Tax officers should not serve GST notices merely as a formality, especially when taxpayers fail to respond to electronic communications, the Madras High Court observed.

The bench said that “No doubt, sending notice by uploading in portal is a sufficient service, but, the Officer who is sending the repeated reminders, inspite of the fact that no response from the petitioner to the show cause notices etc., the Officer should have applied his/her mind and explored the possibility of sending notices by way of other modes prescribed in Section 169 of the GST Act, which are also the valid mode of service under the Act, otherwise it will not be an effective service, rather, it would only fulfilling the empty formalities.”

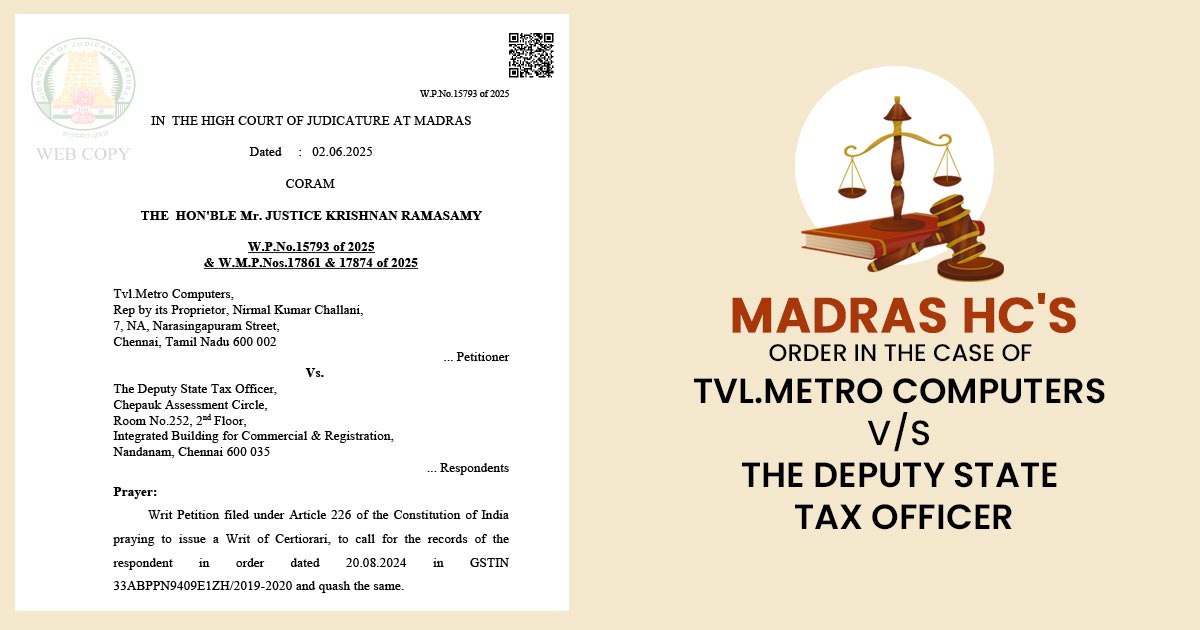

Tvl. Metro Computers, the applicant, contested the assessment order based on all the prior notices that have been uploaded only on the GST portal under the “View Additional Notices and Orders” section.

The applicant was not informed about these notices and, therefore, cannot submit a reply in time. They said that they desired to file 25% of the disputed tax and asked for the chance to show their case afresh.

Read Also: Madras HC: GST Notice Must Be Properly Served via RPAD If No Response on Portal

No hearing chance is furnished before passing the impugned order, the government advocate cited at the time of considering that the notices have been uploaded on the portal. She does not object to the case being remanded as per the partial tax payment.

The court, uploading the notices on the GST portal, comprises valid service under the law; these services could not be regarded as appropriate when there is no answer from the taxpayer.

The officer must see the other valid modes of service u/s 169 of the GST Act, like registered post or email, to ensure actual receipt and persuasive communication.

Justice Krishnan Ramasamy warned that only completing procedural formalities without assuring the actual service consequences in inappropriate adjudication and undesired litigation, which makes the taxpayers and the judicial forums burdened. Officers should opt for the other modes of service when desired to keep the objective and spirit of the GST Act.

The Court overturned the disputed order and returned the case to the assessing officer. It has been directed that new procedures be initiated, contingent upon the petitioner paying 25% of the contested tax within four weeks.

The petitioner is required to submit a reply within three weeks following the payment. After this submission, a personal hearing will be scheduled, and a new decision will be issued based on the merits of the case in accordance with legal standards.

| Case Title | Tvl.Metro Computers vs. The Deputy State Tax Officer |

| Case No. | W.P.No.15793 of 2025 & W.M.P.Nos.17861 & 17874 of 2025 |

| For Assessee | Ms.C.Rekhakumari |

| For Revenue | Ms.Amirta Poonkodi Dinakaran |

| Madras High Court | Read Order |