The appeal filed by the Income Tax Department against Intime Vanijya Private Limited has been dismissed by the Income Tax Appellate Tribunal (ITAT), Kolkata bench, stating that the disputed tax amount of ₹7.97 lakh is below the ₹60 lakh threshold specified in CBDT Circular No. 09/2024.

In the case of AY 2013-14, in which the assessing officer made an addition of Rs 25.80 lakh under section 68 of the Income Tax Act, 1961, deeming specific transactions as unexplained cash credits. The same addition has been removed by the National Faceless Appeal Centre (NFAC), asking the revenue to appeal to the ITAT.

The appeal of the revenue was submitted with a 153-day delay, condoned post accepting the explanation of the department of administrative pressures. The actual tax effect in the proceedings was just Rs 7.97 lakh, which is less than the Rs 60 lakh fiscal limit that the CBDT specified to file the appeals before the Tribunal.

It was noted by Dr. Manish Borad (Accountant Member) that the CBDT Circular No. 09/2024, dated September 17, 2024, restricts to file the appeals in which the tax effect is less than Rs 60 lakh, till the applicability of exceptional situations. The bench, the appeal was being dismissed on the same technical basis, the problem sought by revenue remained open for examination in future proceedings, if needed.

The department has been furnished the liberty by the tribunal to recall the order if the case falls beneath any exceptions cited in the circular of CBDT. The order of dismissal outlined the compliance of the judiciary with the norms of administration, which has the motive to lessen the unnecessary litigation in small tax effect cases.

To ease tax litigation and lessen the backlog of cases in the appellate forums, the same decision has arrived.

Also Read: Kolkata ITAT Sets Aside CIT(A) Order on Scheduled Tribe Doctor’s Tax Exemption Claim U/S 10(26)

The amended fiscal limits of the CBDT are made for the department to think more about its resources on high-value disputes while preventing the protracted litigation towards smaller tax amounts.

Preserving the rights of the department to pursue the case if higher stakes arise in forthcoming assessments, the order draws a closure to the same dispute.

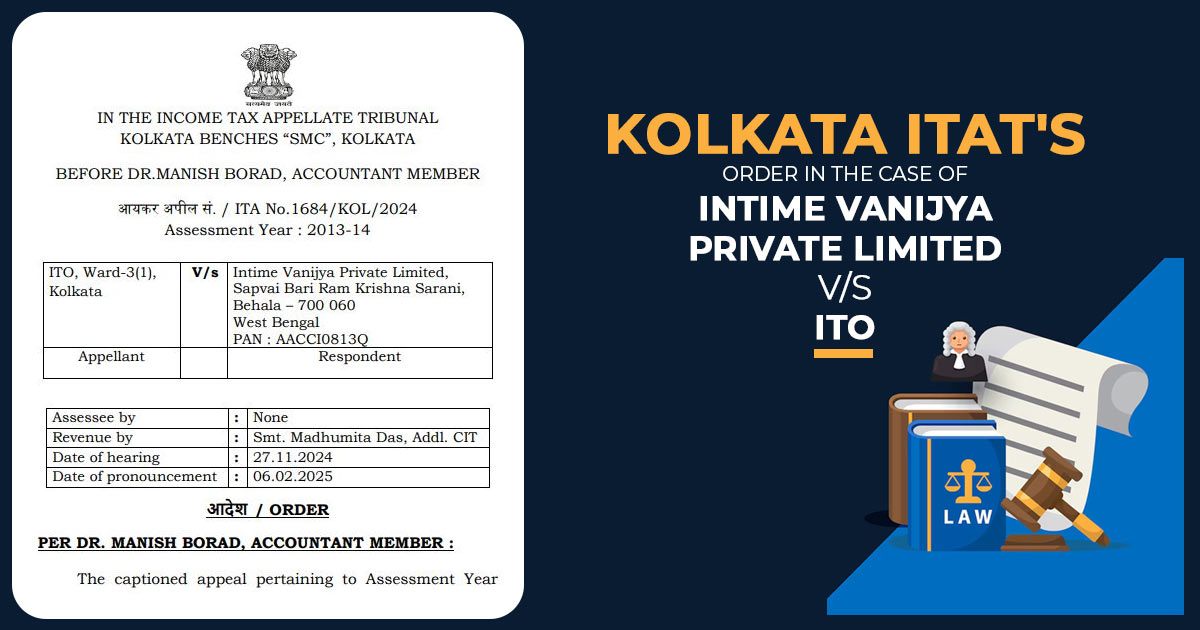

| Case Title | Intime Vanijya Private Limited vs. ITO |

| Citation | ITA No.1684/KOL/2024 |

| Counsel For Appellant | None |

| Counsel For Respondent | Smt. Madhumita Das, Addl. CIT |

| Kolkata ITAT | Read Order |