For processing pending returns filed under section 139 of the Income Tax Act, 1961, for the assessment year 2023–24 (AY 2023–24), the Central Board of Direct Taxes (CBDT) has authorised additional time. This may result in long-awaited refunds or income tax demand notices being issued to taxpayers over the coming months.

What Has CBDT Mentioned?

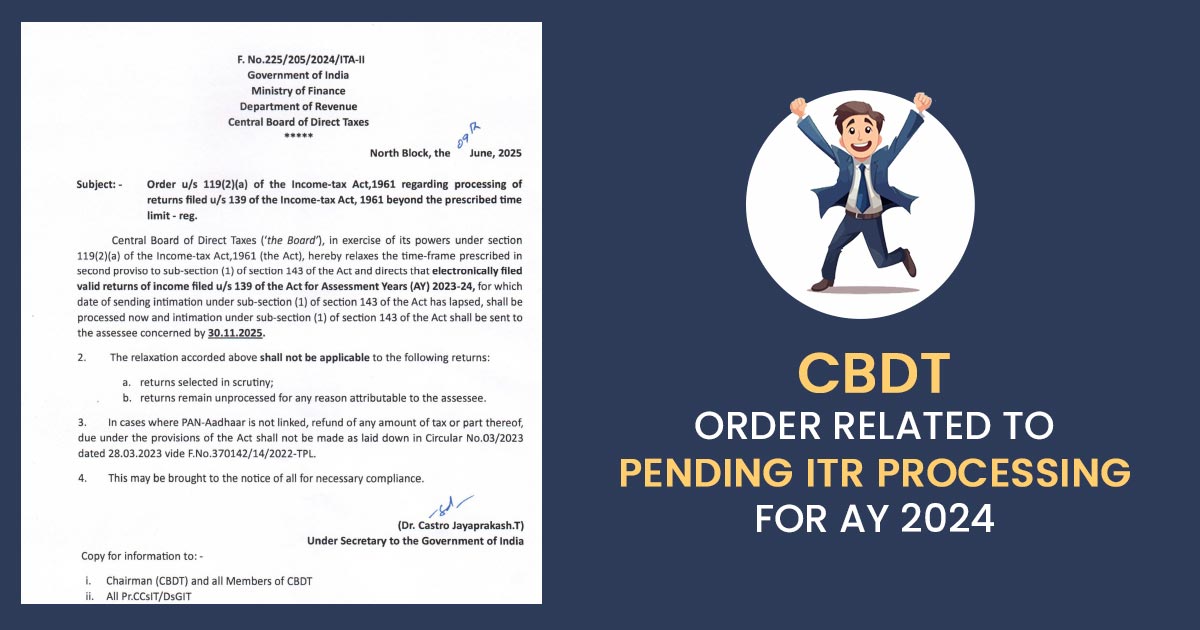

CBDT, in a directive issued under Section 119(2)(a) of the Act, has relaxed the timeline specified in the second proviso to Section 143(1). “Valid electronically filed returns for AY 2023-24, which remained unprocessed due to the lapse of the statutory timeline, shall now be processed and intimations under section 143(1) will be sent by November 30, 2025,” the order dated June 9, 2025, mentioned.

Those individuals whose ITRs are valid, though, were not processed earlier; the same relief is merely to them. But under the same relaxation, the returns selected for scrutiny or delayed due to taxpayer-related issues will not be covered.

Who Shall be Profitable?

Due to processing delays, the taxpayers awaiting refunds for AY 2023-24.

Under Section 139, the returns that were submitted electronically through, were unable to be acted upon on the original due date.

But, the CBDT has articulated that the same relaxation “shall not be applicable” to:

ITRs Lagged for Scrutiny Assessments

Those ITRs that are pending because attributable to the taxpayers, like missing information or mismatches.

No Tax Refund without Linking PAN-Aadhaar Card

Under a caution. If your Permanent Account Number and Aadhaar are not linked till now, then any eligible refund shall not be released. The CBDT cited that “refund of any amount of tax or part thereof, due under the provisions of the Act shall not be made” unless PAN-Aadhaar is linked.

What Must You Do Now for This?

- Check your ITR status on the e-filing portal.

- Ensure PAN-Aadhaar linkage if you’re expecting a refund.

- Wait for the communications of the income tax department; you may either obtain a refund or a notice of demand as per your filing.

- The tax department, through the same extended window, has the objective to clear a backlog, drawing relief and resolution to the lakhs of taxpayers.

Read Below Order