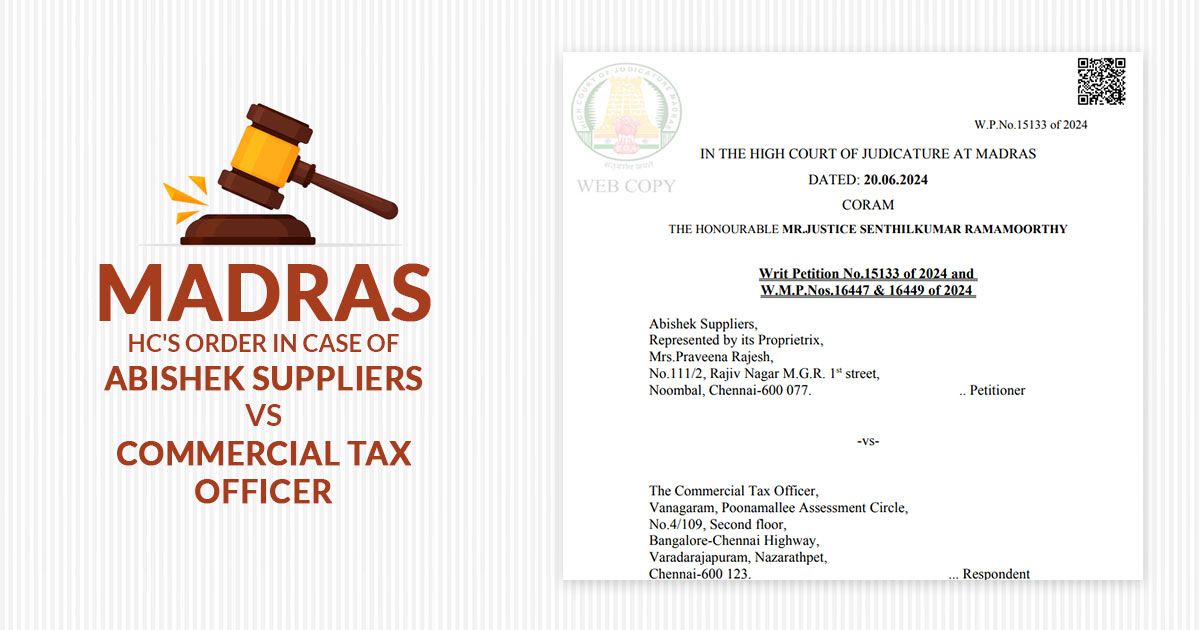

The Madras High Court in a ruling addressed the issue of a mismatch between GSTR 1 statements and GSTR 3B returns in the case of Abishek Suppliers vs. Commercial Tax Officer.

The decision of the court has emphasized procedural lapses and highlighted the importance of complying with the principles of natural justice. An opportunity to be heard on the merits of the case has been allowed by the court to Abishek Suppliers conditional upon a 10% pre-deposit of the disputed tax demand.

An adverse order on April 16, 2024, has been faced Abishek Suppliers post failing to upload a response to an SCN issued dated 14th December 2023. For differences between the GSTR 1 statement and GSTR 3B return, the notice seeks an explanation.

Through the related council, the applicant has been represented and claimed that the mismatch has arisen because of an accidental error, merely the transactions for November and December 2017 were uploaded in GSTR 1 at the time GSTR 3B engaged all transactions. The applicant has asked for more time to elaborate difference however unable to upload the reply because of technical issues.

High Court Proceedings and Opinions

The counsel of the applicant during the proceedings stressed the unintentional sort of error and ought for a fair chance to clarify the mismatch. It was agreed by the applicant to remit 10% of the disputed tax demand as a pre-condition for remand.

Mrs. K. Vasanthamala representing the respondent claimed that the natural justice was adhered to, quoting the issuance of the SCN and the following order. She said that the applicant has provided an adequate time to reply.

Madras High Court Judgment and Reasoning

The impugned order has been analyzed by the Madras High Court which remarked that the tax suggestion was affirmed only because of the failure of the applicant to respond. The procedural oversight has been considered by the court and the applicants desire to follow the condition of the pre-despite. It was mentioned by the court that in the interest of justice, the applicant is required to be permitted to challenge the tax demand on the merits.

Read Also: Madras HC Directs Re-adjudication for Mismatch B/W GST Returns and 26AS After 10% Pre-deposit

Madras High Court Ruling

- Setting Aside the Impugned Order: The order was set aside by the court on 16th April 2024, contingent on the applicant depositing 10% of the disputed tax within 2 weeks.

- Chance to furnish a response: The opportunity was furnished to the applicant to provide a response to the SCN within the said timelines.

- Personal Hearing and Fresh Order: The respondent on the receipt of the response and confirmation of the pre-deposit was asked to furnish a reasonable chance for a personal hearing prior to issuing a fresh order within 3 months.

Closure: The ruling by the Madras High Court in the case of Abishek Suppliers vs. Commercial Tax Officer highlights the judiciary’s devotion to ensuring fair treatment and sustaining natural justice principles in tax disputes.

The court by granting a hearing chance and highlighting procedural compliance, has designated a precedent for managing GSTR mismatches and corresponding disputes. The decision serves relief to Abishek Suppliers and acts as a critical reminder for tax authorities and taxpayers to ensure due process is adhered in tax adjudication.

| Case Title | Abishek Suppliers Vs. The Commercial Tax Officer |

| Citation | Writ Petition No.15133 of 2024 W.M.P.Nos.16447 & 16449 of 2024 |

| Date | 20.06.2024 |

| For Petitioner | Ms.V.Vijayalakshmi |

| For Respondents | Mrs.K.Vasanthamala, Govt. Adv. (T) |

| Madras High Court | Read Order |