall victim to fraudulent activities will not receive any tax relief. The Gujarat GST authority for Advance Ruling (AAR) has discovered that the goods supplied in the bogus transactions are within taxation.

It outlined that the GST is applicable on the supply instead of the sale, even when the seller is defrauded and is unable to get the payment.

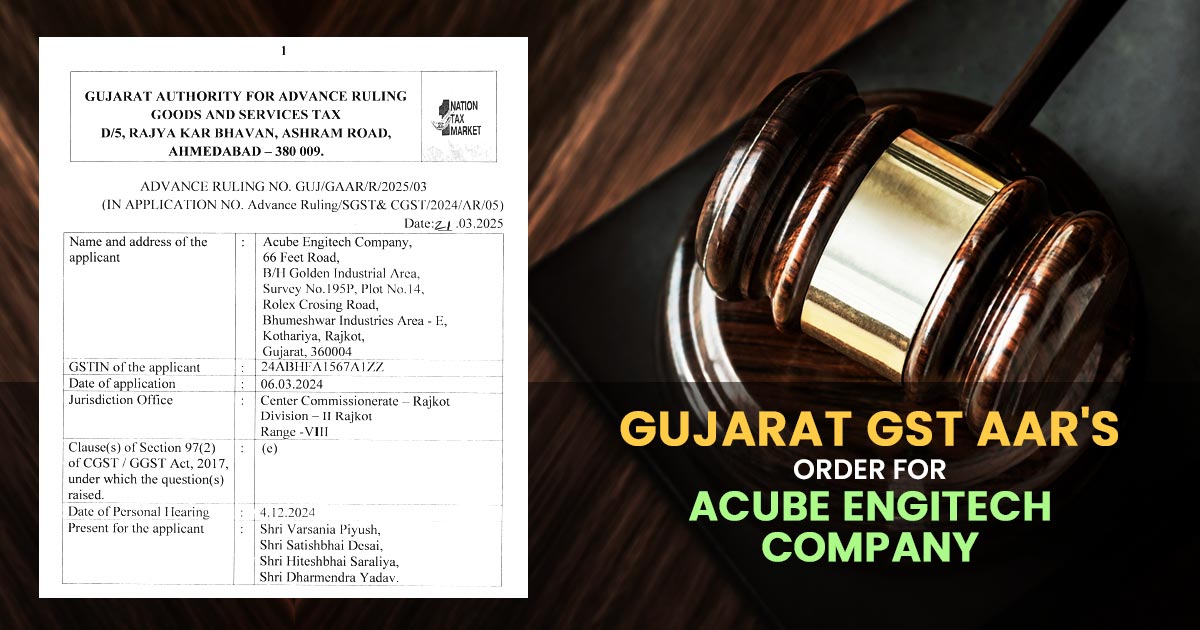

A Rajkot-based submersible pump manufacturer, Acube Engitech Company, asked the Gujarat GST AAR for clarification post being defrauded by an Assam-based group.

In 2023, the company delivered 5,660 pumps of Rs 14.51 crore to the Matak Autonomous Council, subsequently finding the order was based on wrong documents in the name of the council.

Even after filing a police complaint, the company was aware of the GST liabilities and asked for an advance ruling on whether goods supplied under bogus circumstances were authorised as a supply u/s 21 of the Integrated Goods & Services Tax Act.

According to section 20 of the IGST Act, read with section 12 of the CGST Act the order of the authority marked that the company has made supplies. “Under the GST Act, 2017, the levy is on supply of goods and services or both, except taxes on supply of alcoholic liquor for human consumption in terms of Article 366 (12A) of the Constitution of India,”the authority stated in the order. It was also clarified that the word used is “supply and not sale”.

Read Also:- Gujarat AAAR Reverses AAR’s Decision, Grants GST Exemption on Govt Consultancy Services

Under the ruling, it validated the physical delivery of goods and dismissed the opinion of the company that bogus orders do not form a supply. “An element of fraud may vitiate a contract, but how it would enable the applicant to move out of the ambit of the term ‘supply’ as defined under section 7 of the Act,” the authority stated.

| Applicant Name | Acube Engitech Company |

| GSTIN of the applicant | 24ABHFA1567A1ZZ |

| Date | 06.03.2024 |

| Applicant | Shri Varsania Piyush, Shri Satishbhai Desai, Shri Hiteshbhai Saraliya, Shri Dharmendra Yadav. |

| Gujarat GST AAR | Read Order |