The High Court of Madras quashed the refusal of the GST Input Tax Credit (ITC) for late filing of GSTR-3B, mentioning the retrospective revision to the Central Goods and Services Tax(CGST) Act,2017.

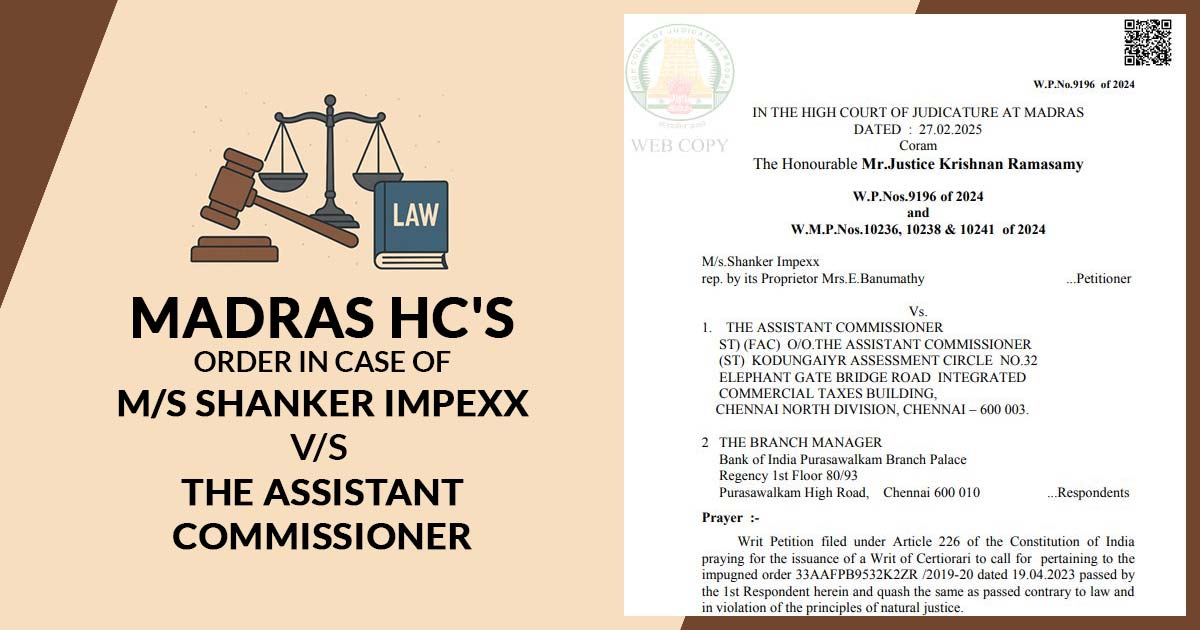

The applicant, Shanker Impexx, had contested the order passed by the first respondent dated 19.04.2023. The counsel of the petitioner said that the issue had already been settled by the Court in a batch of writ petitions, including W.P. No. 25081 of 2024, dated 17.10.2024, and requested the same relief.

The Government Pleader validated that the case was covered by the previous decision.

It was marked by Justice Krishnan Ramasamy that the problem raised in this writ petition has been addressed previously in a batch of petitions, along with W.P. No. 25081 of 2024, decided on 17.10.2024.

In that case, the bench noted that the applicants had submitted their GSTR-1 returns at the said time; they cannot submit GSTR-3B because of genuine issues such as financial problems during the COVID-19 lockdown, health problems, and fire accidents. Consequently, they forgot the due date to claim the ITC, which resulted in the reversal of their claims and asked for tax, interest and penalty.

Subsequently, founded on the 53rd GST Council Meeting carried on 22.06.2024, the government extended the last date to claim ITC for FYs 2017-18 to 2020-21 to 30.11.2021. This shift was provided retrospective effect via the Finance Act (No. 2) of 2024 and also explained by official notifications and circulars.

Considering such developments, the court quashed the previous orders and asked the department not to proceed on the problem of limitation and ordered the de-freezing of bank accounts. It also permitted the refund or adjustment of any amount that has been recovered previously.

The bench permitted the Writ Petition on the same lines as the present case concerned the same problem.

| Case Title | M/s Shanker Impexx vs. The Assistant Commissioner |

| Citation | W.P.No.9196 of 2024 |

| Date | 27.02.2025 |

| Counsel For Appellant | M/s.Ramya Krishnan |

| Counsel for Respondent | Mr T.N.C.Kaushik |

| Madras High Court | Read Order |