The Mumbai bench of the Income Tax Appellate Tribunal ( ITAT ) asked the AO to permit Tax Deducted at Source ( TDS ) credit to transferees, despite when the certificates are in the name of the amalgamated or demerged company.

Concerning non-granting of TDS to the tune of Rs. 8,13, 81,645, the taxpayer has raised grounds. Mr. Percy Pardiwala representing the taxpayer furnished that the TDS credit was not provided via AO the reason the TDS certificates were not in the taxpayer’s name, but it was in the name of an amalgamated/demerged company. He furnished that the pertinent income has already been assessed in the taxpayer’s hands and therefore the TDS deducted out of the stated income must be granted credit in the taxpayer’s hands.

In this matter, the two-member bench of the tribunal comprising C V Bhadang ( President ) and B.R. Baskaran ( Accountant member) carried that the resulting company in the matter of demerger and transferee company in the case of transfer, are eligible to claim TDS credit, even if the TDS certificates are in the name of demerged company/transferor company.

In the matter, the taxpayer has proposed the pertinent income despite the TDS certificate being in the name of an amalgamated/demerged company. ITAT asked the AO to authorize TDS credit to the taxpayer post verifying that the pertinent income has been assessed via the AO in this year.

The subsequent problem argued by the taxpayer is concerned with the disallowance of Provision for Expenses. As seen before the taxpayer had furnished for the outstanding expenses since the finish of the year in the books of accounts. No TDS was deducted, it disallowed 30% of the Provision for outstanding expenses under Section 40(a)(ia) of the Income Tax Act.

The taxpayer has not elaborated on the accounting method when the actual expenses surpass the provision amount, he noted. AO discovered the fault with the provision incurred for the agency incentive, Channel placement charges etc. AO concluded that the provision for the outstanding expenses was incurred on adhoc basis and no reasonable certainty of the incurring expenses was there.

Therefore, the AO carried that the provision for outstanding expenses was disallowable in toto. As the taxpayer had disallowed 30% of expenses u/s 40(a)(ia) of the Income Tax Act, the AO disallowed the left 70% of the claim.

The bench viewed that the provision for outstanding expenses claimed by the taxpayer was an ascertained obligation only. Therefore, ITAT considered that the DRP was not explained in confirming the disallowance made through the AO. Therefore, the addition of 70% of expenses amounting to Rs.109, 46, 79,368 made by the AO was obligated to be deleted.

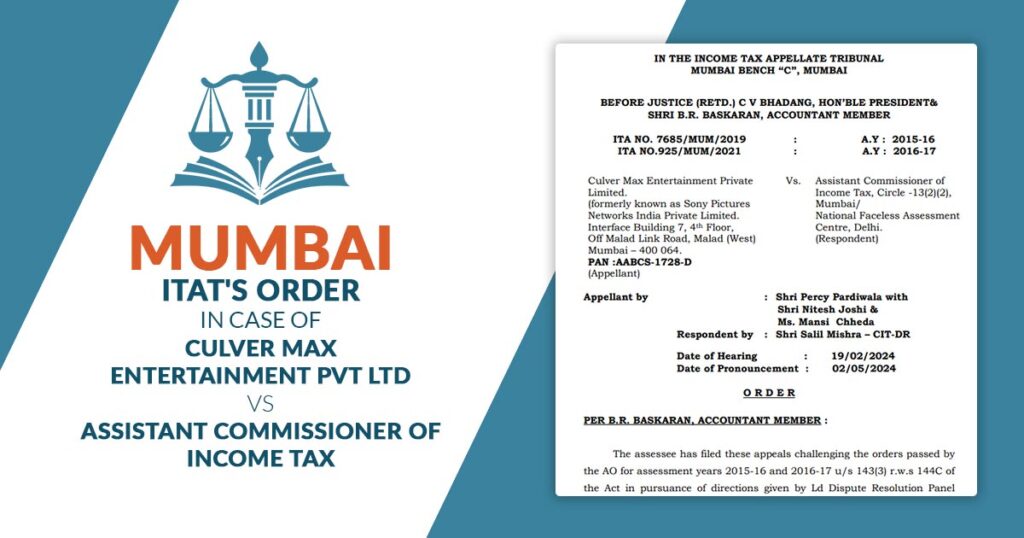

| Case Title | Culver Max Entertainment Private Limited Vs. Assistant Commissioner of Income Tax |

| Citation | ITA NO. 7685/MUM/2019 ITA NO.925/MUM/2021 |

| Date | 02.05.2024 |

| Appellant by | Shri Percy Pardiwala with Shri Nitesh Joshi & Ms. Mansi Chheda |

| Respondent by | Shri Salil Mishra – CIT-DR |

| Mumbai ITAT | Read Order |