LLPs have become a popular form of organization among entrepreneurs for the reason that they combine the benefits of a partnership and a company.

Since 2008, India has introduced the Limited Liability Partnership (LLP) concept. Both partnerships and companies can be formed under an LLP. In India, the LLP Act, 2008 governs the formation of LLPs. In order to incorporate an LLP, there must be at least two partners. Although, there is no upper limit to the number of partners in an LLP.

Each LLP should have a minimum of two designated partners, at least one of whom should be a resident of India. LLP agreements outline the rights and duties of designated partners. All the provisions of the Partnership Act, 2008 and those specified in the partnership agreement are directly their.

Latest Update

28th July 2022

- The process of applying for a PAN and allotting it via the simplified proforma for incorporating limited liability partnerships (LLPs) electronically (form: FiLLiP) of the MCA. Read Notification

Determine and Partners Address Proof

- Proof of PAN Card or Passport (Foreign Nationals & NRIs)

- Proof of Aadhar Card/Voter’s ID/Passport/Driver’s License

- Proof of the latest bank statement/telephone or mobile bill/electricity or gas bill

- Proof of passport-sized photograph specimen signature (blank document with signature [directors only])

Proof of Registered Office

- Proof of the latest bank statement or telephone or mobile or electricity or gas bill.

- Proof of Notarized rental agreement in English

- Proof of No-objection certificate from the property owner

- Proof of sale deed/property deed in English (in case of owned property)

Read Also: Due Dates of Filing ROC Annual Return

Why Register LLP Under MCA?

Enrolling the LLP provides various advantages with the main benefits being the limited liability of partners. The members of the company would be subjected to the small amount of debt incurred through it. The same varies from the proprietorship and partnership in which the personal assets of the directors and the partners are not saved when the business gets bankrupt. Registering an LLP in India provides the subsequent advantages:

- LLP is a separate legal entity from the partners. Every partner would sue the other for the condition which evolves. It has an uninterrupted existence that follows perpetual succession that is the partners may leave, however, the business stays. The term of the dissolution needs to be mutually agreed towards the company to dissolve

- Transferring the ownership of LLP is indeed easier. An individual would quickly be shown in as a designated partner and the ownership transferred to them

- LLPs that pose a capital amount of lower than 25 lakhs along with a turnover of less than 40 lakhs per year would not need any formal audits. The same build the registering as LLP advantageous towards the small businesses and startups

- An LLP has partners, who own and handle the business. The same varies from a private limited company whose directors might be different from shareholders. For this cause, VCs would not invest in the LLP framework

- LLP would own or take upon the property this is because it is considered as a juristic individual. The partners of LLP would not avail the property as theirs

Advantages of Starting the LLP

- It is a separate legal entity from its partners

- The induction of the partner is easier

- No need for audits for the small business

- No variation between the owner and partner

Easy Procedure to Register the LLP in India

An LLP in India is registered by following the steps outlined in this article. Using this guide, you will learn How to register an LLP in India, what documents you need for registration, and what forms to submit for LLP registration.

Receive DSC & DPIN of Partners

The initial step is to receive the DSC under MCA of the needed partners of the limited liability partnership. The cause for the same would be that all the forms are required to be submitted online and need the partner’s digital signatures. The statutory needs that all the partners furnish for the DPIN number. The application needs to be made in Form DIR-3.

Application for Name Approval

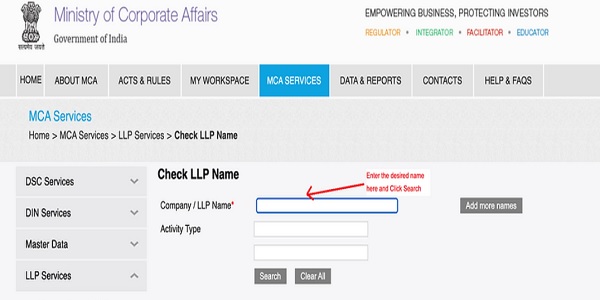

The same procedure consists of enrolling the LLP. Before you perform the same, you will be required to see that when the name is already obtained. The Availability of the name would be studied on the MCA website through the mentioned procedure.

Step 1: Tap here to review the proposed name is available for the LLP

Step 2: Post to tapping the search operations if the same name is NOT USED, the page will show a message stating “No Results Found for Reserve this name for Company/LLP”.

Step 3: Now we see that the name is available, there are two choices. Either proceed with the enrollment or reserve the unique name(RUN). RUN is suggested for the people who would not go to register the LLP quickly however at some future date. For these people, it is to be suggested that they need to reserve their recommended name thus the same would be used by anyone else.

Filling FiLLip Form Under MCA for Online Registering an LLP

The complete procedure of registration of LLP is online and is executed via a pdf that would be downloaded from the MCA website through the steps.

Step 1: Login at MCA V3 portal with user name and password using this link

Step 2: Select form “FiLLip Incorporation of LLP” from the list as shown below:

Step 3: Fill the form and proceed to Form 9 (Consent to Act as Designated Partner)

Step 4: Proceed to Form 17 (optional); Proceed to Form 18 (optional)

Step 5: SRN will be generated on successful submission of the form.

Step 6: Download the form and affix DSC.

Format to the download of the LLP Consent (Form 9) & sheet of subscribers

Please NOTE – The witness in the Subscriber’s sheet must be a Chartered Accountant(CA)/ Company Secretary(CS) / an Advocate.

Easy Uploading the MCA Form on Govt Portal

The last process is to upload the FiLLIp on the MCA portal. After successful generation of SRN on submission of form, an option to upload such form should be reflected on My Application in “Pending for Action” Tab. Users can click on the upload form and upload the DSC affixed PDF and proceed for payment. Please ensure that the form post affixing all the Digital Signatures is less than 6 MB.After successful generation of SRN on submission of form, an option to upload such form should be reflected on My Application in “Pending for Action” Tab. Users can click on the upload form and upload the DSC affixed PDF and proceed for payment.

Save SRN Number & Execute Payment

Once the form needs to submit, you would be automatically redirected to make the payment. Once the payment has been made a challan would be generated including the Service Request Number(SRN). Store challan as you would require it for future references.

As the form is authorized via a related official of the Ministry then you would obtain an email concerned with that and the status of the form would be amended to Approved.

Filing the LLP Agreement Under MCA

Once the form has been approved, an incorporation certificate would be provided. An LLP agreement would be required to be provided within 30 days of the incorporation of LLP.

Format To Download for the LLP Agreement

LLP agreement regulates the common rights and responsibilities of the partners and also governs the LLP and its partners.

- LLP agreement should be filed in Form 3 online on the MCA Portal

- In 30 days of the incorporation date, Form 3 for the LLP agreement needs to be filed

- LLP agreements should be printed on stamp paper. Towards every state, the value of stamp paper varies each other

An LLP agreement would require to provide within 30 days of the start of the LLP.

LLP formation begins from receiving the DSC to file Form 3 has taken nearly 15 days as per the presence of documents.

Formed an LLP with friend last year. But due to COVID and all restriction business could not fly. We got busy in our regular jobs. We intend to focus on business in some time but what are the compliance and taxation need to keep company active. We have 0 revenue as of yet and only our contributed money is lying idol in bank.