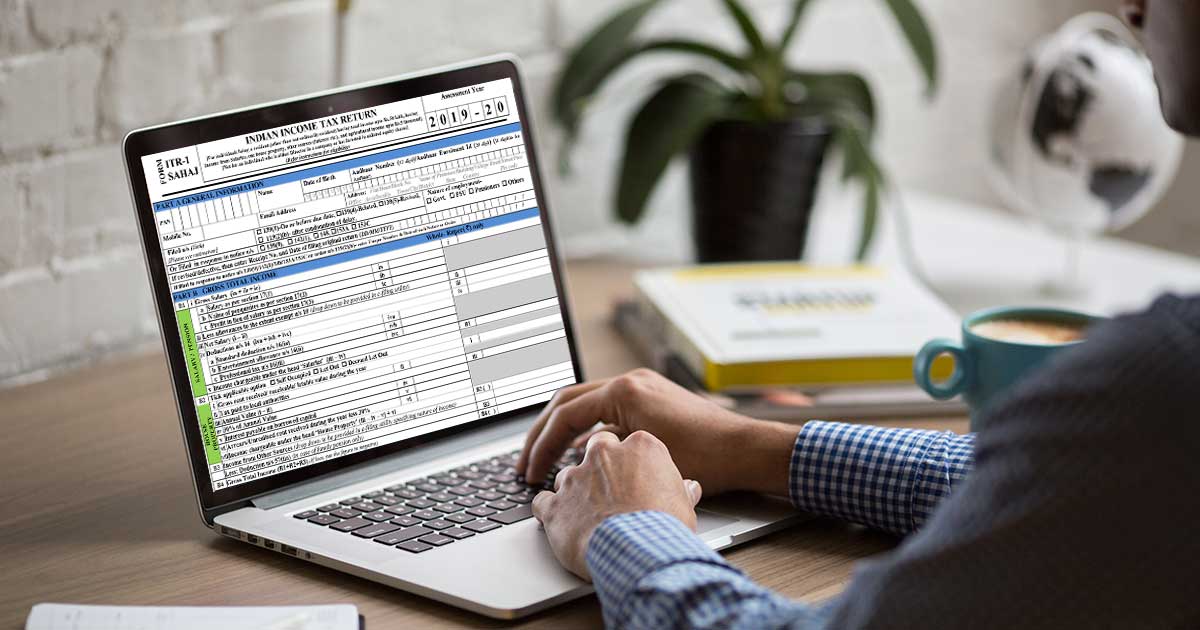

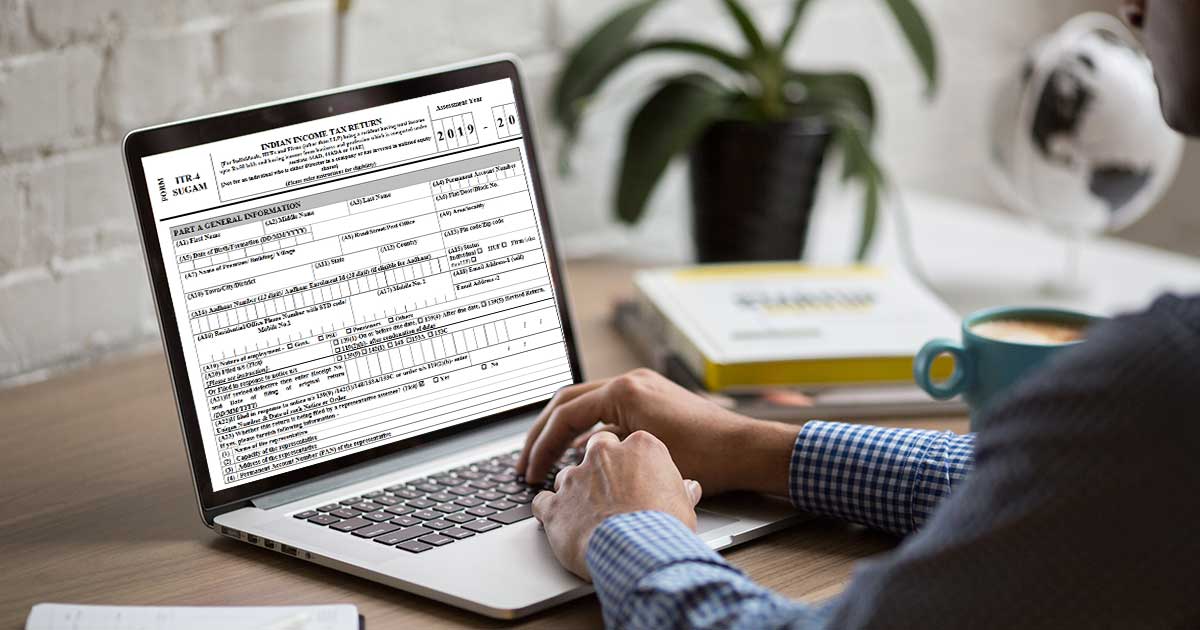

Income Tax Return Forms – ITR 1 (Sahaj) and ITR 4 (Sugam) for the Assessment Year 2020 – 21 have been notified by the Central Board of Direct Taxes ( CBDT ) in the first week of January 2020.

The ITR 1 Sahaj is an ITR form

The ITR 4 Sugam is an ITR form for Individuals, Hindu Undivided Families who are engaged in a business with a turnover below INR 2 Crores and Professionals with total income of more than INR 50 Lakhs, subject to the condition that they have opted for the presumptive income scheme as per Section 44AD, Section 44ADA and Section 44AE of the Income Tax Act.

The new ITR Form notified by CBDT for the AY 20-21 has come up with some changes. The two main changes in these forms indicates the prohibition on filing either in ITR-1 or ITR4 when the individual is a joint-owner in the house property and an ineligibility for filing ITR-1of those individuals who have deposited more than INR 1 crore in a bank account or has incurred INR 1 lakh or INR 2 lakh on electricity or foreign travel, respectively.

So, as per the notification, an individual taxpayer who is owning house property in joint ownership cannot file return either in ITR-1 or ITR4.

And ITR-1 Form is invalid for those individuals who have deposited more than INR 1 crore in the bank account or those who have paid ₹1 lakh in electricity bills in a year or incurred ₹2 lakh expense on foreign travel.

Besides, the Income Tax department has made it mandatory to quote the Passport number in ITR 1-Sahaj and ITR 4-Sugam

Other disclosures sought in the new ITR forms include disclosure of the amount when the aggregate expenses incurred on foreign travel for self or others exceed INR 2 lakhs and also when the deposited amount or aggregate of amounts in one or more current account during the previous year exceeds INR 1 Crore.

The Forms also sought details about the aggregate amount exceeding INR 1 lakh on the electricity consumption during the previous year.

There are some changes in case of 44AD or 44ADA or 44AE. These changes require the assessee to give the following details:

- Opening and Closing balance of cash in hand

- Opening and Closing balance of bank accounts

- Total amount received in cash during the year

- Total Amount deposited in the bank during the year

- Total cash outflow from cash balance during the year

- Total withdrawal from Bank during the year