The Madras High Court Single Bench of Justice K Kumaresh Babu in a decision mentioned that the act of availing a Goods and Services Tax (GST) registration and paying tax dues post inspection could not be cited as voluntary, keeping the levying of penalty on the GST taxpayer.

The writ petition was furnished contesting the order asking the applicant to file the GST obligation including interest and fill penalty for the GST obligation. The counsel for the applicant Joseph Prabhakar, furnished that the applicant is the charitable trust that has the registered office at Karur.

Under the mentioned trust applicant runs a marriage hall. He claim that the CGST department preventive unit visited the marriage hall and sought to hand over the whole accounts and records.

Therefore the applicant’s manager furnished the same. Also on summon the applicant furnished the ITR, Balance Sheet, and Profit and Loss account up to 31.03.2019 along with the bank statement of the Trust and Trustees. Also, the applicant cited that certain amounts are reimbursable to the related persons.

He also mentioned that the applicant file a response dated 12.01.2022 to explain the application of cum tax basis method and objected to the interest and to invoke Section 74(1) CGST Act that the petitioner neither suppressed any payments nor intentionally misrepresented. He furnished that the total value arrived via the second respondent comprises the advance, reimbursable amount, and GST.

He argued that the second respondent’s presumption is against the basic norms of indirect taxation and the applicant is not obligated to file the service tax as it is an agent of the government which would be required to get filed via the related person.

He also mentioned that against the order in original, the applicant filed a plea to the first respondent. It was argued by the applicant that the tax demand is in the total value of the taxable supply and the applicant is qualified to arrive at GST obligation applying cum tax basis under Rule 35 of CGST Rules 2017.

It was claimed that no penalty will be imposed as the applicant has released the full tax obligation under section 73(8) of the Act even before the initiation of proceedings.

Also, the council claimed that on learning that the applicant is a supplier of service drawing the GST obligation forthwith registered dated 14.02.2020 under the GST Act, 2017. He mentioned that nonregistration is neither intended nor wanton.

As the applicant was cooperating with the respondents, the rulings laid on via the first respondent in order in plea do not apply to the case of the applicant, counsel cited. He also mentioned that the applicant considered the total value merely to buy peace.

The applicant is another person who furnishes the service and pays them. Therefore the total receipt value is not reliable. He disagrees that the second respondent shall not have furnished the notice u/s 73(1) when the tax obligation and the penalty get filed or otherwise the second respondent shall have furnished the notice merely for the shortfall amount.

Mr. R.Gowri Shankar, learned counsel for the respondents opposing the claim of the applicant furnished that the applicant was rendering taxable activities like renting of marriage halls and other related taxable supplies. An investigation based on the intelligence was rendered in the premises of the applicant dated 23.01.2020 by the Preventive Unit. hence it is discovered that the applicant neither registered with the GST department nor released the GST obligation.

Also, he furnished that on the grounds of incriminating documents and depositions of the applicant and a few clients, the GST obligation came to the tune of Rs 69,54,554 for the period July 2017 to January 2020. Afterwards, the applicant enrolled with the GST department with effect from 14.02.2020 i.e. nearly more than 20 days from the initiation date of department proceedings/ investigation.

Hence the GST obligation is been calculated by the applicant on the cum tax basis and released the GST obligation of Rs 58,93,702/- and penalty a sum of Rs.8,84,056/- on 03.08.2020.

He claimed that the applicant had obtained the bigger amounts of rent without getting the GST registration not filed GST, and not filed statutory GST returns from July 2017 to January 2020 and therefore cum-tax benefit was not extendable for the applicant.

Specifically in the same matter, there is an intended misdeclaration and suppression of facts, and therefore the advantage of cum tax benefits could not be extended to the applicant and he laid on the rulings to assist his arguments.

He argued that the applicant provided the donation receipts for the amount they get for their service and did not furnish the receipt for all the other services confirming that the applicant with the intended objective suppressed the fact and evaded the tax payment.

Read Also: Confusion Cleared! GST Levy on Marriage or Goods & Services

He asserted that the supply of electricity for the renting premises is a composite supply and hence, the rate of principal supply on renting of immovable property shall be applicable. Also, it furnished that for the cause of fraud or any willful misstatement or suppression of facts to evade tax emerged under Section 122(2)(b) of the CGST Act, the penalty would be equal to ten thousand rupees or the tax due from such person, whichever is higher.

Thus the applicant was levied with their tax obligation amount as a penalty. Via arguing the aforesaid reasons, the respondents furnished that the order-in-Original and order-in-Appeal are effective in statute and do not need any interruption of the same court, the writ petition was dismissed in the prayer.

The bench noted that “The entire claim against the petitioner had arisen from its own failure to register itself under the GST Act as required under law. Only pursuant thereto, the petitioner had remitted the tax that he is liable to pay. Even though such action is claimed to be a voluntary payment by the petitioner, it should be seen that the petitioner had attempted to evade payment of tax which is liable to be taxed and only according to the inspection affected by the respondent, the petitioner had submitted himself for payment of tax and hence, the same cannot be said to be a voluntary payment and has been made only to wriggle out of the penal consequences.” It was remarked that, “This conduct of the petitioner to evade tax will also fall under suppression and fraudulent activities envisaged under Section 74 of the GST Act. Hence, the contention that Section 74 cannot have been invoked against the petitioner cannot be countenanced.”

Noting that “Only after the inspection they have agreed to pay the tax by registering themselves. This conduct cannot be said to be a voluntary conduct. There have been contraventions of provisions of the GST Act for which the petitioner is liable to make good the non-payment and also suffer penal consequences for the same”, the writ petition has been dismissed by the Madras High Court bench.

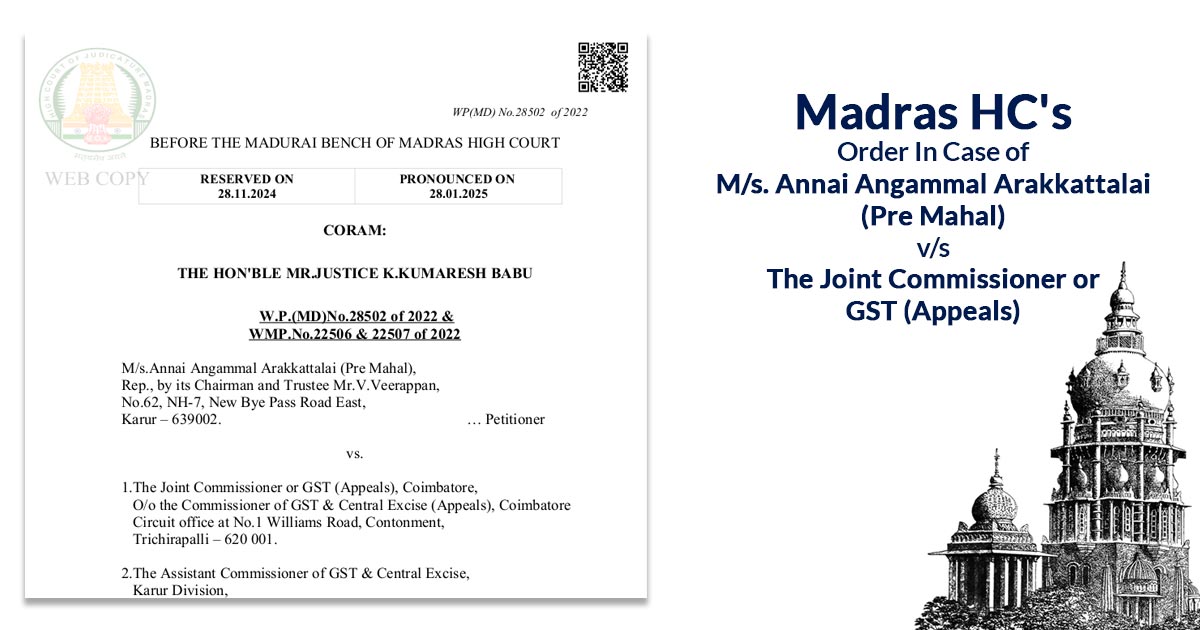

| Case Title | M/s.Annai Angammal Arakkattalai (Pre Mahal) Vs. The Joint Commissioner or GST (Appeals), Coimbatore |

| Citation | W.P.(MD)No.28502 of 2022 WMP.No.22506 & 22507 of 2022 |

| Date | 28.01.2025 |

| For Petitioner | Mr.Joseph Prabhakar |

| For Respondents | Mr.R.Gowri Shankar, Standing Counsel for RR1&2 |

| Madras High Court | Read Order |