The Madras High Court in a ruling has furnished the taxpayer to improve the errors in not filing the annual returns GSTR-9 and GSTR-9C under the Goods and Services Tax Act, 2017, with pre-deposit conditions.

The applicant in the said duration of 2018-19 furnished its returns and filed the precise taxes. However, on the applicant’s annual return verification, it was discovered that the applicant had not furnished the annual return in Form GSTR-9 and GSTR-9C.

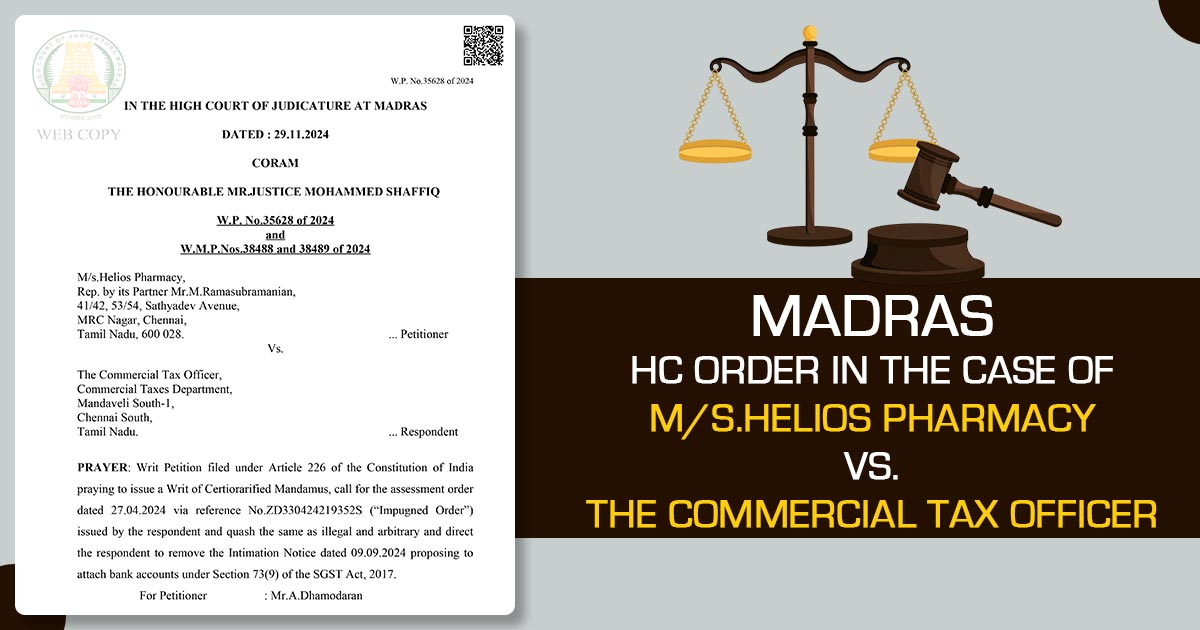

The filed present writ petition contest the impugned order passed via the respondent on 27.04.2024 for the AY 2018-19.

A Dhamodaran represented the petitioner and for the respondent, Amrita Dinakaran put in appearance, being the Government Advocate.

Writ Petition Appeals

For issuance of a Writ of Certiorarified Mandamus, the petitioner had requested, asked for the assessment order on 27.04.2024 furnished via the respondent and quashed it as illegal and arbitrary and asked the respondent to eliminate the Intimation Notice dated 09.09.2024 proposing to attach bank accounts under Section 73(9) of the SGST Act, 2017.

The related counsel furnished for the applicant that he is a trader and reseller of pharmaceutical products and is registered under the Goods and Services Tax Act, 2017.

The learned counsel for the petitioner provides that an intimation in Form DRC-01A was issued dated 26.10.2022 followed by a notice in DRC-01 on 07.07.2023. Additionally, a personal hearing was proposed dated 18.07.2023.

Court’s Observations

The applicant does not furnish its response nor claim the chance for a personal hearing. Learned counsel for the applicant furnished that neither the SCN nor the impugned order of assessment has been provided to the applicant by the tender or sending the same by RPAD, rather than it has been uploaded in the GST portal, hence the applicant was not learned about the initiated proceedings and therefore unable to take part in the adjudication proceedings.

The learned counsel for the applicant furnished that if the applicant is furnished with a chance then they shall be able to elaborate the alleged discrepancies.

The applicant’s counsel put reliance on the court ruling for the matter of M/s.K.Balakrishnan, Balu Cables vs. O/o. the Assistant Commissioner of GST & Central Excise in W.P.(MD)No.11924 of 2024 on 10.06.2024, to provide that this court has remanded the case back in similar cases within the payment of 25% of the disputed taxes.

It said that the applicant is ready and wants to file 25% of the disputed tax and that they might be allotted one final chance before the adjudicating authority puts forth their objections to the proposal, to which the related Government Advocate appearing for the respondent does not have any objection.

Madras High Court Decision

It carried that, “In view thereof, the impugned order dated 27.04.2024 is set aside and the petitioner shall deposit 25% of the disputed tax within four weeks from the date of receipt of a copy of this order. The impugned order of assessment shall be treated as show cause notice and the petitioner shall submit its objections within four weeks from the date of receipt of a copy of this order along with supporting documents/material.”

Read Also:- Easy Guide to GSTR 9C (GST Audit Form) Online Return Filing Process

It was observed that “If any such objections are filed, the same shall be considered by the respondent and orders shall be passed under law after affording a reasonable opportunity of hearing to the petitioner.”

Conditions on Assessee/GST Registered Taxpayer

If the aforesaid deposit is not filed or objections are not furnished in the said duration i.e. four weeks from the date of receipt of a copy of this order then the impugned order of assessment shall stand restored.

| Case Title | M/s. Helios Pharmacy V/S The Commercial Tax Officer |

| Citation | W.P. No.35628 of 2024 |

| Date | 29.11.2024 |

| Counsel For Appellant | Mr.A.Dhamodaran |

| Counsel For Respondent | Ms.Amrita Dinakaran, Government Advocate |

| Madras High Court | Read More |