The Allahabad High Court asked the New Okhla Industrial Development Authority (NOIDA) to compensate the taxpayer Rs. 19,22,778, which was charged to the taxpayer as tax and penalty in proceedings u/s 73 of the Goods and Services Tax Act, 2017.

The petitioner gives his property on rent in Gautam Budh Nagar(Noida). The rent received from the property was imposed to tax under the GST Act. The petitioner duly deposited the one-time lease rent of Rs. 97,18,500/- and the tax of Rs. 17,49,330/- with NOIDA. It was pleaded by the petitioner that he submitted his return u/s 39 of the GST Act. In the form GSTR-3B, the tax deposited by the petitioner to NOIDA was not reflected due to a mistake by NOIDA.

It was claimed by the petitioner that even though he furnished the proof in proceedings under section 73 of the Act to show the deposit of tax, it was not regarded, and tax and penalty were levied. It was claimed that the appellate authority also did not consider the material on record while dismissing the plea of the applicant.

It was claimed by the applicant that once NOIDA had accepted the tax deposit, he could not be required to deposit it again.

NOIDA counsel considered that the amount for the tax obligation was deposited via the applicant, therefore, it was deposited under the incorrect head, which was not reported to the applicant to allow him to make rectifications.

Recommended: Issuance of SCN Under GST – Section 73(10) with Time Limits

After reviewing the counter affidavit submitted by NOIDA, Justice Piyush Agrawal noted that NOIDA acknowledged its mistake in not depositing the tax provided by the petitioner under the incorrect category. Given these circumstances, the Court determined that the challenged orders were not arbitrary.

“Before parting, it will be relevant to notice that the tax amount paid by the petitioner to the NOIDA authorities was accepted and deposited under the wrong head, hence the petitioner cannot be permitted to suffer from the mistake committed on the part of NOIDA. The petitioner paid the legitimate tax to NOIDA, which was not deposited under the proper head and therefore, on account of that, the petitioner has to face not only the proceedings of GST but also the imposition of penalty,” the Court mentioned.

Justice Agrawal, referencing the Supreme Court decision in Batliboi Environmental Engineers Limited vs. Hindustan Petroleum Corporation Limited and Another concerning the calculation of compensation, ordered NOIDA to pay the petitioner a sum of Rs. 19,22,778, which was the penalty determined by the assessing authority.

As per that, the writ petition was disposed of.

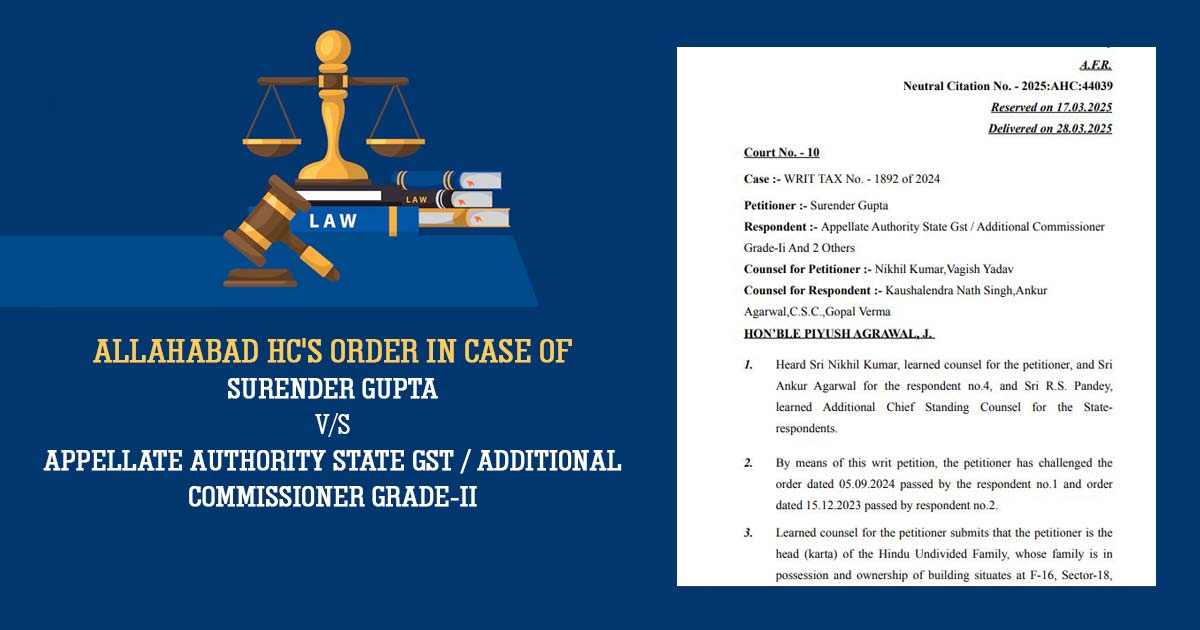

| Case Title | Surender Gupta vs. Appellate Authority State GST / Additional Commissioner |

| Citation | WRIT TAX No. – 1892 of 2024 |

| Date | 28.03.2025 |

| Counsel For Appellant | Nikhil Kumar,Vagish Yadav |

| Counsel for Respondent | Kaushalendra Nath Singh,Ankur |

| Allahabad High Court | Read Order |