The Bombay High Court accepted an unconditional apology rendered via officers of the Goods and Services Tax (GST) Department, under their arrest of the Petitioner while his opportunity to record a statement had been scheduled at a later date.

A Writ Petition has been formed by the Petitioner Mishal J. Shah Hindu Undivided Family (HUF) to the Bombay High Court asking the directive to ask for the validity and legality of GST notices furnished before the applicant and asking the directives for eliminating the provisional attachment and defreezing of their Bank Account which had been made inactive upon doubt that the Petitioner was concerned in the bogus GST Input Tax Credit (ITC) claim.

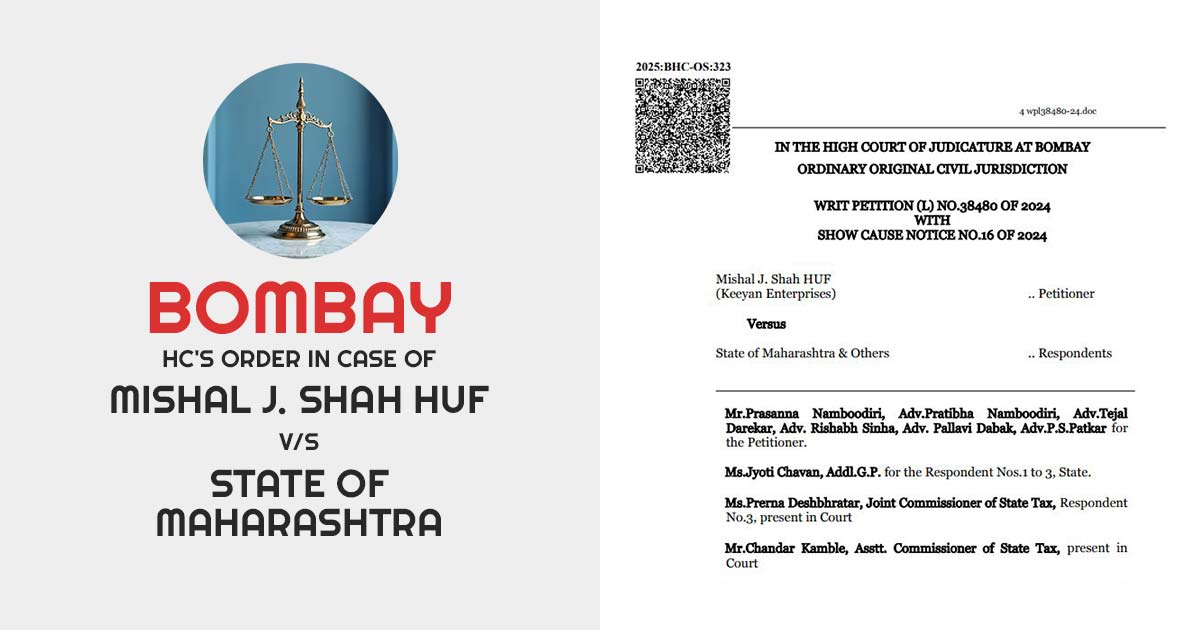

In the preceding hearing to the High Court, Advocates Prasannan Namboodiri, Pratibha Namboodiri, Tejal Darekar, Rishabh Sinha, Pallavi Dabak and P S Patkar had furnished that the applicant had been placed under arrest by the GST Authorities dated 19 December 2024 even after provided a chance to record his statement scheduled for 30 December 2024.

The Bombay High Court, marking the GST authority’s conduct in arresting the applicant has furnished the Show Cause Notice (SCN) to Chandar Kamble, Assistant Commissioner of State Tax as well as Prerna Deshbhratar, Joint Commissioner of State Tax hinting towards the initiation of Contempt Proceedings.

The GST Officers, represented by Jyoti Chavan, Additional Government Pleader furnished in their Affidavits that the applicant is a Director of M/s JMC Metals Private Limited, an enterprise suspected of availing ITC in a fake manner to the tune of Rs 9.54 Crores, GST authorities due to the applicants’ designation as Director of the arraigned company has arrested and not under the meaning of any measure opted against his position as the Karta of the applicant HUF.

Read Also: Separate Notification Not Required for Cross-Empowerment of State GST Officials

The apologies of GST Authorities have been considered by the Division Bench of Justice B. P. Colabawalla and Justice Firdosh P. Pooniwalla and released the show cause notice issued against them, issuing a caution to take strict care before any arrest gets incurred, to assure the letter of law.

| Case Title | Mishal J. Shah HUF vs. State of Maharashtra |

| Citation | Writ Petition (L) No.38480 of 2024 |

| Date | 07.01.2025 |

| Petitioner by | Mr.Prasanna Namboodiri, Adv.Pratibha Namboodiri, Adv.Tejal Darekar, Adv. Rishabh Sinha, Adv. Pallavi Dabak, Adv.P.S.Patkar |

| Respondent by | Ms.Jyoti Chavan, Ms.Prerna Deshbhratar |

| Bombay High Court | Read Order |

I appreciate your efforts to help legal itinerary