GST PMT 06 has been a popular way of tax-paying in registered taxpayers for one month after bearing in mind the availability of input tax credit completely that may be a straightforward administration on own of the second and third month in which additional input tax credit amount available compared with the tax liability going outward.

Draft GSTR-1 will be provided to taxpayers, giving them details of the liability to be paid in the quarter GSTR-3B.

Supplies proclaimed in form GSTR-1

In quarter GSTR-3B system computed values will also be auto-populated.

Now, if in the last month of quarter compare with first two months one has excessive credit available,

Following questions come to light while filling the aforesaid type of GST return

- How to offset liability that is cleared?

- Full amount of ITC should be taken in GTSR 3B or not?

To clear it out let me explain it with a practical example,

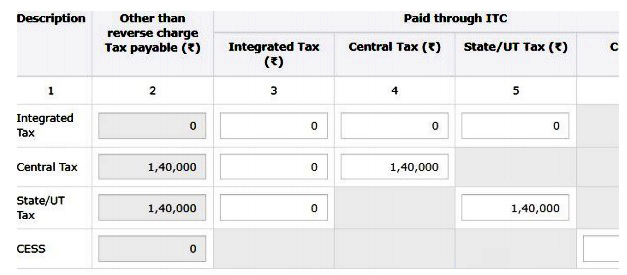

Assume, someone is been availed with a quarterly scheme for January-21 to March-21. In the month of January 6,00,000/- is the outward supply of that person on which 30,000/-is tax liability of CGST and SGST each, and 10,000 of an input tax credit of CGST and SGST is also available each after reuniting GSTR 2A

So, a liability of 20,000/- each of CGST and SGST was paid through cash by the taxpayer.

Now, the same registered individual has a tax liability of Rs 50,000 of SGST and CGST each for the second month(Feb-21) and Rs. 80,000 of an input tax credit of CGST and SGST each. A registered person would not have to deposit any amount of this month, because an excess amount of Rs 30,000/- of each CGST and SGST credit is available.

Now the essential month is March 21 the enrolled person has the outward tax liability of Rs 60,000 of CGST and SGST each and the input tax credit is available 1, 00,000 of CGST and SGST So, the balance amount of Rs. 40,000/- of each CGST and the SGST tax credit is open and the enrolled individual will not collect any amount of tax for the stated month.

The assessee shall furnish a draft GSTR-3B which contains the information of the liability to be furnished through the assessee at the time of quarterly GSTR-3B. This shall be made on the grounds of the supplies declared in FORM GSTR-1 for the quarter. It shall indeed include information from the optional IFF (2,80,000/-) and total input tax credit

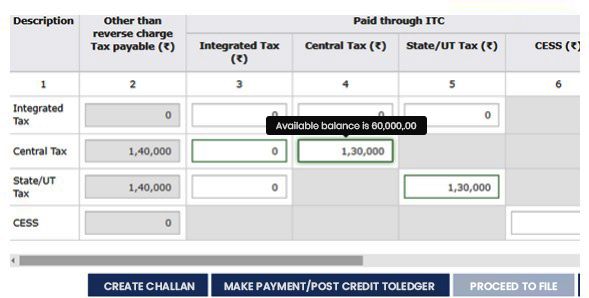

The issue is how to practise the cash balance of Rs 10,000 CGST and SGST each, which are furnished through GST PMT 06 for Jan 21 with respect to the auto-population amount in GSTR 3B that shows the excess amount of ITC is available and enrolled individual is not needed to deposit any payment in the quarterly filing the GSTR 3B form

You can manage from ITC in the GSTR 3B form from ITC (balance credit of Rs.60,000 is paired with books after adjustment) and post to that adjustment the balance payment of Rs 10k is automatically furnished via available cash on the GST portal and your return is met through GSTR-1 cash ledger and books of accounts.