A GST demand order has been set aside by the Madras High Court and ordered a personal hearing on 10% pre-deposit need, remarking that a turnover mismatch between Form 26AS and GST returns was because of certain periods (April 1, 2017 to June 30, 2017) falling within the pre-GST period.

In the writ petition, on 28.12.2023 the applicant, Haarine Associates contested an original order is being contested based on the violation of norms of natural justice and non-application of mind.

Under the applicable GST legislation, the applicant filed the returns for the assessment period 2017-2018. Following an SCN that was issued dated 7.8.2023, the impugned order was issued thereafter on 28.12.2023.

The counsel of the applicant furnished that the GST legislation was effected on 01.07.2017. The GSTR1 statement GSTR 3B return and the annual return of the applicant show the turnover from 01.07.2017 to 31.03.2018.

From the period 01.04.2017 to 30.06.2017, being pre-GST, shall naturally consequence in a mismatch between Form 26AS and the GST returns of the applicant.

It was argued by the counsel that the tax obligation was levied established on this mismatch. The applicant without prejudice to this contention, agreed to remit 10% of the disputed tax demand as a prerequisite for remand.

The respondent’s counsel argued that the norms of natural justice were complied with through issuing a notice in Form ASMT 10 on 05.07.2023, a show cause notice on 07.08.2023, and a personal hearing notice on 15.09.2023.

The bench of Justice Senthilkumar Ramamoorthy, analyzing the impugned order said that GST obligation was charged as of the difference between the turnover shown in Form 26 AS and the turnover in the GST returns of the applicant.

The counsel of the applicant elaborated that the same difference emerges as of the period from 01.04.2017 to 30.06.2017 which was not counted within the GST period. A reconsideration is required Since the impugned order was issued without addressing this aspect and without a hearing, given that the applicant remits 10% of the disputed tax demand, the court remarked.

On the condition that the applicant remits 10% of the disputed tax demand within 2 weeks of obtaining a copy of the same order, the impugned GST order was set aside. To provide a reply to SCN within the said period the applicant was authorized.

The High Court asked the respondent to furnish a reasonable chance along with a personal hearing and to provide a new order within 3 months of receiving the applicant’s reply and pre-deposit. The bank attachment was indeed lifted as the assessment order was set aside.

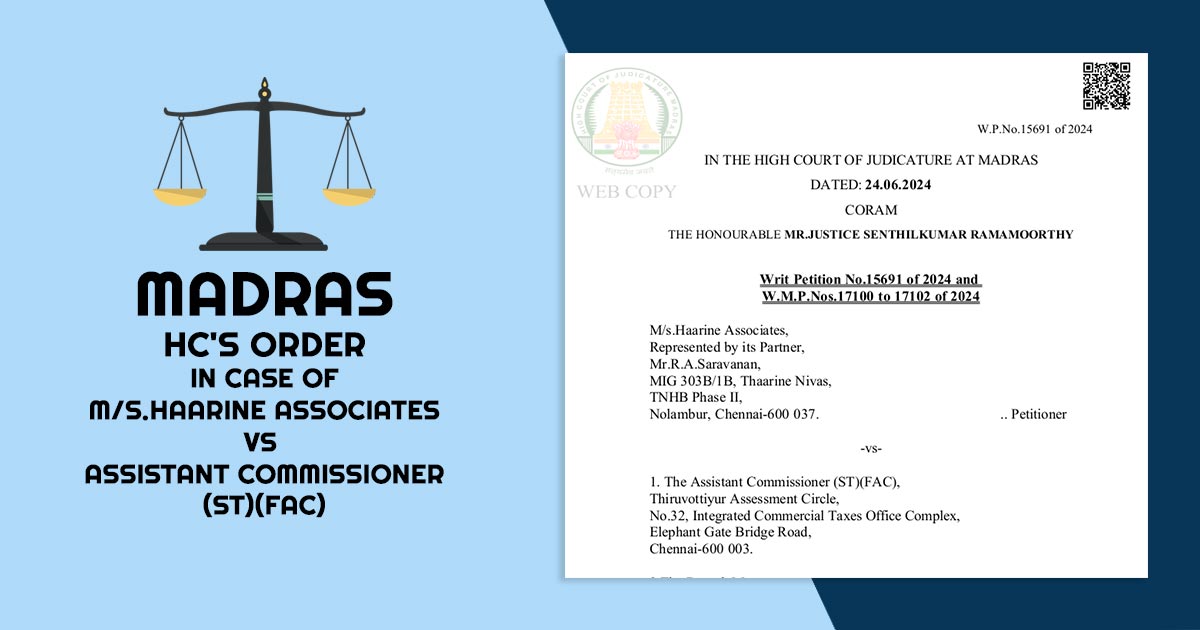

| Case Title | M/s.Haarine Associates Vs. The Assistant Commissioner (ST)(FAC) |

| Citation | Writ Petition No.15691 of 2024 W.M.P.Nos.17100 to 17102 of 2024 |

| Date | 24.06.2024 |

| For Petitioner | Mr.Rajkumar P. |

| For R1 | Mr.T.N.C.Kaushik, AGP (T) |

| Madras High Court | Read Order |