The Visakhapatnam Bench of the Income Tax Appellate Tribunal (ITAT) has provided relief to a non-resident taxpayer after discovering that a revised Income Tax Return (ITR) was filed fraudulently by a consultant without the taxpayer’s knowledge. This wrongful action led to a tax demand of ₹12.93 lakh for the assessment year 2024–25.

The case is concerned with Nagarjuna Vutla, who had originally filed his ITR dated 22 July 2024 after claiming relief under the Double Tax Avoidance Agreement by submitting Form 67. However, a consultant thereafter submitted a revised return dated 6 August 2024, allegedly without the consent of the taxpayer. The revised return exhibited enhanced salary and other income and was signed and submitted to the Centralised Processing Centre (CPC), Bengaluru, with a fake signature

CPC, on the basis of this revised return, had issued an intimation u/s 143(1) dated 5 February 2025, raising a tax demand of Rs 12,93,760. The taxpayer said that only after getting the demand notice, he came to know about the revised IT return, and thereafter filed a cybercrime complaint, alleging his income tax login had been hacked.

The appeal of the taxpayer has been dismissed by the Commissioner of Income Tax (Appeals) based on the fact that no appeal lay against the intimation u/s 143(1), considering the same as a non-appealable order. The taxpayer contesting the same had approached the ITAT.

The Tribunal, relying on the Supreme Court ruling in CIT v. Kanpur Coal Syndicate (1964), held that an appeal is kept where there is a complete or partial refusal of tax obligation. The ITAT said that the revised return does not match the income shown in Form 26AS and accepted the claim of the taxpayer of a fake filing.

Subsequently, the Tribunal set aside the case and asked the assessing officer to either permit the taxpayer to submit a correct return or file an appropriate computation of the income, including supporting documents. The assessing officer was asked to perform a de novo assessment after analysing the records.

For statistical objectives, the appeal was permitted, and the order was pronounced on 5 December 2025.

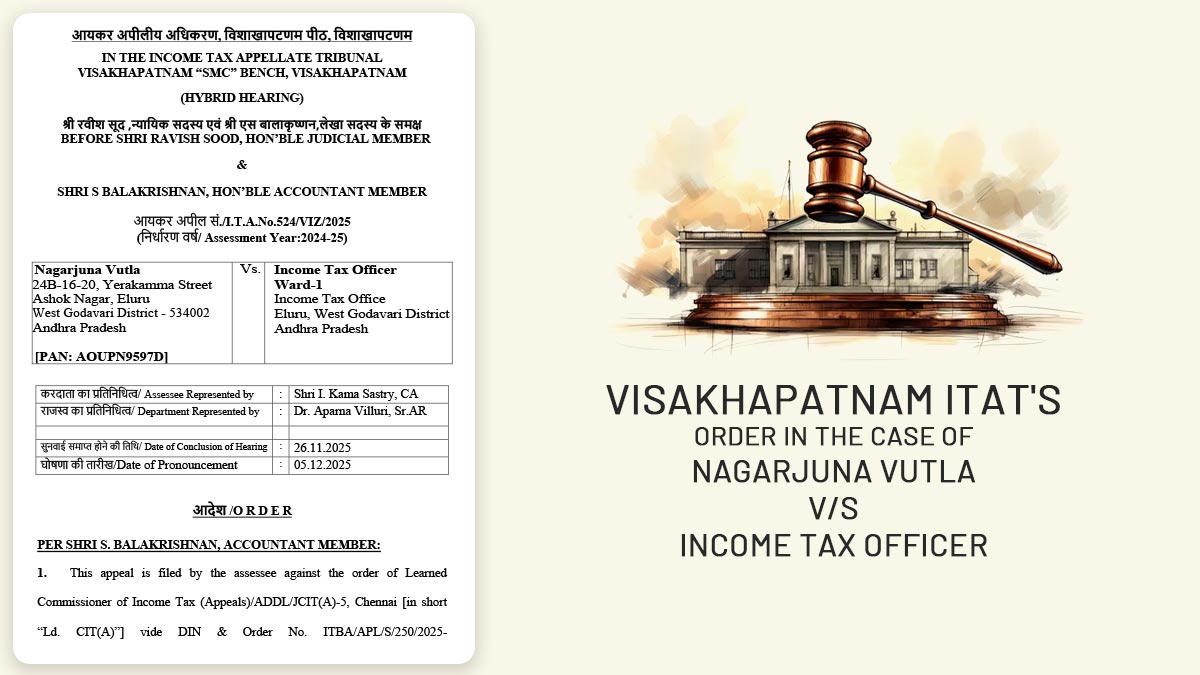

| Case Title | Nagarjuna Vutla vs Income Tax Officer |

| Case No. | I.T.A.No.524/VIZ/2025 |

| For Petitioner | Shri I. Kama Sastry, CA |

| For Respondent | Dr Aparna Villuri, Sr.AR |

| Visakhapatnam ITAT | Read Order |