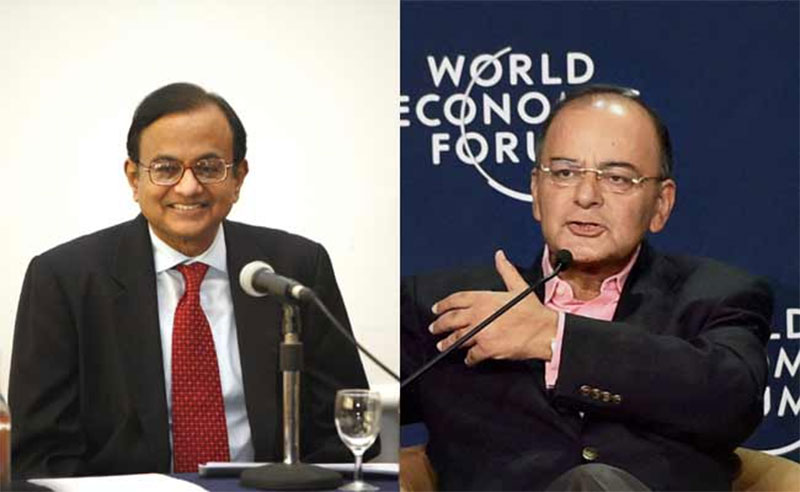

The Indian Finance Minister, Arun Jaitley held a meeting on Tuesday to make changes with the opposition party Congress. He believes that these demands can “damage” the new system compared to its benefits.

He also told at an event organized by the ASSOCHAM, these demands would be “extremely unfair” to the India “if we try to impose in the name of political compromise, a GST with a defective architecture.”

Ex-Finance Minister of India, Mr. P Chidambaram has given respond to the FM’s comments, “FM’s confrontational speech at ASSOCHAM not the best way to reach out to opposition on GST.”

This sparring happened before the meeting of all parties on Wednesday to discuss the GST Bill that is known as a big reform for the country and it will create a single market for more than a dozen state levied for the first time since independence. GST would hike the economy market as expected.

See More: PM Narendra Modi Expects to Pass the GST Bill in 2016

Moreover, the Centre has set a deadline for the GST on April 1, 2016. The government will be trying their best to roll-out the new system from April 1. The GST bill has been stucked in last session in the upper house of Parliament due to oppose by the Congress. The chief opposition party wants to complete their demands and demands are that to reduce the GST rate at 18 percent and scrapping 1 percent inter-state tax (CST). The winter session starts from today, therefore, government will discuss on the GST panel with the opposition parties.

Mr. Jaitley said, “We are reaching out to them, we are willing to discuss with them because some of these suggestions may not necessarily be in the larger interest of the GST structure.”

FM further told, “The wisdom which dawned on my friends in the Congress party had not dawned on them when Pranab Mukherjee (as Finance Minister) introduced the GST (in 2011). It did not dawn on them when (then Finance Minister) P Chidambaram accepted the Standing Committee recommendations but to come out with the preposterous suggestion that tariff must be mentioned in the Constitution document so that in a given exigency if tariff has to be altered you need a two-third majority in both houses of Parliament and has to go to each of the states.”

Arun Jaitley also added, “And when tariff rate has to be mentioned in the Constitution itself, (then it) is a flawed architecture…Because the GST with flawed architecture can actually damage the system much more than it can benefit.”

you are aware that our govt. is financing economic deficit by printing currency notes through R.B.I. IN VIEW THEREOF Public is facing surplus of currency in the market i.e, inflationary trend .,whereas impact of GST will increase Govt’s income to meet out economic exigencies without circulating currencies notes .i am of the opinion that GST would be helpful in reducing inflationary trend and govt would be in a position to acquire more income comparatively to materialize maximum of economic development policy. hence per capital income can be increased in comparison to other countries at large.