The taxpayer’s plea was dismissed by the Kolkata Bench of Income Tax Appellate Tribunal (ITAT) for the penalty imposed u/s 271(1)(c) of the Income Tax Act,1961 for Assessment Year 2013-14, as withdrawn under the Vivad se Vishwas Scheme.

The petitioner/taxpayer, Raj Kumar Agarwal HUF appealed against the 09.05.2024 order of the Commissioner of Income Tax(Appeals), which kept a penalty u/s 271(1)(c) for AY 2013-14. The taxpayer has contested the Rs 14,48,660 penalty u/s 271(1)(c), asserting it was unjustified as all facts were revealed, the explanation was bona fide, and the additional income was voluntarily revealed before receiving reasons for reopening the assessment.

Filing Appeals Law and Procedure

Section 271(1)(c) of the Act permits the tax authorities to levy a penalty if the taxpayer conceals the income or furnsihes the precise data in their return. The penalty can vary from 100% to 300% of the tax that was evaded or underreported. But the taxpayer can contest the penalty if they could prove that no intent was there to conceal the income or furnish the wrong data.

The counsel of the taxpayer mentioned that the taxpayer has chosen the Vivad se Vishwas, 2024 scheme and requested to withdraw the appeal, which the department did not oppose.

The two-member bench including Pradip Kumar Choubey(Judicial Member) and Rakesh Mishra (Accountant Member) remarked that u/s 91(2) of the Vivad se Vishwas Scheme, 2024, appeals are considered withdrawn once a declaration is filed and a certificate is issued by the Designated Authority. Section 91(3) also directed the taxpayer to withdraw appeals and furnish proof of payment u/s 92(2).

As the taxpayer asked to withdraw the plea the tribunal permitted the plea to be dismissed. The tribunal cited that if needed the taxpayer can submit a Miscellaneous Application to restore the appeal.

The taxpayer submitted the plea was dismissed as withdrawn.

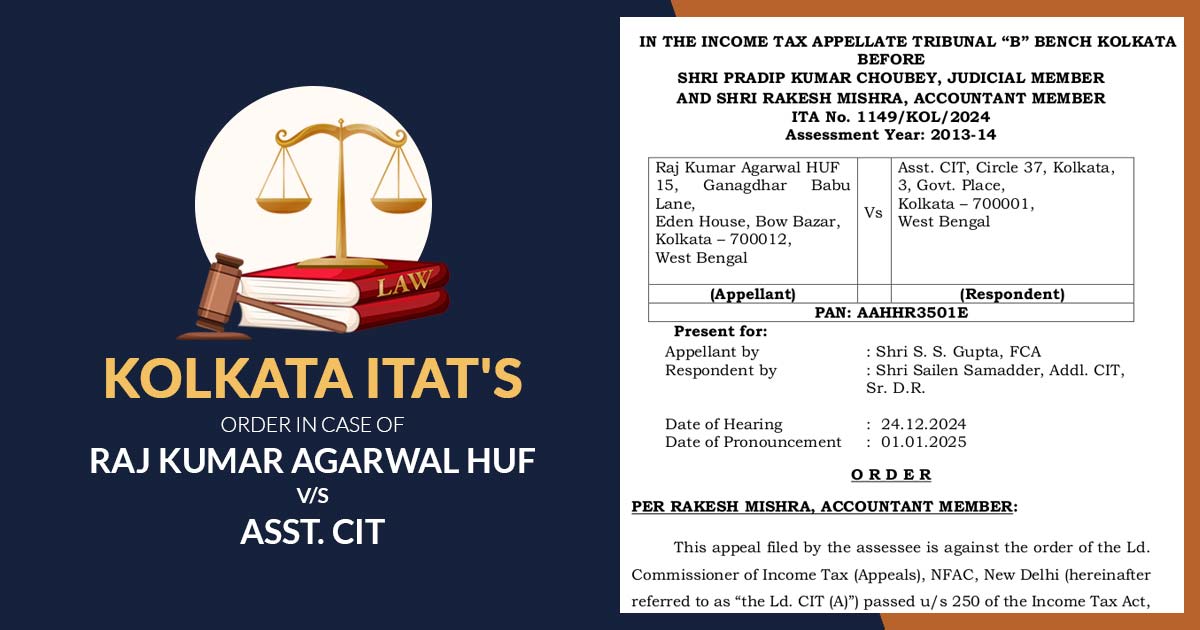

| Case Title | Raj Kumar Agarwal HUF Vs. Asst. CIT |

| ITA No. | 1149/KOL/2024 |

| Date | 01.01.2025 |

| Appellant by | Shri S. S. Gupta, FCA |

| Respondent by | Shri Sailen Samadder, Addl. CIT, Sr. D.R. |

| Kolkata ITAT | Read Order |