The Himachal Pradesh High Court refused to quash the complaint under Section 69 of the CGST Act, noting that the use of fake supplier addresses indicates prima facie GST evasion.

As per the bench, “When the officials went to the addresses mentioned in the invoices and found that no such entity existed, it was sufficient to infer that the invoices were fake, and the material shown to have been supplied as per the invoices could not have been supplied since no such person existed at the given address.”

Section 69 of The Central Goods and Services Tax Act, 2017, authorises the Commissioner to order arrest in case any of the specified offences under section 132 of the CGST Act.

Justice Rakesh Kainthla, the court must have a prima facie case while practising inherent power, and does not sift the proof to discover its creditworthiness or value. The same is for the trial court to see where the case is pending; therefore, the complaint could not be quashed as the investigation was not made with the GST authorities in Delhi.

The applicant indulged in large-scale evasion of tax by taking the bogus ITC. They declared inward supplies (purchases) from Delhi and U.P.-based floating fictitious and non-existent firms, which were registered to pass on the fake benefit of ITC on the strength of fake invoices.

Therefore, against the taxpayer, a complaint was submitted for the commission of offences punishable under Section 69 read with Section 132 of the HPGST/CGST Act, 2017, read with Section 20 of the IGST Act, 2017.

The applicants, being dissatisfied with the filing of the complaint and the proceedings due before the Trial court, have submitted the petition claiming that the provisions of HPGST/CGST and IGST Acts are silent concerning the arrest, investigation, and filing of the complaint.

Taxpayer, the HPGST Act has made the provisions of investigation provided under Cr.P.C. applicable to the HPGST Act. Under the act, officers have been furnished with the unbridled authority. The provisions of Sections 69 and 132 are arbitrary and unreasonable. It is a breach of Article 21 of the Constitution of India.

Read Also:- HP HC: GSTR-9 and GSTR-9C Filing Before Amnesty Notification Date Can’t Be Denied a Late Fee Waiver

The department, applicants must be arrested for the breach as per Sections 69 and 132 of the Act. The provisions of arrest are controlled by the Cr. P.C. The provisions of Cr.P.C. will also apply to the investigation and filing of the complaint as per Section 4(2) read with Section 5 of the Cr. P.C.

The bench directed to the case of Radhika Agarwal v. Union of India, (2025) 150 GSTR 121, where the Apex Court held that the provisions of Cr.P.C. apply to the proceedings executed under the GST Act if no provision is there to the contrary.

For the GST Act, the submission that the provisions of Cr.P.C. are not applicable and the act does not specify anything for the process of investigation, inquiry, or trial is not correct, the bench mentioned.

Also Read:- HP HC: Penalty U/S 16(7) VAT Act Requires Satisfaction of Section 16(4) Applicability

The bench said that “It was submitted that the investigation was not properly conducted. The officials visited the addresses mentioned in the invoices and did not contact the GST Officials in Delhi to ascertain the proper names and addresses. This submission will not help the petitioners. When the officials went to the addresses mentioned in the invoices and found that no such entity existed, it was sufficient to infer that the invoices were fake, and the material shown to have been supplied as per the invoices could not have been supplied since no such person existed at the given address.”

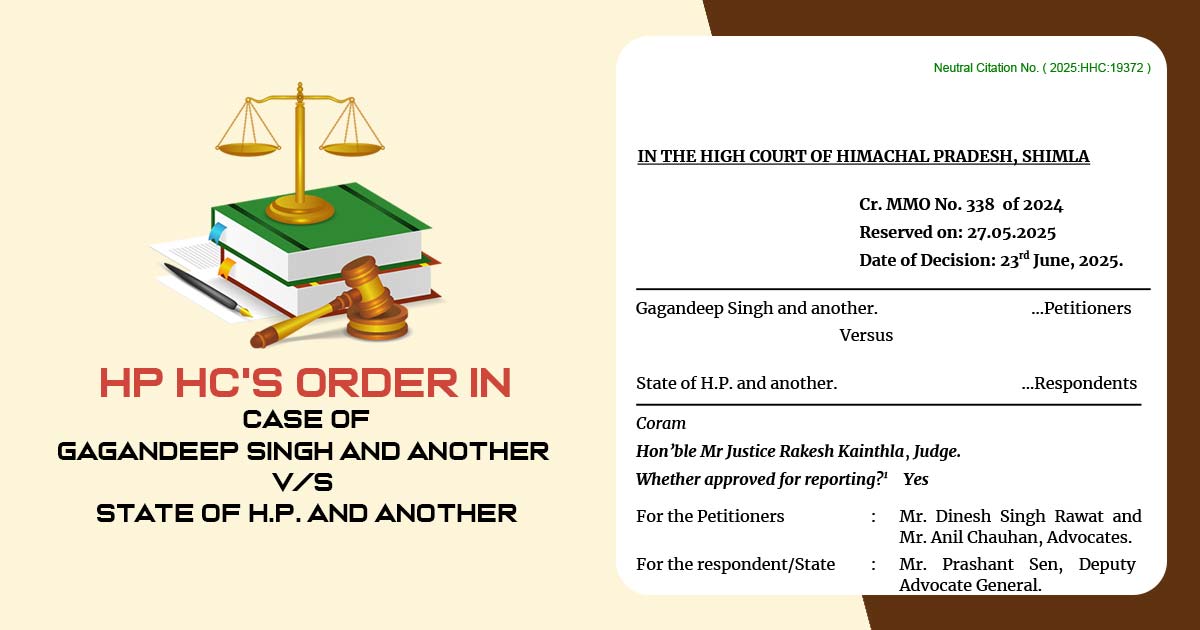

| Case Title | M/s. Gagandeep Singh and another V/S State of H.P. and Another |

| Citation | MMO No. 338 of 2024 |

| Counsel For Petitioners | Mr. Dinesh Singh Rawat and Mr. Anil Chauhan, Advocate |

| Counsel For Respondent | Mr. Prashant Sen, Deputy Advocate General |

| Himachal Pradesh High Court | Read Order |